Ethereum Price Hits 'Do Or Die' Level: Here's Why

KEY POINTS

- Ethereum (ETH) could trade lower after breaking a "do or die" support level

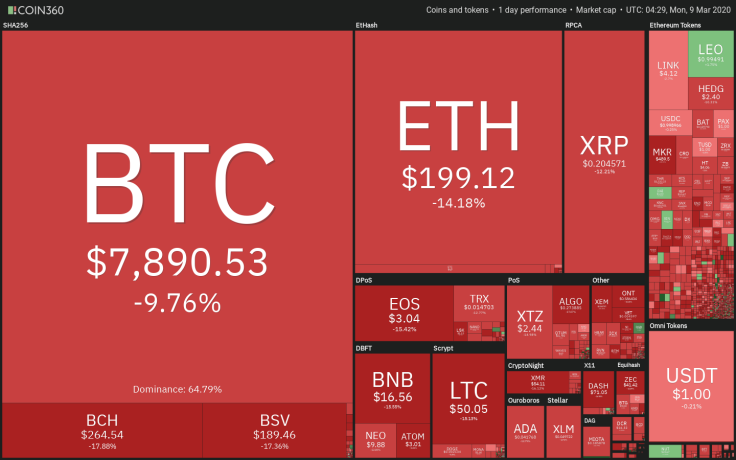

- The whole crypto market faced a massive selloff that amounted to a loss of about $21 billion

- The selling pressure came after OPEC's failure to make a deal regarding production that caused US crude prices to drop below $28 a barrel

A massive selloff in the crypto market took place on Sunday that dragged most cryptocurrencies down to double-digit losses. The value that was shed-off by all cryptos amounted to $21 billion with Bitcoin (BTC), the market's flagship token, dropped nearly 8% and continues to decline on Monday. Ethereum (ETH) erased almost 16% and broke a support level that could potentially open the flood gates for lower prices.

The top two cryptos were head to head in posting gains since the start of the year, and the clear winner so far was Ether. Both BTC and ETH were already down by mid-February, but BTC's bearish activity was more pronounced. Bitcoin currently rests at oversold levels on the RSI for quite some time now, particularly with the 4-hour and 1-hour timeframes. ETH, on the other hand, was expected to trade higher and not look back, especially at a price of under $200.

At this rate, a support level that top crypto analyst and trader Jacob Canfield showed is a "do or die" level for ETH. Canfield posted a chart on Twitter that delineated where that support area lies.

"Ethereum sitting on a do-or-die level for its current trend. A break here could see sub $200 ETH and lower," Canfield tweeted.

#Ethereum sitting on a do-or-die level for its current trend.

— Jacob Canfield (@JacobCanfield) March 8, 2020

A break here could see sub $200 $ETH and lower. pic.twitter.com/I4HCZzFEgP

And, a few hours after Canfield broadcasted his chart, that level got breach as massive selling transpired.

"Well, that was fast. $195 tapped under relentless sell pressure all day."

Well, that was fast. $195 tapped under relentless sell pressure all day. pic.twitter.com/SdhUMd9yG4

— Jacob Canfield (@JacobCanfield) March 9, 2020

The selling pressure came on the heels of the news that Saudi Arabia failed to strike a deal with the rest of its OPEC allies on curtailing production and had gone on rouge in slashing prices, which have caused US crude prices to trade under $28 a barrel. There were also steep declines in the Hong Kong and Japan stock markets that the crypto market soon followed.

Bitcoin, at its significant oversold levels, could present an attractive opportunity for bulls to recapture the most popular crypto at lower prices if most of them believe that the likely direction is back above $10,000 levels.

"We can expect more of this volatility sparked by macro health and financial shocks, but ultimately long term investments in the digital future and it's key asset Bitcoin will be a winning strategy," Jehan Chu, co-founder of Kenetic Capital, told CNBC.

But, for ETH, it's just on its way to the oversold area on the RSI, at least on the daily, which could mean that further bearishness is a possibility.

© Copyright IBTimes 2025. All rights reserved.