As a small business owner, I know the importance of understanding and relating to customers. My business, which ships specialty sauces, salsa and soups around the country, is all about knowing what my customers like.

Post-election uncertainty in Greece pushed investors away from stocks and commodities, lowering German and U.S. bond yields and eroding the euro's value as investors sought the dollar. France's benchmark CAC 40 Index erased its Monday gains, which had confounded investors. The reality sank in a day late as euro zone uncertainties that popped up over the weekend took root. Greek stocks have lost 10 percent of their value so far this week.

U.S. gasoline is getting cheaper. In the last four weeks, the average weekly U.S. retail price of regular unleaded gas has fallen 4 percent, according to the Energy Information Administration.

American Airlines began the lifetime all-you-can-fly AAirpass program in the 1980s to earn cash on the quick, but several customers quickly got much more in return.

Industrial output in Germany shot up far more than expected in March, following February's weather-related weakness, renewing hopes that Europe's biggest economy may have avoided recession.

The companies whose shares are moving in pre-market trade Tuesday are: FreightCar America, Zynga Inc, Micron Technology, Akorn, Patriot Coal Corp, Mako Surgical Corp, Fossil Inc, Electronic Arts, Wynn Resorts and United States Steel Corp.

Small business optimism in the U.S. rose more than expected in April, as companies increased plans to hire and invest, according to a private study released on Tuesday.

Futures on major US stock indices point to a lower opening Tuesday as growing concerns over political instability in Greece weighed on sentiment.

The makers of the meat product infamously labeled pink slime have reportedly decided to close three of its beef processing plants, following months of criticism against the use of the meat filler in food products.

Japanese technology conglomerate Toshiba Corp said Tuesday that its net profit for the three months ending March 31 declined 63 percent from a year earlier on a strong yen and weak global sales of digital products.

Asian stock markets advanced Tuesday, recovering from their biggest fall in six months in the previous session on concerns over election results in France and Greek.

Western markets rallied Monday to make up for jitters about French and Greek election results that sent them down earlier. The rebound was possibly due to investors looking for bargains after stocks were dumped Friday after the disappointing U.S. nonfarm payrolls report.

U.S. consumer credit expanded in March at the fastest pace since late 2001, boosted by a rebound in credit-card use, and higher student and car loans, data from the Federal Reserve showed Monday.

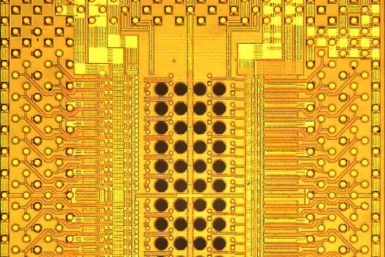

The Semiconductor Industry Association, which represents the top U.S. chipmakers, lauded bipartisan approval in the U.S. Congress to boost funding for both the National Science Foundation (NSF) and the National Institute of Standards and Technology (NIST).

The debate over austerity versus growth is a false choice for policymakers, International Monetary Fund Managing Director Christine Lagarde said on Monday.

3i Group plc (London: III) the largest listed UK private equity company, is in talks with Spain's Ferrovial to sell its Enterprise maintenance and cleaning company, the Financial Times reported.

Analysts at Citigroup are slashing their estimates regarding just how much mining companies globally will spend this year, suggesting the industry is headed for a substantial slowdown, the Financial Times is reporting.

Spain, the euro zone's fourth-largest economy, said Monday industrial output decrease by 7.5 percent in March compared to the prior year, following sharp unemployment and shrinking gross domestic product, according to official data.

Germany's Economics and Technology Ministry reported Monday factory orders rose in March, spurred primarily by businesses looking away from the euro zone and to the United States and emerging markets. Orders rose 2.2 percent from February, spurred by a 4.8 percent growth in export orders from outside the currency zone.

British bank Barclays PLC (London: BARC) is making a grand entrance into the U.S. retail banking space, debuting an online savings account this week that pays substantially more in interest to accountholders than its closest competitors.

In an interim relief to the foreign investors, Indian Finance Minister Pranab Mukherjee Monday said that the government would delay the implementation of the General Anti-Avoidance Rules (GAAR) by one year.

U.S. stock index futures fell on Monday as elections in France and Greece stirred up new uncertainties about how the region will tackle its ongoing debt crisis.

The companies whose shares are moving in pre-market trade Monday are: GTSI Corp, Tata Motors, Frontier Communications, Yahoo, National Bank of Greece, Cognizant Technology Solutions, American International Group, Southern Community Financial, Huntsman Corp. and Genworth Financial Corp.

Futures on major US stock indices point to a lower opening Monday after key elections in Europe showed that voters rejected pro-austerity governments.

Asian stock markets declined Monday after election results from Greece and France fueled concerns about Europe reviving the debt crisis.

Asian stock markets plunged Monday as weaker-than-expected US employment report and election results from Europe weighed on investor sentiment.

Oil prices fell Monday to add to the sharp decline in the previous session as French and Greek election results raised doubts about those countries' commitment to the austerity measures to sort out Eurozone debt crisis.

Highlighting the economic data this week -- May 7-11 -- are the March trade-balance figures to be released Thursday. Economists expect the U.S. trade deficit to widen after its sharp narrowing in February.

The sharp decline in the Indian rupee coupled with strong demand for the dollar forced the Reserve Bank of India (RBI) to intervene and announce measures to ease the pressure on of the rupee.

Disappointing jobs growth in the U.S., together with shrinking manufacturing and services activity in the euro zone, had equities and commodities in retreat and bond yields down. News this weekend isn't likely to calm jitters, with elections in both Greece and France, which may get its first new socialist president since 1981.