New York To Increase Tax On Residents Earning Over $1 Million, Highest In US

KEY POINTS

- New York state may increase taxes on the city's millionaires

- The budget proposal could increase the city's marginal income tax rate to become the highest in the country

- The new tax rate would help the state recover from a $15 billion deficit

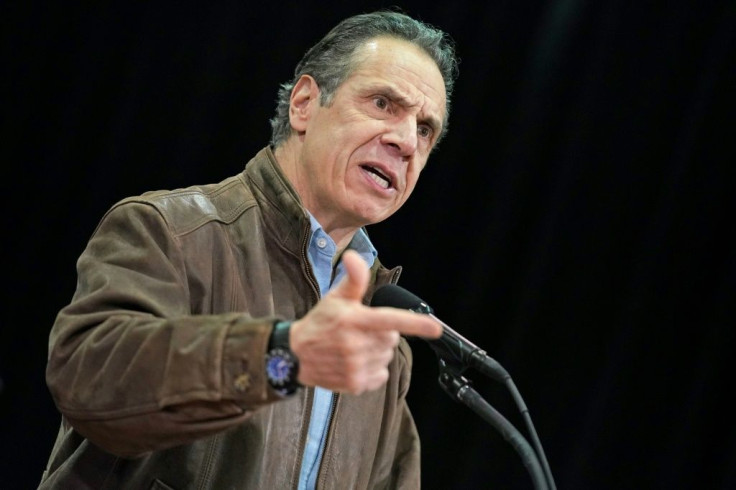

Millionaires in New York City could fall under the highest tax rate in the country as Gov. Andrew Cuomo and state legislative leaders on Monday were near to agreeing on a budget proposal that would lead to an extra $4.3 billion per year by raising income and corporate taxes.

The 2022 budget proposal calls for two new personal income tax brackets that would expire by the end of 2027. It could potentially legalize sports betting to create an additional $500 million in tax revenue, according to The New York Times.

Under the proposal, people earning between $5 million and $25 million are expected to be taxed on 10.3% of their income. People earning more than $25 million could be taxed on 10.9% of their earnings.

The budget proposal would also affect individuals earning over $1 million and couples making above $2 million as their tax rates would rise from 8.82% to 9.65%.

New York City currently has a top income tax rate of 3.88%. If the 2022 budget proposal is passed, people living in the city would pay between 13.5% and 14.8% in state and local taxes.

It would become the highest marginal income tax rate in the country, The New York Times reported.

In January, Cuomo said he would increase taxes if the White House failed to provide sufficient federal funding to help the state recover from a $15 billion deficit.

“This budget is really the economic reconciliation of the Covid crisis, the cost of the Covid crisis,” Cuomo said during a virtual address from the State Capitol’s Red Room in Albany. “This year, it’s going to be about reconciling the responsibility of the battle and completing the battle.”

On Monday, the governor said he and state officials were close to finalizing the details of the 2022 proposal.

“We have a conceptual agreement on all issues, I think it is fair to say,” he told reporters during a conference call. “We’re dotting some i’s, we’re crossing some t’s.”

Economist Stephen Moore told Fox Business that raising taxes by $4 billion would likely cause Wall Street to leave the city.

“This is supposed to be the place that's the financial capitol of the world. And they're taxing the very people, the finance industry,” Moore said. “I think Wall Street is going to move out of New York if this kind of tax and spend continues.”

© Copyright IBTimes 2025. All rights reserved.