Apple Pay Customers Use Service More Frequently Than Other Mobile Payment Services, Study Finds

Mobile payments are gaining traction in the United States. According to a survey from banking consultancy, Mercator Advisory Group, 71.5 million U.S. adults used mobile payments in 2015, up from 61 million in 2014. Of those adults, the study found that Apple Pay customers paid for purchases with the service more frequently than mobile payment users as a whole.

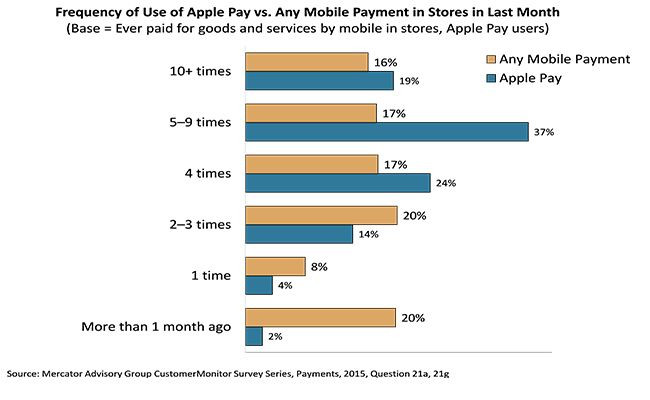

Apple’s mobile payment service was originally introduced in the iPhone 6 in 2014 and has since made its way into the Apple Watch and the iPhone 6S. According to the study, half of mobile payment customers use the technology at least once a week to purchase goods, but 80 percent of Apple Pay customers used it at the same frequency. About 19 percent use Apple’s mobile payment service use it at least 10 times in a month, compared to 16 percent of mobile payment customers.

“Smartphone penetration is maturing, gaining broad-based market penetration as most U.S. consumers use their mobile to shop and increasingly buy goods and services in stores and online,” Karen Augustine, manager of primary data services at Mercator Advisory Group, said in a press statement. “Convenience is driving them to use mobile payments more often at the stores they visit, especially to redeem timely and useful e-coupons, discounts and loyalty rewards.”

Reward cards weren’t originally compatible with Apple Pay when it first launched in October 2014. However, Apple later added support for both loyalty cards and in-store credit cards with the release of iOS 9 in September. Also spurring the increased use of Apple Pay is a growing number of merchants that accept the service, such as Best Buy, Rite Aid and White Castle. Coffee chain, Starbucks, is also expected to begin accepting Apple Pay in its retail stores, starting in 2016, according to Re/code.

The mobile payments market has grown increasingly crowded in recent months as Google began the rollout of Android Pay -- a service similar to Apple Pay. At the same time, Samsung launched its own mobile payment service, dubbed Samsung Pay, in South Korea and the U.S. By the end of 2015, the global mobile payment industry is expected to reach $549 billion up from $392 billion in 2014, according to Future Market Insights.

The report’s findings are based on Mercator’s CustomerMonitor survey of 3,008 U.S. adult consumers in June.

© Copyright IBTimes 2025. All rights reserved.