Brexit Effect On US Real Estate: Why Millennials May Be Priced Out Of Some Markets

Pricey New York real estate might get even more costly whether or not Britons vote to shuck their membership in the European Union, and millennials might see either more competition from foreign investors pricing them out of the market, or will benefit from falling interest rates — cheaper mortgages — engendered by a faltering global economy.

With the Brexit vote looming Thursday, high-net-worth real estate investors — both individual and institutional — are eyeing New York and other gateway U.S. cities as safe havens, spooked by uncertainty that has crept into the London market in the last year, not only as a result of the contentious Brexit campaign but also because of recent policy changes involving visa approvals and real estate taxes.

New York real estate attorney Edward Mermelstein said big-money foreign investors have been shifting to the U.S. market for the past year, and the turmoil generated by the Brexit campaign has escalated the trend.

“There is a fairly strong consensus the British economy is going to be negatively affected by Brexit,” Mermelstein said. “Paired with what has been happening recently in the investment atmosphere, it's only going to put additional pressure on Britain as a place to invest.”

Lawrence Yun, chief economist at the National Association of Realtors, estimated that foreigners invested $80 billion in U.S. real estate last year. Overall, U.S. real estate is worth approximately $22 trillion, about 2 or 3 percent of it controlled by foreign investors.

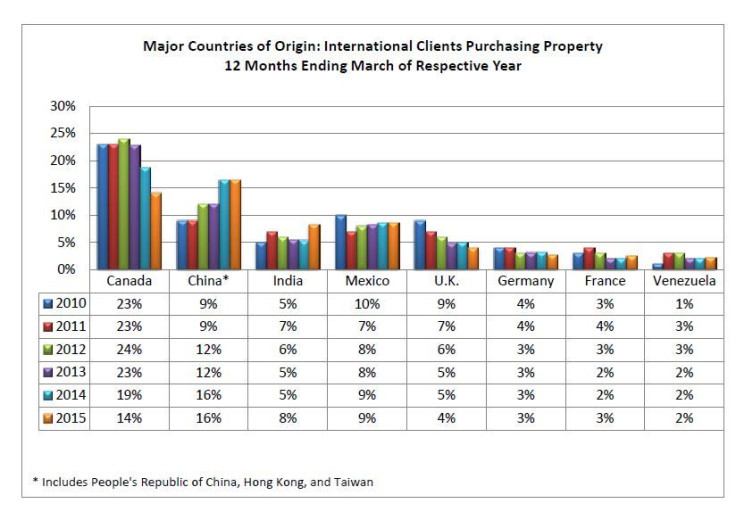

Last year, 16 percent of that investment came from China, followed by Canada at 14 percent and Mexico at 9 percent. Eight percent of investment came from India, followed by Britain at 4 percent, France and Germany at 3 percent, and Venezuela at 2 percent.

From April 2014 through March 2015, the Realtors estimate, foreign buyers bought 209,000 houses, valued at $104 billion and representing 8 percent of the sales volume, with Florida, California, Texas and Arizona accounting for half the purchases. The average price of those houses was $500,000, compared to the average U.S. home price of $256,000.

New York real estate attorney Edward Mermelstein said big-money foreign investors have been shifting to the U.S. market for the last year, and the turmoil generated by the Brexit campaign has escalated the trend.

“There is a fairly strong consensus the British economy is going to be negatively affected by Brexit,” Mermelstein said. “Paired with what has been happening recently in the investment atmosphere, it's only going to put additional pressure on Britain as a place to invest.”

Should Britons vote to go it alone, the British economy is expected to slow, pressuring the pound sterling and bonds.

“The implication of Brexit taking place is that it is looking good for the U.S. market,” Mermelstein said.

Yun said the prospect of Britain turning toward isolationism has raised “questions of confidence,” encouraging investors to seek opportunities elsewhere. “The U.S. will be considered competition or a safe haven,” Yun said, adding that a Brexit implies a reduction in international trade and a negative impact on economic expansion for both Britain and the EU, which will trickle down to other countries.

“That could lead to interest rates falling. The mortgage rate here in the U.S. could begin to decline because of lower GDP [gross domestic product] expansion. That always benefits the housing market,” Yun said.

Yun said in addition to New York, cities like Washington, Miami, Los Angeles and San Francisco are most likely to benefit, also possibly the Tampa Bay area in Florida, Chicago and Dallas. Smaller metro areas are unlikely to see much impact unless foreign investors see the bigger markets as overbought, Yun said.

Mermelstein said major European cities, including Paris and Rome, also are likely to benefit and attributes the shift out of London to the British trying to revive the concept of home ownership. British officials are trying to open the market to local purchasers by restricting visa applications and altering real estate tax laws to enable Britons to purchase homes at younger ages.

“Britons value ownership of personal property differently. In many cases they don’t get married until they are able to afford a home,” Mermelstein said. “This has caused the birth rate in Britain in plummet. Families are starting much later. Home ownership has become out of reach for many people.”

Yun said an influx of foreign capital to the U.S. real estate market could make it more difficult for young adults in the targeted cities to purchase property as well.

“First-time buyers are struggling to get into the market as it is. If more foreigners, typically cash purchasers, get into the market, they will face stiff competition to get their properties,” Yun said. “Typically younger purchasers need a mortgage. If they have to compete with foreign buyers with all cash, that hinders first-time buyers from getting their home.”

Mermelstein said, however, the influx of foreign capital probably would have little impact on first-time buyers, likely because they would be looking at the lower end of the market. He sees most investment coming from individuals willing to buy $15 million properties.

“Ten to 15 people will shift the needle significantly,” he said. “An investor I was advising was making London home base. He shifted his business and home to the U.S. His home purchase alone was $40 million. That’s not including the business interests. Individuals are making those kinds of commitments to the U.S. as opposed to Britain. You don’t need too many of them to move the needle.”

Another side benefit to a Brexit would be the creation of an atmosphere of stability in U.S. credit markets, Mermelstein said.

“The commercial real estate market also will continue to attract foreign investment — in secondary markets, not just New York, San Francisco and Chicago,” he said.

© Copyright IBTimes 2025. All rights reserved.