Jpmorgan chase Stories

JPMorgan’s 'London Whale' Trading Blunder Didn’t Scare Away All Money Managers

JPMorgan Chase & Co. (NYSE: JPM)'s multibillion-dollar "London Whale" trading mess sent some well-known money managers running for the exit, but new regulatory filings show that several big hedge-fund players loaded up on JPMorgan as they saw the stock's 22 percent drop in the second quarter as a buying opportunity.

Facebook Fraud Trial? Not Until Year-end At Earliest, Experts Say

Any trial in U.S. District Court of the more than 50 shareholder lawsuits alleging fraud by Facebook (Nasdaq: FB), the No. 1 social networking site, and its underwriters could be as much as five months away, lawyers said.

Bank Of America Sells Merrill Unit To Julius Baer - A List Of Assets Sold Since 2011

Bank of America Corp. (NYSE: BAC), the lender divesting assets to raise capital, said Monday it has agreed to sell Merrill Lynch's International Wealth Management business outside the U.S. to Swiss private bank Julius Baer Group Ltd.

Samsung Galaxy S3 Releases With Battery Issues: How To Fix The Drain Problems And Find Out If Your Device Is Affected

Samsung's Galaxy S3 has become one of the leading smartphones on the market, hitting the 10 million-unit sales mark in less than two months after its launch. Although the device has been dubbed as the Korea-based company's flagship smartphone of 2012, it does come with its share of issues.

BlackBerry Investor Backs IBM Bid; Values RIM Assets At $9.6B

BlackBerry investor Victor Alboini said he welcomed a bid for Research in Motion's enterprise business by IBM, saying it would greatly enhance value of an undervalued asset.

IBM Eyeballing Bid for BlackBerry Developer RIM: Report

BlackBerry developer Research in Motion (Nasdaq: RIMM) has been approached by International Business Machines Corp. (NYSE: IBM) about a possible sale of its enterprise services unit, Bloomberg News reported, citing two insiders.

US Regulators Tell Big Banks To Develop Collapse-Prevention Plan: Reuters Exclusive

U.S. regulators directed five of the country's biggest banks, including Bank of America Corp and Goldman Sachs Group Inc, to develop plans for staving off collapse if they faced serious problems, emphasizing that the banks could not count on government help.

Peregrine Semiconductor Shares Jump 7% In IPO, Reversing Facebook Jinx

Shares of Peregrine Semiconductor Corp. (Nasdaq: PSMI) jumped 7 percent to $15 a share as they started trading the first time as a public company. Peregrine becomes the third technology initial public offering in a month to rise at the opening of trade, jn contrast to the May 18 IPO of Facebook (Nasdaq: FB), the No. 1 social networking site.

Peregrine Semiconductor Resumes Tech IPO Parade After Facebook's Fiasco

Peregrine Semiconductor, which has sold more than a billion high-frequency chips to the mobile industry in the past five years, raised $77 million in its IPO on Tuesday and plans to start trading Wednesday, the latest technology IPO since the Facebook fiasco.

Standard Chartered Sparks Scrutiny of India Offshoring

Offshoring of back-office work to India, a trend among banks and accounting firms, came under new scrutiny with allegations that Standard Chartered Plc moved compliance oversight work dealing with Iranian banking transactions to India to avoid U.S. regulators.

Knight Capital Being Saved By Very People It Tried to Screw Over

There's one developing storyline in the saga of Knight Capital Group Inc., the Wall Street market maker that lost more than $440 million Wednesday when an automated trading program it had just installed went berserk, that's not being talked about: It is being propped up by the very people it tried to screw over.

Treasury To Sell $4.5 Billion In AIG Stock, Taxpayers Will Still Own A Majority Stake

The U.S. Treasury Department on Friday said it plans to sell $4.5 billion in American International Group Inc. (NYSE: AIG) shares, further cutting its ownership stake in the bailed-out insurer.

Bank Stocks Throw a Party But Forget To Invite JPMorgan

Shares of U.S. banks of all sizes and specialties rose Friday over 3 percent, handily beating the performance of the wider stock market, which itself was in a head-first rally following a week of disappointing news. But there was one big exception to the equity party: megabank JPMorgan Chase and Co. (NYSE:JPM), which looked poised to underperform its peers in late-afternoon trading.

July Employment Report Sparks Risk-On Sentiment In Markets

The U.S. government's report Friday that 163,000 jobs were created last month, far more than expected, sparked a risk-on sentiment among investors.

Knight Capital, Firm At Center of Wednesday NYSE Trading Glitch, On The Ropes

The firm at the center of a software glitch that prompted highly irregular trading patterns Wednesday morning in shares of more than 100 New York Stock Exchange issues is hanging on by a thread.

Pre-Market Movers (OCZ Technology, Green Dot, Exelixis, Mellanox, Nokia, Synacor, Microsoft, Statoil, JPMorgan Chase)

OCZ Technology Group, Green Dot, Exelixis, Mellanox Technologies, Nokia Corp, Synacor, Microsoft Corp, Statoil ASA and JPMorgan Chase & Co are among the companies whose shares are moving in pre-market trading Monday.

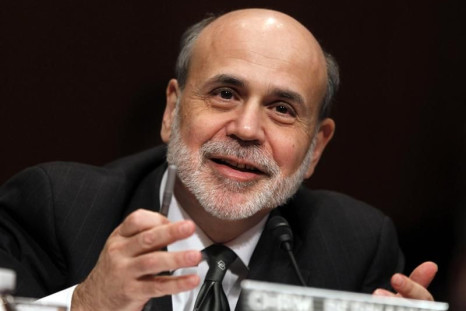

Central Bank Preview: What Will Fed, ECB, BOE Do Next Week?

Next week could see some major worldwide financial implications, depending on what three of the world's largest central banks do at their scheduled meetings.

Caterpillar Inc. (CAT) Q2 Profit Rises, Lifts 2012 Forecast

Caterpillar Inc. (NYSE: CAT), the largest maker of construction and mining equipment, reported a 67 percent jump in its second-quarter profit that topped analysts' estimates and boosted its full-year outlook as demand increased from North American builders and overseas miners.

Caterpillar Inc. (CAT) Earnings Preview: Decent Q2, Cautiously Optimistic Outlook

Caterpillar Inc. (NYSE: CAT), the world's largest maker of construction and mining equipment, is expected to report strong second-quarter profit as resurgent sales of construction machinery in the U.S. and ongoing global demand for mining equipment offset weakening sales in Europe, China and Brazil. The impact of acquisitions will also play a part.

Pre-Market Movers (Philips, PhotoMedex, Deutsche Bank, Morgan Stanley, United States Steel, Bank of America, Ford Motor, JPMorgan Chase)

Philips Electronics, PhotoMedex, Deutsche Bank, Banco Santander, Morgan Stanley, United States Steel Corp, Bank of America Corp, Ford Motor and JPMorgan Chase & Co. are among the companies whose shares are moving in pre-market trading Monday.

NY Fed Urges 'Capital Control' Of Money Market Funds

The Federal Reserve Bank of New York is proposing that money market managers be empowered to hold back depositors' money for 30 days in the event of a run on funds. The controversial proposal is being called by critics a kind of capital control.

Facebook IPO Jinx Falls: Palo Alto, Kayak Soar

Two months after the trading fiasco in the initial public offering of Facebook (Nasdaq: FB), the No. 1 social networking site, tech IPOs are soaring again. Palo Alto Networks (Nasdaq: PANW) and Kayak Software (Nasdaq: KYAK) shares soared in their IPOs.

For Investors In Bank Stocks, Profit, It Seems, No Longer Matters

Investors seem to be disregarding the parade better-than-expected profit figures from major financial institutions this earnings season, instead using top-of-the-line revenue and return on equity numbers to guide their investment decisions.

Bank Of America, Morgan Stanley, Citigroup: Global Banking Giants To Begin Another Round Of Layoffs

The golden age of being a banker is so far in the past. After a brutal year of massive layoffs in the global financial industry last year, the axe is starting to fall again.

After Facebook Fiasco, Tech IPOs Stage Comeback

Two months after the trading fiasco in the initial public offering of Facebook (Nasdaq: FB), the No. 1 social networking site, tech IPOs are heading to market again.

Bank Of America Seen Swinging To Profit, Hobbling to Just Above the Brink

Bank of America Corp. (NYSE:BAC), the troubled financial behemoth that teetered just above the abyss during the last few weeks of 2011 and has since made somewhat of a recovery, is expected to swing to profit when it reports quarterly financial results Wednesday morning.

JPMorgan Traders Might Face Criminal Charges

JPMorgan receives another blow even as it flounders in the midst of a FERC power market manipulation probe and talks with U.S. regulators for its alleged involvement in rigging key benchmark interest rates.

US Regultors Probing Into The Escalating Libor Scandal

Taking inspiration from global regulatory investigations into the interest rate manipulation, the U.S. is now building strong evidence of criminal wrongdoings against big banks and individuals ensnared in the heart of the scam.

Despite Mediocre Results, Vikram Pandit Gets His Mojo Back

The chief executive of New York-based Citigroup Inc. (NYSE:C) had a surprisingly confident outlook for his bank's future business prospects during a conference call with analysts Monday.

Seven Banks That Annoy Credit Card Customers The Most: New CFPB Database

The Consumer Financial Protection Bureau's complain database has been live for six weeks, Here's who ranks best and worst among the big credit card issuers.