Jpmorgan chase Stories

NYC pension funds want tougher Wall Street clawbacks

New York City's pension funds want three big Wall Street banks to impose tougher compensation-clawback rules for top executives.

Jefferies Earnings Prop Up Wider Bank Sector

Wall Street banks woke up to an unexpected positive surprise Tuesday after one of the financial sector's most prominent medium-sized investment banks posted results that exceeded analyst expectations, showing strength in the much-battered sector in spite of a highly volatile fourth quarter. Earnings for Jefferies Group (NYSE:JEF) were 50 percent higher than analysts had expected.

Investors target JPMorgan over $95 billion of RMBS

A law firm that led mortgage bondholders to extract a $8.5 billion settlement from Bank of America Corp is turning its sights on JPMorgan Chase & Co .

Fitch Downgrades Seven Global Banks

Fitch Ratings, the third-biggest of the major credit rating agencies, downgraded seven global banks based in Europe and the United States, citing "increased challenges" in the financial markets.

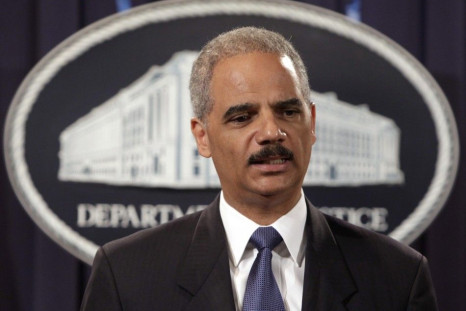

Senator Asks AG to Reject Foreclosure Settlement Waiving Banks' Liability

Sen. Maria Cantwell wrote to Attorney General Eric Holder Thursday expressing concern that a nationwide settlement regarding major banks' foreclosure practices should not grant immunity in future investigations into their conduct leading up to the mortgage crisis.

WaMu Settles Dispute, Eyes Bankruptcy Exit

Washington Mutual Inc., the biggest bank to fail in U.S. history, said it reached a settlement in a dispute between shareholders and certain creditors that had prevented the bank from emerging from Chapter 11 bankruptcy proceedings.

Former WaMu execs agree to settle FDIC lawsuit: report

Former Washington Mutual Inc executives agreed to settle a lawsuit for less than 10 percent of the $900 million originally sought by the FDIC for their role in the biggest bank failure in U.S. history, the Wall Street Journal said, citing people familiar with the situation.

Wall Street Tumbles on Europe, Intel's Lowered Outlook

Stocks tumbled on Monday, as concerns about Europe returned to the forefront after major credit ratings agencies warned that European leaders had not done enough to tackle the region's debt crisis.

Sheila Bair Said to be Lead Candidate to Monitor Foreclosure Settlement

Sheila Bair, former chairwoman of the Federal Deposit Insurance Corp. (FDIC), is said to be the leading candidate to monitor banks during a nationwide foreclosure settlement.

Barclays’s Top-Paid CEO Bob Diamond Fires 30 Execs for 'Being Jerks'

Barclays Plc. (BCS) chief executive Bob Diamond has fired as many as 30 bankers for violating his newly imposed "no-jerk" rule and acting in a way that embarrasses the company.

MF Global clients to get $2.2 billion

A judge approved a $2.2 billion transfer to U.S. commodities customers of fallen brokerage MF Global on Friday as a trustee acknowledged there were suspicious transfers leading up to its October 31 collapse.

Wall Street Rises on EU Deal, but Rally Seen as Temporary

Stocks rose on Friday as European Union leaders agreed on measures to tackle the region's sovereign debt crisis and data showed U.S. consumer confidence rose to a six-month high.

Wall Street Rebounds after EU Deal, but More Stress Seen

Stocks advanced on Friday as European Union leaders agreed on measures to address the region's sovereign debt crisis, while U.S. consumer confidence rose to its highest level in six months.

Large U.S. Bank Stocks Happy on Euro Summit News

Stock in the largest American banks were particularly bullish on the developments, trading up in heavy volume during pre-market action in the New York Stock Exchange. Shares of Citigroup (NYSE:C), Bank of America (NYSE:BAC) and Goldman Sachs (NYSE:GS) were up more than 2 percent in very early pre-market trading. Morgan Stanley (NYSE:MS), whose operations are generally considered to be more sensitive to developments out of Europe than its large bank peers in the U.S., was up over 3 percent.

Stocks, Commodities and Euro Sink on EU Summit Letdown

Asian shares, commodities and the euro fell Friday on growing doubts that European leaders could forge a credible plan to solve the euro zone's debt crisis at a summit later in the day.

JPMorgan Profit View Lowered by Susquehanna

Susquehanna Financial cut its profit estimates of JPMorgan Chase & Co. (NYSE:JPM) after the company guided weak results for its investment bank unit.

MF Global trustee must prove disinterestedness

Bankruptcy Judge Martin Glenn said he needs more information from James Giddens, the trustee winding down bankrupt brokerage MF Global , to determine if Giddens has a conflict of interest in the case.

U.S. targets mortgage servicers for poor performance

The Obama administration said on Wednesday it will keep the pressure on two big U.S. banks to help more troubled borrowers from losing their homes by withholding payments to the banks under a foreclosure-prevention program for the third straight quarter.

Occupy Homes: Protesters Target Foreclosures on Dec. 6 'Day of Action'

Occupy Homes, an offshoot of Occupy Wall Street, will protest in foreclosed and vacant properties in around 25 U.S. cities on Tuesday's Day of Action, promoting what organizers call the basic human right of housing.

Financial Stocks End Strange Day on Odd Note

A strange and winding day for the shares of major U.S. financial companies ended as oddly as it began, as shares of major U.S. banks seemed to brush off bad news on sovereign debt ratings that rattled the wider market and shares of five of the biggest financial institutions traded on the New York Stock Exchange ended the session on a sell imbalance.

Lehman Brothers Comes Back From the Dead

Over the past few days, Lehman Brothers has announced several actions one might not expect from what is arguably the most notorious bankrupt company of the last decade. It is looking to name a new board of directors and is engaging in a bidding war for another company.

Michael Kors IPO Valued at $3.6 Bil, Designer Seeks to Raise $792.3 Mil

Break out the bubbly, Michael Kors is going public, with an IPO valued at $3.6 billion.

Bank Earnings Will Tank This Quarter: Wells Fargo

In a research note, banking industry analyst Matthew Burnell reduced fourth-quarter earnings estimates for JPMorgan Chase (NYSE:JPM), Citigroup (NYSE:C), Goldman Sachs (NYSE:GS) and Morgan Stanley (NYSE:MS). Burnell reduced the earning estimates for JPMorgan and Citi by about 4 percent, but sounded a much more pessimistic note on Goldman and Morgan Stanley.

SAP to buy SuccessFactors for $3.4 Billion

Germany's SAP announced a $3.4 billion cash deal to buy U.S. Web-based software company SuccessFactors, joining the scramble among technology firms to offer cloud-computing services to businesses.

JP Morgan arranges loan for SAP's SuccessFactors buy

JPMorgan Chase & Co is arranging the 1-billion-euro ($1.34 billion) loan that SAP AG is taking on to help pay for its $3.4 billion takeover of SuccessFactors, SAP co-Chief Executive Bill McDermott told Reuters.

SAP Offers $3.4 Billion for SuccessFactors

Germany's SAP announced a $3.4 billion cash deal to buy U.S. web-based software company SuccessFactors, joining the scramble among technology firms to offer cloud-computing services to businesses.

SAP Offers $3.4 Billion Cash to Buy SuccessFactors Inc.

Germany's SAP announced a $3.4 billion cash deal to buy U.S. Web-based software company SuccessFactors Inc., joining the scramble among technology firms to offer cloud-computing services to businesses.

U.S. Stock Market Friday Caps Best Week in About 3 Years

Stocks ended flat on Friday but capped the best week for Wall Street bulls in almost three years after data showed the U.S. unemployment rate dropped to a 2-1/2 year low.

GMAC Mortgage to Stop Massachusetts Activity After Suit

In the wake of a lawsuit filed by the Massachusetts attorney general, GMAC Mortgage, a subsidiary of Ally Financial, said on Friday that it would stop buying mortgage loans in the state after Dec. 5.

Wall Street on track for stellar week on jobs data

Investors pushed stocks higher on Friday, heading for the best week since early 2009, on news the U.S. unemployment rate fell to a 2-1/2 year low.