Apple’s Mac Shipments Decline In US PC Market In Q3 As Tablets Continue To Erode Worldwide PC Sales: Reports

Shipments of Apple’s (NASDAQ:AAPL) Mac computers declined in the third quarter of 2013 while other top players in the U.S. personal compurer, or PC, market saw year-on-year growth even as global demand for PCs is being threatened by the proliferation of tablets, according to the latest quarterly PC market estimates from Gartner and International Data Corporation, or IDC.

“The third quarter is often referred to as the 'back-to-school' quarter for PC sales, and sales this quarter dropped to their lowest volume since 2008,” Mikako Kitagawa, principal analyst at Gartner, said in a statement.

“Consumers' shift from PCs to tablets for daily content consumption continued to decrease the installed base of PCs both in mature as well as in emerging markets. A greater availability of inexpensive Android tablets attracted first-time consumers in emerging markets, and as supplementary devices in mature markets.”

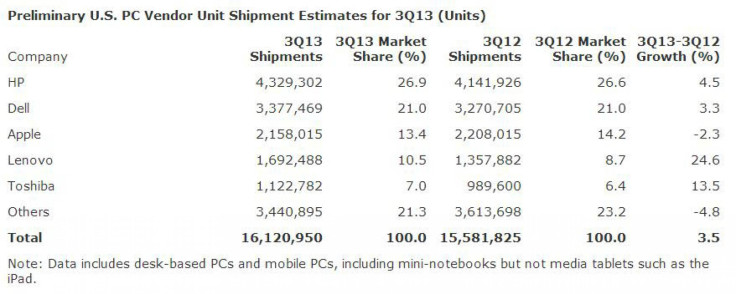

Although the estimates from both research firms showed a general trend of decline in Mac shipments in the U.S., their numbers differed significantly. According to the Gartner report, Apple’s Mac was the only product to suffer a decline in shipments (-2.3 percent) in the quarter while its top four competitors registered growth in the same period.

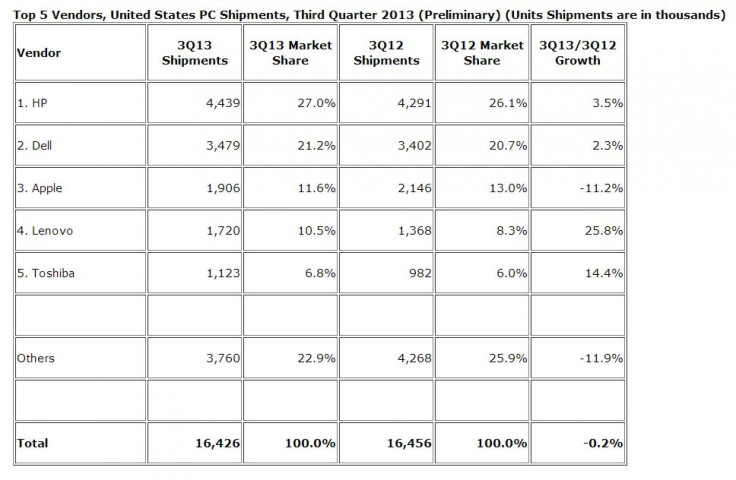

Meanwhile, IDC showed in its report that shipments of Mac computers were down by 11.2 percent in the third quarter while the overall PC market in the country slipped by 0.2 percent year-on-year.

However, regardless of the differences in estimates, both reports showed that shipments of Windows-based computers continued to outpace that of Macs in Apple’s domestic market.

As for other players, Gartner's report showed that HP (NYSE:HPQ) topped the U.S. PC market in the third quarter of the year with year-on-year growth of 4.5 percent and accounted for 26.9 percent of market share. Dell (NASDAQ:DELL) came in second place with 3.3 percent year-on-year growth with 21 percent of the market.

The estimated shipment of 2.16 million Macs helped Apple secure third position, according to Gartner, with a 13.4 percent market share, while Lenovo (HKG:0992) and Toshiba (TYO:6502) followed with 10.5 percent and 7 percent of the market respectively.

IDC's estimates also ranked the companies in the same order. According to the report, HP topped the chart with 27 percent of the market and Dell came second with 21.2 percent market share. Apple was listed third with 11.6 percent market share, followed by Lenovo and Toshiba with 10.5 percent and 6.8 percent of the U.S. PC market respectively.

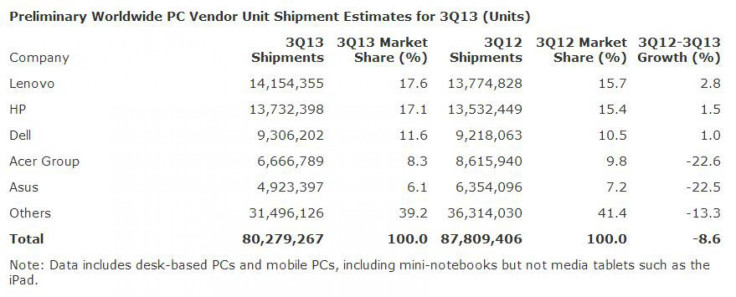

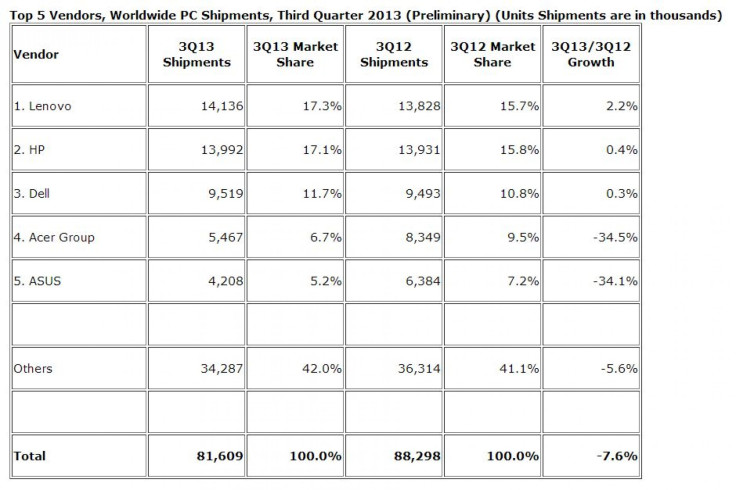

Neither Gartner nor IDC mentioned Apple's market share in the worldwide PC market for the quarter, as the company did not rank among the top five manufacturers worldwide. Here are the tables from Gartner and IDC for worldwide PC vendor shipment estimates in Q3 2013:

Gartner:

IDC:

According to Gartner, worldwide PC shipments totaled 80.3 million units in the third quarter of 2013, an 8.6 percent decline from the same period last year. IDC’s report estimated that global PC shipments totaled 81.6 million units during the three-month period -- a 7.6 percent year-on-year decline.

According to another recent estimate, worldwide tablet shipments will exceed total PC shipments on an annual basis by the end of 2015.

© Copyright IBTimes 2025. All rights reserved.