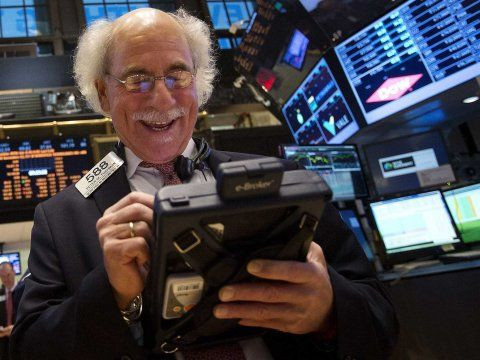

Dow Jones Industrial Average, S&P 500 Index Smash Record Closing And Intraday Highs

The Dow Jones Industrial Average and S&P 500 Index hit intraday and closing record highs on Wednesday, boosted by the Federal Reserve’s Beige Book, which showed the U.S. economy is continuing to expand at a “modest-to-moderate” pace.

While consumer spending remained at a “slight-to-moderate” rate, the Fed said price pressures will continue to stay steady as wage growth remained modest. "Reports from the 12 Federal Reserve Districts suggest that national economic activity continued to expand in October and November. A number of Districts also noted that contacts remained optimistic about the outlook for future economic activity," the Fed said in the report.

Following the report, the blue chip Dow Jones Industrial Average, which tracks the share prices of the 30 largest publicly traded U.S. industrial companies, gained 32.94 points, or 0.18 percent, to hit a record finish at 17,912.49, breaking its previous record closing high of 17,879.55. This was the second time this week the price-weighted index surpassed both its record intraday and closing highs, previously set on Tuesday. The Dow smashed its record intraday high of 17,897.05 during the previous session and climbed to 17,924.15 in afternoon trading.

The S&P 500 stock index, which tracks the share prices of the nation's 500 largest publicly traded companies, edged up 7.78 points, or 0.38 percent, to end at a record high of 2,074.33. The Index also broke its previous intraday high and rose to 2,076.28 in afternoon trading. The S&P 500 previously hit an intraday and closing high of 2,075.76 and 2,072.83, respectively on Nov. 28.

The tech-heavy Nasdaq Composite added 18.66 points, or 0.39 percent, to finish at 4,774.47.

Ahead on the economic calendar, weekly jobless claims are released at 8:30 a.m. EST on Thursday, followed by the government’s monthly jobs report for November issued on Friday. Also on Thursday, the European Central Bank and the Bank of England will announce their latest monetary policy decisions on interest rates, which are at historic lows.

“We not only believe that the Eurozone is flirting with deflation, we also think the rest of the global economy is now in a disinflationary period,” Peter Cardillo, chief market economist at Rockwell Global Capital, said in a note. “While Mr. Draghi [European Central Bank President Mario Draghi] has consistently reassured the markets of expanding stimulants, a surprise move could adversely affect the markets.”

© Copyright IBTimes 2025. All rights reserved.