Federal Reserve Will Begin Reducing Monthly Bond Buying In December: Analysts

The Federal Reserve will probably reduce its asset purchases in December, the next scheduled time it will update its forecasts and the next time it has a scheduled press conference, analysts at the London-based macroeconomic research company Capital Economics said Friday.

Their report follows the Fed’s wholly unexpected announcement Wednesday that it wasn’t ready to cut back its $85-billion-a-month stimulus because the U.S. labor market has not improved enough, even though the Fed had signaled otherwise in July. U.S. stock markets hit record highs after the announcement of the continued stimulus, intended to keep interest rates low and encourage business investment. Treasurys also shot higher as interest rates plunged.

“The Fed appeared to be moving the goal posts as much as coming to a different conclusion about what the incoming data was telling us,” Capital Economics wrote.

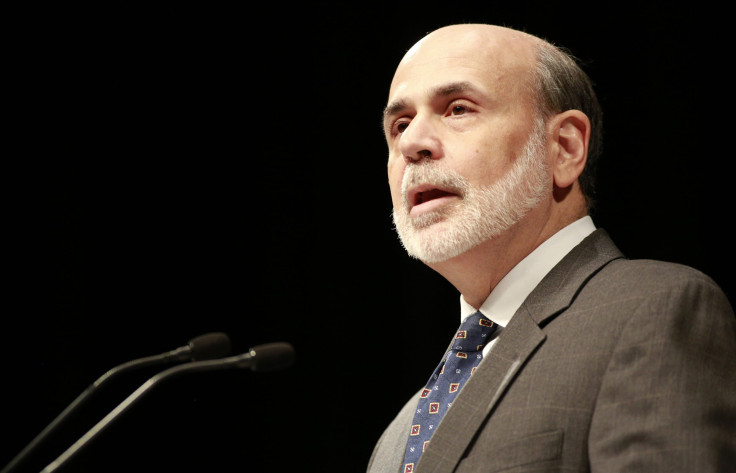

The analysts fear a lack of clear communication on the Fed’s part will increase uncertainty and market volatility in the coming months. Their main complaint is that officials like (Chairman) Ben Bernanke “have done a very poor job of communicating to the markets how improvements in the labor market should be gauged.”

They cited Bernanke’s evolving peg for unemployment as an example. He set a target for 7 percent unemployment, a consensus of the Federal Open Market Committee, later called it a mere guide post, and then on Wednesday said there is not a magic number the Fed is shooting for."

With a degree of uncertainty, Capital Economics analysts expect the Fed to halt its asset purchases completely by mid-2014.

© Copyright IBTimes 2024. All rights reserved.