Apple's Spending Growth Looks Set To Slow

When a company is enjoying significant revenue growth, it's not hard for it to aggressively increase spending. However, when times get tougher, the company needs to be more thoughtful about each dollar that it spends in a bid to carefully balance investment in its long-term future with the need to deliver value to shareholders in the present.

It would seem that after Apple's (NASDAQ:AAPL) Jan. 2 financial guidance reduction, the company is set to slow its spending growth, according to a new report from Bloomberg. Let's take a closer look at what's going on.

Cutting back on hiring in certain places

Per Bloomberg, Apple "will cut back on hiring for some divisions after selling fewer iPhones than expected and missing its revenue forecast for the holiday quarter," citing "people familiar with the matter."

The report also indicates that Apple CEO Tim Cook "said he is yet to fully determine which divisions would cut back on hiring, but said that key groups such as Apple's artificial intelligence team would continue to add new employees at a strong pace."

Bloomberg also reports that the executive "emphasized that a division's importance to Apple's future isn't measured by hiring rates." I'd imagine that Cook said this to try to assuage fears among employees within the groups that will ultimately see hiring rates slow that their jobs aren't in jeopardy. The last thing that the company needs in a situation such as the one that it's currently facing is for key personnel to leave for apparently greener pastures as a result of these actions, as that talent will be essential to keeping Apple's product pipeline filled with the products that'll power its operating results in the years ahead.

This makes sense. There are some areas within Apple where the company has already has large and capable teams working to build next-generation products and technologies. By contrast, Apple is widely believed to have some catching up to do in areas like artificial intelligence (likely why Cook pointed explicitly to those efforts) and may be in the process of staffing up efforts for future products and technologies that it doesn't yet have competence in.

Impact to Apple's financials

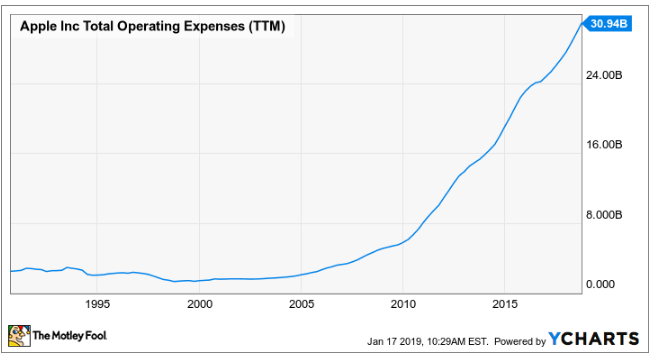

It's often the case that companies calibrate their operating expenses based on their expected revenue growth. With the company's revenue growth in fiscal 2019 clearly set to be lower than what it had previously expected, it's not surprising that Apple's decision makers are looking to curb operating expense growth -- growth that has, over the last decade, been quite robust.

With that being said, I don't think Apple's operating expenses will be flat or even decline in the near future. I still believe the company will grow its operating expenses (Apple grew operating expenses during its fiscal 2016 even though sales were down), but that this growth will be subdued until its revenue begins perking up.

Another thing to consider is that Apple is still in a position where it's generating a lot of free cash flow and the company has been quite clear that it intends to continue to buy back a lot of stock with that free cash flow. While stock buybacks don't affect a company's operating results, they can help to buoy earnings per share (EPS) by reducing the share count. An aggressive buyback can allow Apple's EPS performance to meaningfully outpace the underlying operating results, providing the company with near-term cover to allow it to keep growing spending as needed.

This article originally appeared in the Motley Fool.

Ashraf Eassa has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Apple. The Motley Fool has the following options: long January 2020 $150 calls on Apple and short January 2020 $155 calls on Apple. The Motley Fool has a disclosure policy.