Central Bank Gold Buying Slows, As Russia Sells Precious Metal In September: IMF Data

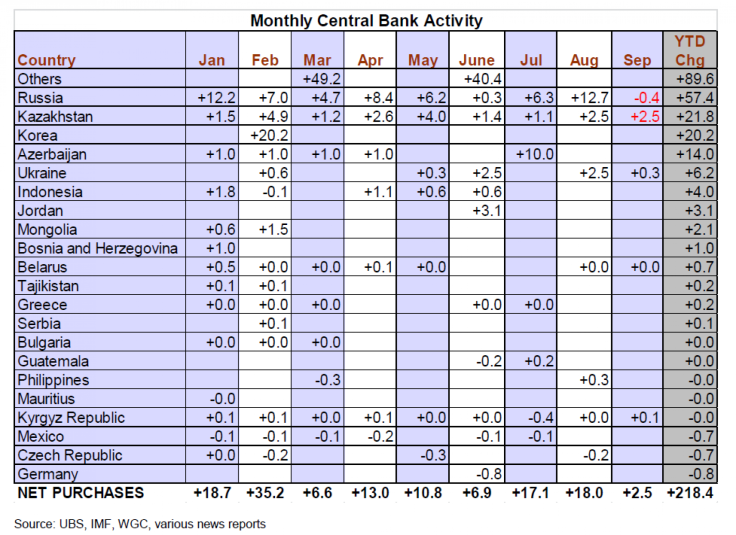

Gold buying by the world’s central banks has slowed so far this year compared to last year, though central banks as a whole remain net buyers of the metal, the latest International Monetary Fund (IMF) data shows.

But the surprise is that Russia, a key and consistent buyer in recent years, sold 12,000 ounces of gold in September.

Still, the country now owns 32 million troy ounces of gold, up from the 20.8 million it owned in 2009.

Central banks buy gold to diversify their reserves, away from simply foreign and paper currencies. Central banks as a whole became net buyers of gold in 2010, reversing an older trend that saw them selling gold to raise cash. Emerging markets like China and Russia drove the trend, as advanced economies held and still hold vastly more in gold reserves.

That buying trend looked stable, until now. Emerging-market banks may have less cash to help add gold to their reserves, thanks to currency volatility and capital outflows this year, reports the Wall Street Journal. That volatility may have been driven by a buoyed North American stock market, as investors shift attention away from emerging economies and back toward a slowly recovering U.S.

“Although buying appetite remains intact, the pace has certainly slowed down this year,” wrote UBS AG (VTX:UBSN) analyst Joni Teves in a research note on Tuesday. Central bank purchases from January to August 2013 are 40 percent lower than the same period last year, she said.

Advanced economies owned 706 million ounces of gold as of August 2013, relative to 215 million ounces owned by emerging and developing countries, according to IMF data. But emerging countries added about 40 million ounces since 2009, compared to less than 2 million ounces by advanced economies since then.

“It is virtually impossible to ascertain the exact motivations behind central bank gold movements,” added Teves. She noted, however, that Russia also sold gold in September 2012, so there could be a seasonal explanation.

Russian central bankers may have also taken advantage of gold’s 11 percent price rally from August to September, selling a small amount of metal for a quick profit, she wrote.

Central banks are likely to slow gold buying by 34 percent in 2013, according to precious metals tracker Thomson Reuters GFMS, after two straight years of net purchases.

Part of the problem is the steep, 20 percent decline in gold prices this year, which ended 12 years of strong price upticks. That may have prompted central bankers to wait for a stable market.

"It really does blunt the support that gold has," said Jeff Wright, an analyst with H.C. Wainwright & Co., to the Journal. "Purchasing by central banks was the failsafe, the line in the sand [supporting prices in] a volatile market. It's a very important shift."

Others, like gold strategist George Milling-Stanley, who has advised central banks on gold buying for years, have been more optimistic.

Western European central banks tend to have 75 percent or more of their external reserves held as gold, compared to less than 5 percent for many emerging economies, he said.

“All of the buying is coming from what we used to call the emerging markets -- China and India, Russia, Brazil, Mexico -- that have very, very low proportions,” he told IBTimes at a commodities conference in September.

“Most of the central banks I’ve talked to in the developing world simply say, 'We need to have more gold in our reserves, without a specific target,'” he said.

Gold hit a five-week high in trading on Monday and opened in New York at $1,352 per ounce on Tuesday morning.

© Copyright IBTimes 2024. All rights reserved.