Bitcoin Halving Could Push BTC Price To $50K, Hedge Fund Manager Predicts

KEY POINTS

- The increasing demand for Bitcoin will ultimately drive its price up according to a hedge fund manager.

- BTC could soar to $50,000 after halving.

- Past BTC halvings have driven the price of Bitcoin up.

Bitcoin (BTC) halving is not until four to five months from now, and plenty have speculated where prices will be after the event. To one hedge fund manager at Lightning Capital and adjunct professor at Baruch College, BTC could soar to $50,000 because of halving.

In a Medium post, Charles Hwang shared how he sees the popular crypto reaching more than double its December 2017 high, which he considers a conservative figure. Hwang believes that due to the reduction of the rewards that miners receive for verifying and recording transactions -- aka, halving -- on the Bitcoin blockchain and the increasing demand for the crypto, prices are bound to go up.

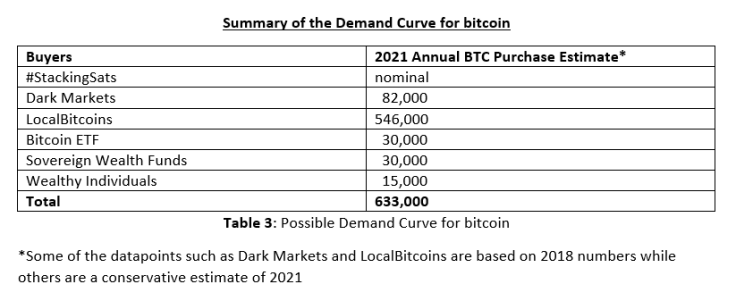

Hwang noted that even at steady demand, which he estimates at 633,000 BTC for 2021, and the supply that will be down to 328,500 BTC per year, it's most likely that it will spark a bull run.

What will drive Bitcoin demand?

The question of where demand will come from or if there will actually be one will ultimately dictate the materialization of price projections.

Hwang highlighted several catalysts or possible sources for where the demand for BTC will originate and estimated the quantity of BTCs for each buyer. Bitcoin's demand curve, according to Hwang, will come from LocalBitcoins, Bitcoin ETF, Sovereign Wealth Funds, Wealthy Individuals, and "stackingsats" (a term for those hoarding satoshis or the smallest unit of BTC).

This is Hwang's table where he listed where demand will come from as well as the estimated BTC quantity:

Historical basis

Hwang also noted a historical basis for his prediction since the past two halvings had taken BTC prices to new levels and that prices today are still higher than the prices before both halvings.

"The price at the end of July 2018 around $7,000 was still higher than $600–700 when the halving event started. In addition, bitcoin hit a low of $3,300 in December 2018. This price is still higher than the previous high of $1,200," Hwang wrote.

Moe Adham of Forbes expressed the same view in that the halvings would trigger higher prices, but not immediately as what others might expect, but at a gradual pace like 12-18 months.

© Copyright IBTimes 2025. All rights reserved.