3 Reasons Disney+ Could Soon Overtake Netflix

KEY POINTS

- Netflix’s content spending is far behind Walt Disney’s

- Disney could dominate with streaming sports

- Netflix has tapped out of available markets; Disney+ is still expanding

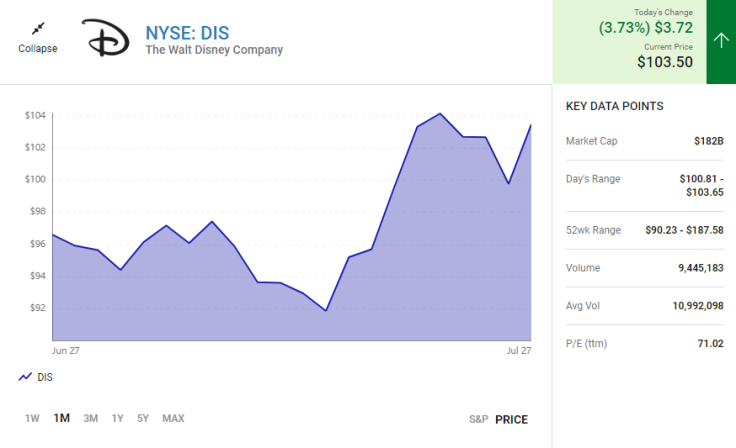

Walt Disney (DIS 3.73%) launched Disney+ in 2019, targeting a global subscriber base of 60 million to 90 million by 2024. That goal was soon revised upward as sign-ups took off at a rapid clip. At last count, Disney+ and Hotstar (its India subsidiary) have almost 138 million streaming customers combined.

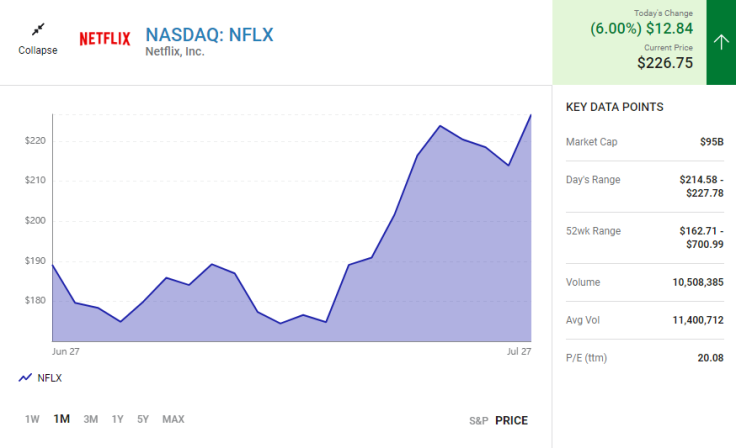

The figure is still far behind Netflix (NFLX 6.00%), which has roughly 220 million customers, making it the most popular streaming service in the world. But that position is far from secure as Netflix faces many headwinds, including a decline in subscriber numbers. Many expect Disney+ to take Netflix's crown in the next few years -- and there are growing signs it could happen even sooner.

1. Netflix is capping its content spend

Netflix has confirmed it will spend about $17 billion on content in 2023, approximately the same amount it will invest in 2022. It also spent $17 billion in 2021, which was a significant bump in the $11.8 billion the company spent in 2020. These are vast sums of money by any metric, but in the streaming wars, content spend is everything.

Walt Disney has earmarked about $32 billion for new content in fiscal 2022, which is up from the $25 billion it spent in 2021. The company has not disclosed spending plans for 2023 yet, but it's likely Walt Disney will remain the big spender in town. And though much of what the House of Mouse will produce will be released theatrically, much of it will subsequently land on Disney+.

2. Disney has streaming sports and big ambitions

Since rolling out ESPN+ in 2018, Walt Disney has shown that live sports can work in streaming. Though the service has somewhat limited live streaming options for major league sports, unlike its cable sibling ESPN and related TV networks, ESPN+ has still attracted over 22 million subscribers, recording consistent growth quarter after quarter.

Keeping in mind that Disney CEO Bob Chapek has previously waxed lyrical about a full-featured ESPN streamer as being "the ultimate fan offering," it seems likely Walt Disney will make sports central to future growth.

Netflix is not sleeping on the passion that live sports evoke. As the company has found with feature documentaries such as Icarus and the auto racing documentary series Formula 1: Drive to Survive, viewers are drawn to the stories that emanate from the world of sports. But at the time of this writing, Netflix has no live sports, something it has reportedly sought to rectify.

According to several reports, Netflix entered a bidding war as it tried to secure multiyear broadcast rights for Formula 1 racing. But it was unsuccessful, and the international racing series will remain for a while longer at its current home, ESPN.

There are still plenty of options out there for Netflix if it really wants live sports events. It could follow Amazon's NFL template and secure a few games of a high-profile sport without having to buy into everything. Or it could mimic Apple's approach to Major League Soccer, tying up a growing league for years to come.

Still, whatever Netflix does, it still faces the reality that whenever Walt Disney deems the time is right, it can turn on the ESPN full-streaming spigot and probably migrate more than a few cable holdouts over to an all-inclusive streaming Disney bundle. Unless Netflix pulls off a genius move and somehow secures the rights to a top-flight league or three, whatever it gets its hands on will likely still pale in comparison. Essentially, it has to get going from a standing start.

3. Disney+ has a lot of room to grow

Perhaps Netflix's biggest problem is that it had little competition in the streaming industry for roughly a decade. That allowed the company to not only blaze a path for what a global streaming service could be but also provide a guide to those that followed.

Some 15 years after it transitioned into a streamer, Netflix has established itself in over 190 countries. Considering there are 195 recognized nations in the world -- including Russia (which Netflix exited earlier this year) -- the company has pretty much run out of territory.

By contrast, Disney+ has launched in just over 100 markets, and is rolling out to dozens more over the coming months. Each fresh territory represents a whole new pool of potential subscribers. Many of those countries have already been exposed to what Netflix has to offer.

If Netflix can put a stop to its subscriber churn and invest in even more content that people love, then it could maintain its position for a long time yet. But those are far from minor challenges, and Walt Disney is clearly focused on Disney+ being a "must have" service in homes across the planet. Should things continue at their current pace, Netflix might have to adjust to being the second-biggest streamer sooner rather than later.

This article originally appeared in The Motley Fool.

Tom Wilton has business dealings with Netflix but holds no financial position in any stocks mentioned. The Motley Fool has positions in and recommends Netflix and Walt Disney. The Motley Fool recommends the following options: long January 2024 $145 calls on Walt Disney and short January 2024 $155 calls on Walt Disney. The Motley Fool has a disclosure policy.