IRS announced the beginning of the 2023 tax season for accepting and processing 2022 returns. Here's what to know.

Tax season is here, and the IRS has some advice for those filing their taxes in 2022.

A new rule under the American Rescue Plan to go into effect Jan. 1, 2022 could affect how and when users report taxable income on payment apps like PayPal.

Tips to prep your business for tax season.

Determining how much money your business needs in its account shouldn't be a daunting task. Here is how you can arrive at a realistic figure that works well for your business.

Let's dive into a business plan and master budget, unwrap them and make them easier to digest.

Multiple bank accounts and adequate planning are essential for proper money management.

Figuring out what counts as a business expense doesn't need to be tricky. Here's a guideline to help.

Choosing the right tax filing service for your small business can be tough, but we've laid out the differences.

After years of battle to view Trump’s tax records, House Democrats will finally receive his returns from the IRS.

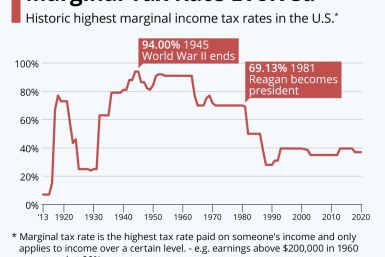

Tax measures like the one Ocasio-Cortez floated in 2019 used to be standard in U.S. economic life.

New York City residents earning over $25 million could pay as much as 14.8% of their earnings in taxes.

How long can your business go before running out of money? That's what we're here to help find out.

There are a lot of risks involved with taking out a loan, but it could be the difference between success and failure.

Profit-Sharing plans come in many shapes and sizes, let's take a look at the options!

A top Citigroup trader was reportedly suspended last month after he was accused of evading payments for cafeteria sandwiches.

New third quarter reports show the NYC real estate market has taken a serious tumble, with taxes and recession fears likely to blame.