Bank of america Stories

Bank of America's Settles Countrywide Discrimination Case; Pays Record $335 Million Fine

Investigation had revealed that Countrywide had charged higher fees and rates for more than 200,0000 minority borrowers from 2004-2008, in the midst of the housing boom. Some 10,000 borrowers were also pushed in to sub-prime mortgages when others with similar qualifications got standard mortgages.

Late-day Rally Lifts Bank of America (NYSE:BAC)

A late-day buying spree is causing shares in Bank of America (NYSE:BAC) to soar higher than its big bank peers. The rally began just after 3 p.m., shortly after news broke that the financial institution had settled a federal lawsuit regarding a subsidiary's subprime lending practices for $335 million.

Home foreclosures jump in third quarter-report

The number of new home foreclosures jumped by more than 21 percent in the third quarter as banks moved more aggressively after a pause that began late last year, according to a report released by a bank regulator on Wednesday.

Bank of America: Shoring up Capital Base for Stress Test

Bank of America Corp. (NYSE:BAC) completed its swap of common stock and notes for preferred shares as part of its efforts strengthen its capital base ahead of Fed's 2012 stress test.

Oops! The Top 10 Business Blunders of 2011

Whether it involves embarrassing tweets, tone-deaf CEOs or even the disappearance of money, some oops moments need be relived just one more time.

DJIA Soars, Banks Have Big Trading Day

U.S. stocks soared on Tuesday. The Dow Jones Industrial Average (DJIA) ended up 337 points, or 2.9 percent, to close at 12,103. The S&P 500 Index rose 36 points, or 3 percent, to 1,241, while the NASDAQ rose 80 points, or 3.2 percent, to 2,604.

Technology 2011 in Review: Highlights and Lowlights

No doubt 2011 was a major year for technology in part because it touched everyone differently. Following are some of the highlights and lowlights of the year:

Wall Street to rebound at open, volatility seen

Stocks were poised to rebound at the open Tuesday after declines in the prior session as a drop in Spain's borrowing costs and unexpectedly positive data from Germany eased euro zone debt worries.

Bank of America’s Christmas Gift to Shareholders: A Broken Promise and Further Dilution

Bank of America CEO Brian Moynihan ate his words as the Charlotte, N.C.-based bank once again resorted to non-investor-friendly measures to raise capital, despite saying the bank would not take such actions.

Loan-Modification Blunders Bedevil U.S. Housing Recovery

The federal government's Home Affordable Modification Program is far from perfect, said Josh Zinner, an advocate with the Neighborhood Economic Development Advocacy Project in New York, "but the biggest problem is servicers not doing their job."

7 Positive Predictions for Investors in 2012

With less than two weeks left before the end of the year, all kinds of market participants, from economists at multinational banks to stock bloggers in their bedrooms, have begun to give their predictions for 2012. Here is a lucky set of seven predictions that could benefit investors next year.

Europe's Markets Higher Friday at Mid-Day, Led By Mining Sector

European shares were slightly higher on Friday at mid-day amid thin trading as miners tracked rising metal prices, offset by lingering concerns over the Eurozone debt crisis and reservations ahead of U.S. inflation data.

U.S. Stock Futures Signal Higher Open for Equities

Stock index futures pointed to a higher open for equities on Wall Street on Friday, with futures for the S&P 500, for the Dow Jones and for the Nasdaq 100 rising 0.3 to 0.6 percent.

Fitch Downgrades Seven Global Banks

Fitch Ratings, the third-biggest of the major credit rating agencies, downgraded seven global banks based in Europe and the United States, citing "increased challenges" in the financial markets.

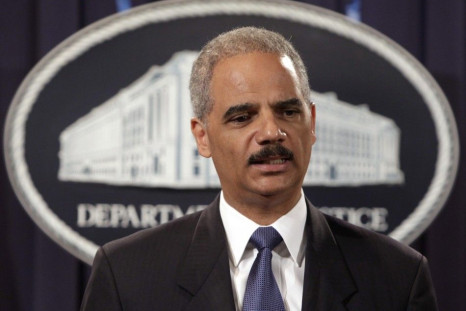

Senator Asks AG to Reject Foreclosure Settlement Waiving Banks' Liability

Sen. Maria Cantwell wrote to Attorney General Eric Holder Thursday expressing concern that a nationwide settlement regarding major banks' foreclosure practices should not grant immunity in future investigations into their conduct leading up to the mortgage crisis.

SEC appeals judge's rejection of Citigroup deal

The top U.S. market regulator is appealing a judge's rejection of a major Citigroup Inc civil securities fraud settlement, according to court papers filed on Thursday.

Lehman Seeks $1.33 Billion Archstone Stake, Challenging Sam Zell

The estate of Lehman Brothers has sought to match Sam Zell's $1.33 billion bid for a 26.5 percent stake in Archstone, sharpening the rivalry for the multifamily housing giant.

SEC Appeals Judge's Scathing Rejection of $285 Million Citigroup Settlement

"We believe the district court committed legal error by announcing a new and unprecedented standard" for approving settlements, Robert Khuzami, head of the Securities and Exchange Commission's enforcement division, said in a statement Thursday.

Morgan Stanley's Job Cuts Only Latest in Wave of Firings at the Heart of Wall Street

Morgan Stanley's announcement that it is slashing 1,600 jobs is only the latest in a late-year blizzard of pink slips being floated among people at the heart of American high-finance. Bonuses are also down sharply. Is the economy Grinch stealing Wall Street's Christmas?

Gold Heads for First Quarterly Fall Since Sept '08: Analysis

A dash for cash has overwhelmed gold's traditional status as a haven from risk, putting the metal on course for its first quarterly fall since end-September 2008, when the global credit crunch was at its worst.

'Mass Affluent' But Not Opulent Slice of U.S. Consumers as Scared as the Rest of Us: Report

Two recent reports on the attitudes of the "mass affluent" revealed that consumers in this wealth bracket have a relatively high level of apprehension about their financial future.

Pros Move Against Mom-and-Pop Investors in December: Report

Two reports released today show two groups, retail investors and professional asset managers, have been moving in markedly different directions in the past two weeks. The armchair stock pickers are getting out of U.S. equities while the pros are claiming they are dumping more cash into the American stock market.

'All American Muslim' Saved by Hollywood Celebs as Lowe's Pulls Ads

The All-American Muslim show has been saved by Hollywood celebrities who have bought the remaining ad slots for TLC's reality series after Lowe's and other companies pulled out.

Bank of America Adds 160 Financial Solutions Advisors to Serve Preferred Customers

Bank of America Corp. (BAC) announced Monday it is hiring about 160 Merrill Edge Financial Solutions Advisors across Southern California and Arizona by the end of first quarter 2012 as part of the firm's plan to enhance the solutions it offers to preferred customers -- those with investable assets of $50,000 to $250,000.

Wall Street Tumbles on Europe, Intel's Lowered Outlook

Stocks tumbled on Monday, as concerns about Europe returned to the forefront after major credit ratings agencies warned that European leaders had not done enough to tackle the region's debt crisis.

American CFOs: Things Will be Worse Off in 2012, But Not at my Company

A survey published Monday by Bank of America Merrill Lynch found a majority believe the U.S. economy will fare worse off next year, yet only 7 percent believe this will force them to lay people off

Sheila Bair Said to be Lead Candidate to Monitor Foreclosure Settlement

Sheila Bair, former chairwoman of the Federal Deposit Insurance Corp. (FDIC), is said to be the leading candidate to monitor banks during a nationwide foreclosure settlement.

Lehman's Bankruptcy Estate Preparing Bid for Archstone Stake: Report

The bankruptcy estate of Lehman Brothers Holdings Inc. is preparing to make a $1.33 billion bid for part of apartment owner Archstone that it does not already hold, according to a report in The Wall Street Journal.

Wall Street Rises on EU Deal, but Rally Seen as Temporary

Stocks rose on Friday as European Union leaders agreed on measures to tackle the region's sovereign debt crisis and data showed U.S. consumer confidence rose to a six-month high.

Wall Street Rebounds after EU Deal, but More Stress Seen

Stocks advanced on Friday as European Union leaders agreed on measures to address the region's sovereign debt crisis, while U.S. consumer confidence rose to its highest level in six months.