XRP Ripple Tokens Skyrocket And Dispel Myths About Cryptocurrency

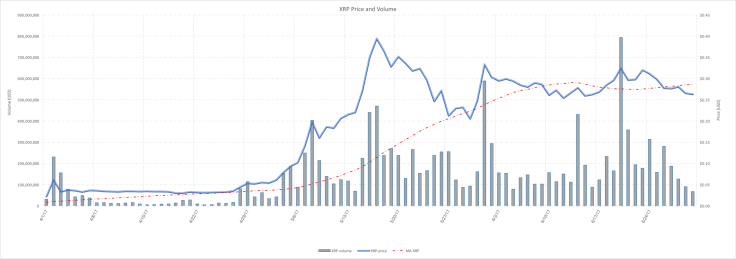

The market value of bitcoin and ether yo-yos almost daily, albeit generally in an upward curve over the long term. Despite the frenzy, one leading cryptocurrency has maintained a pretty steady growth trend with less volatility. Ripple, the San Francisco-based blockchain start-up behind XRP tokens, has a completely different approach compared to its more decentralized cousins. Ripple’s Q2 reports tallied around $30 million worth of XRP transactions from April 1 through the end of June.

Ripple offers a great example of exactly how cryptocurrency is different from fiat currency. When we think about dollars, euros and yen, we ask questions about who is “winning,” which currency is more secure and has higher monetary value. In the end, they are all made of paper, metal and simple digital placeholders. Cryptocurrencies like bitcoin and XRP are exactly the opposite.

“I don’t believe there is a real competition for these [virtual coins] because they have different purposes,” Rouven Heck, the project lead for identity solutions at the Ethereum startup ConsenSys, told International Business Times. “A lot of cryptocurrencies are useful for other reasons and not just simple copies [of bitcoin or fiat].”

It’s helpful to think of virtual tokens like cars or shoes instead of dollars. No one asks if boots, flip flops or stilettos are better, because they are different by design. Boots are great for cold weather and hiking. It’s obvious that flip flops cost less than stilettos. That’s why bitcoin can cost well over $2600 each and XRP just $0.26, yet it’s fair to say both are dominating the market.

Ripple specializes in international payment transfers, partnering with dozens of the world’s leading financial institutions and banks from the U.S. and U.K. to India, Japan and the United Arab Emirates, just to name a few. While Ripple can handle up to 1500 transactions per second, the blockchain community is battling out a technical solution to boost bitcoin’s capacity from just a few up to around 32 transactions per second.

Read: Will The Blockchain Boom Redefine India's Role In The Tech Industry?

“In my opinion it’s clear that we’ve turned a corner with respect to digital assets and acceptance from broader institutions around the planet,” Miguel Vias, head of XRP markets at Ripple, told IBT. He said Ripple is now close to becoming the digital standard for international enterprise transfers. Next quarter, Ripple is narrowing in on lending and payments, everything from loans for cryptocurrency exchange markets to remittance and e-commerce.

“Low value, high volume payments, that’s the sweet spot for XRP, in difficult to access corridors,” Vias said. “Places like the Philippines, Korea and Mexico. Places where maybe you [as a business] didn’t have reach before...maybe going through a digital asset helps ease some of that friction.”

Bitcoin is great for big purchases and Ethereum can create all kinds of different blockchain solutions. Meanwhile, Ripple is exploring the possibilities of what money can do for businesses to help them tap into a truly global economy.

What if instead of thinking of money as a slip of paper, we imagined it was a tool built for a specific purpose. A currency made for enterprise transactions can have so many mechanisms and features for transactions that are much more complex than handing over lots of paper, or sending simple numbers that represent lots of paper.

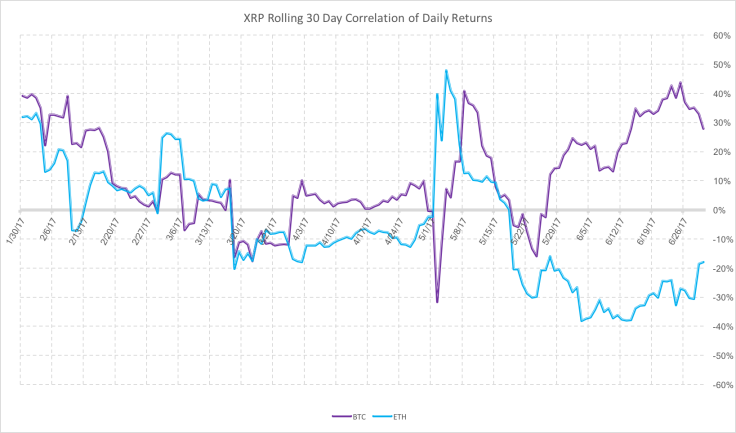

Let’s throw out the idea that cryptocurrencies necessarily need to compete. They certainly impact each other, especially when their values correlate or oscillate. But many of the best cryptocurrencies represent new additions to the shoe collection. Any good wardrobe needs diverse options for all kinds of situations, right? Sometimes you want the respectability of XRP in the office, and the secrecy of Zcash for a personal purchase. There’s no one way to make a great blockchain currency.

Ripple owns the majority of XRP tokens, fueled by a for-profit fintech model rather than an independent algorithm or nonprofit community foundation, like bitcoin and Ethereum. However, the California startup is taking steps to decentralize through business partnerships. Ripple offers both banking solutions and an alternative window into a whole new world of enterprise transactions.

Why does a business need a bank account or an insurance account, with all its extra fees and paperwork, in order to just hold value and move money around?

“If in the future, we can have blockchain identities that collect a lot of information about the individual, in a digital application, then when you go to an insurance company you immediately can share a subset of your identity,” Heck said. “Today, we always have accounts with companies. In the future, I feel companies can just provide products, and the user does not need to have a traditional bank account in order to have a bank product associated with your identity. It will completely change the interaction with financial service providers.”

The banks Ripple is partnering with might evolve to offer businesses completely new types of value in the future, in addition to lightning fast transactions enabled by XRP. In the meantime, the price of XRP continues to skyrocket. The value of XRP swelled almost 4000 percent over the last year, roughly one American quarter per token is around 1,159 percent more value than XRP had in early 2017. CNBC reported XRP is now listed on 30 different cryptocurrency exchanges. And it looks like this is only the beginning.

© Copyright IBTimes 2024. All rights reserved.