A bold plan to slash the U.S. budget deficit fell short on Friday of winning support needed from a presidential commission to trigger congressional action, but it was expected to help shape future budget debates.

Close-out retailer Big Lots Inc cut its outlook for the crucial holiday quarter, in the face of strong competition from rivals especially in the toys category, and a rise in debit card processing fees, sending its shares down 5 percent.

Upset by night raids, tribal elders in Afghanistan threatened to fight the NATO forces like they fought the Soviets, US diplomatic cables suggest.

U.S. stocks edged mostly lower on Friday as Wall Street shook off an unexpectedly weak payrolls report, while investors were reassured by the broader economic picture and the likelihood the Federal Reserve would stay the course on its stimulus plan.

The French government is examining how it could ban website WikiLeaks from being hosted on servers in France, according to a letter written by Industry Minister Eric Besson and seen by Reuters on Friday.

Futures on major U.S. stock indices remained range-bound on Friday as investors await for key U.S. monthly non-farm payrolls and unemployment data from the government.

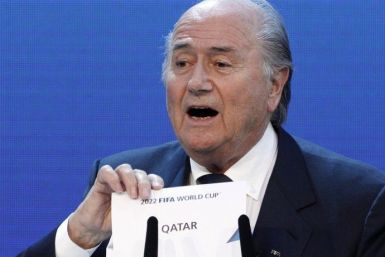

FIFA takes the Football World Cup 2018 and 2022 to new territories of Russia and Qatar, raising concerns over risks involved in the selection of venue.

Jefferies & Co. said in its Wireless and Handsets weekly that tablet and smartphone sell-through has been strong at the start of the holiday shopping season.

Video game publishers say they have positioned themselves to capitalize on the future of digital entertainment. Investors will need more convincing.

USD/CAD is technically poised for a bounce back from current levels just above parity, but given the uncertainty about key data due later in the day, one should also be prepared for a move on the other side, which could easily take the pair to 0.9976 (S1) support.

U.S. employment barely grew in November and the jobless rate unexpectedly hit a seven-month high, hardening views the Federal Reserve would stick to its $600 billion plan to shore up the fragile recovery.

Wall Street mostly shrugged off a weaker-than-expected payrolls report on Friday, leaving stocks little changed as the data didn't alter investors' view the economic recovery is on track.

Whistle-blower website Wikileaks was back online Friday afternoon with a new address from Switzerland. Web users trying to access the new website are being directed to a page with the URL http://213.251.145.96/, suggesting that the group has been unable to find a new hosting provider.

Once yuan becomes fully convertible, countries importing Chinese goods will invariably have to have a reserve of yuan. And they will have to build up a yuan reserve by offloading their dollar reserves. If a major chunk of ASEAN and Latin American countries take this path, it will seriously dent the greenback's status as the global reserve currency.

Economic growth in India will overtake that of China in the next ten years, boosted by huge domestic demand, said noted global economist Nouriel Roubini.

After a long battle, Google has finally confessed to trespassing on a Pennsylvania family’s property to acquire data for its Street View service.

An American company that had been directing traffic to the WikiLeaks website withdrew its services late Thursday, making the site invisible for several hours.

Futures on major U.S. stock indices point to modestly lower opening on Friday ahead of key U.S. monthly non-farm payrolls and unemployment data from the government.

Stock index futures fell from more than two-year highs on Friday, pointing to a slide at the open after a weaker-than-expected payrolls report indicated an economic recovery was still shaky.

Market is widely prepared for better readigs for both the EU indicators due Friday, and as of now, 1.3283 works out to be the nearest target upside on the 4-hour chart.

U.S. employment increased far less than expected in November and the jobless rate jumped to a seven-month high of 9.8 percent, dampening hopes for a self-sustaining economic recovery.

Wall Street's largest two-day rally in three months will be tested by jobs data on Friday, with some in the market predicting a strong report that will push the S&P 500 to a fresh two-year high.