Average annual home prices in China's 70 major cities remained unchanged in February from a year ago, easing from a rise of 0.5 percent in January, according to Reuters' calculation using official data published on Sunday.

Greek banks hard-hit by the country's debt swap might not need all the aid earmarked by the EU and IMF to help them weather the crisis, central bank chief George Provopoulos was quoted as saying on Saturday.

The Federal Reserve bank said on Friday it had made mistakes in calculating bank losses in stress test results released this week.

Goldman Sachs Group Inc scored at least one victory in an otherwise tough week - this one against a coalition of religious groups.

A top regulator on Friday slammed a House bill to boost small business growth, adding to the chorus of critics who appear poised to derail passage of a rare bi-partisan bid to spur growth in an election year.

The Federal Trade Commission is examining whether Google deceived consumers by planting so-called Internet cookies in Apple's Web browser without users' consent, Bloomberg reported on Friday.

The primary advocate group for former MF Global customers is undertaking an effort to convert the commodities broker's bankruptcy status to one that allows a more streamlined liquidation process, saying it would preserve more potential payback for customers.

Consumer prices rose the most in 10 months in February as the cost of gasoline spiked, but there was little sign that underlying inflation pressures were building up.

The U.S. Federal Trade Commission is examining whether Google deceived consumers by planting so-called Internet cookies in Apple's Web browser without users' consent, Bloomberg reported on Friday.

Hedge fund manager Philip Falcone's LightSquared lost its main business partner, Sprint Nextel Corp , but gained $65 million from the breakup that may help its last-ditch effort to get regulatory approval to establish a high-speed wireless network.

Deficits for the next two fiscal years would be slightly higher than the White House envisions if President Barack Obama's budget plan were adopted, the Congressional Budget Office said on Friday.

The S&P 500 closed out its best week in three months with a slim gain on Friday as investors continued to propel equities near four-year highs.

A group of 188 lawmakers on Friday urged President Barack Obama to crack down on predatory Chinese pricing practices, which they said are threatening the auto parts industry.

Hedge fund manager Philip Falcone's LightSquared has lost its main business partner, Sprint Nextel Corp , which returned $65 million in payments to the telecommunications startup.

The S&P 500 rose slightly on Friday and was on track for its best week in three months as investors continued to propel equities near four-year highs.

While little is truly known about the iPhone 5, Apple loves to surprise fans with bold new features. A number of recently-approved Apple patents could provide hints as to the features we might see come September or October.

Glencore is planning a three-way carve-up of Canada's largest grain handler Viterra , an industry source said, to help navigate a politically charged federal review process if it wins a looming bidding war for the company.

The S&P 500 edged higher on Friday in its best week in three months as two slightly softer economic reports, although capping gains, were unable to shake the optimism over the economy that has helped drive stocks to near four-year highs.

The S&P 500 extended its run in its best week in three months on Friday as a pair of slightly softer economic reports, although capping gains, were unable to shake the optimism over the U.S. economy that has helped drive stocks to near four-year highs.

Consumer prices rose the most in 10 months in February as the cost of gasoline spiked, but there was little sign that underlying inflation pressures were building up.

Stocks pared early gains to briefly trade negative on Friday after data showed consumer sentiment fell in March.

British politicians visiting Wall Street would once have been only too happy to have their photograph taken with the head of Goldman Sachs. This week in New York, Prime Minister David Cameron met Goldman Chief Executive Lloyd Blankfein and other bankers in private.

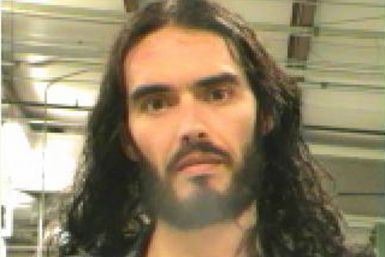

Forgetting Sarah Marshall's Russell Brand had a warrant out for his arrest in New Orleans on Wednesday after he allegedly threw a photographer's iPhone through a law firm's window on Monday. Brand was released on a $5,000 bond after turning himself in on Thursday. The actor was booked on misdemeanor charges of two counts of simple criminal damage to property.

The euro zone may raise the combined lending power of its bailout funds to close to 700 billion euros from 500 billion in a trade-off between German opposition to committing more money and calming markets, euro zone officials said.

Consumer prices rose by the most in 10 months in February as the cost of gasoline spiked, but there was little sign that underlying inflation pressures were building up.

Stocks were set for a modestly higher open on Friday as data showed inflation remained in check as the domestic economy continues to improve.

Industrial production was unchanged in February as a sharp drop in mining output offset a third straight monthly gain in factory production, the Federal Reserve said on Friday.

Consumer prices rose by the most in 10 months in February as the cost of gasoline spiked, but there was little sign that underlying inflation pressures were building up.

Stock index futures edged higher on Friday ahead of data on consumer sentiment and after the benchmark S&P 500 index closed above 1,400 for the first time since the 2008 financial crisis.

The Icelandic government said on Thursday it would repay early a fifth of the billions of dollars of loans it received from the International Monetary fund and its Nordic neighbors in the wake of the collapse of its banking sector in 2008.