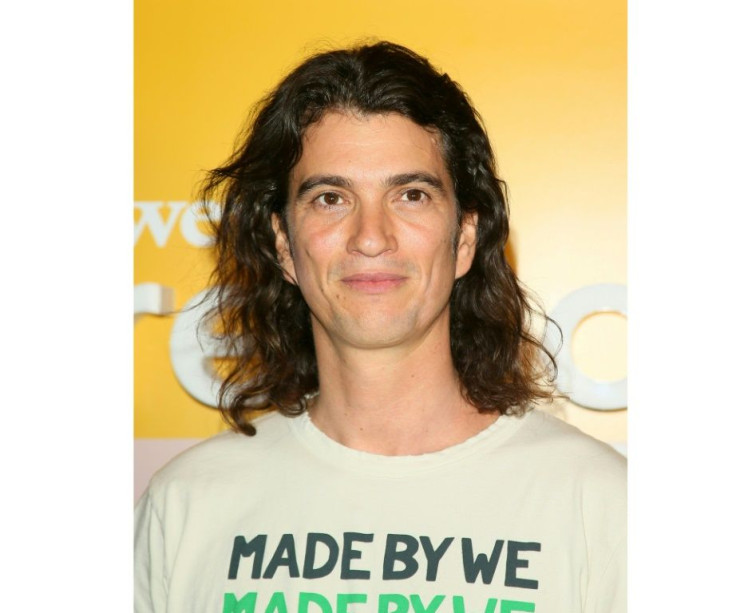

Former WeWork CEO Adam Neumann Could Earn Even More Beyond His $1.6 Billion Exit Package

KEY POINTS

- Adam Neumann already received a $1.6 billion exit package from SoftBank

- SoftBank bailed out WeWork after its IPO collapsed

- SoftBank may be unable to secure more loans from Japanese lenders

Adam Neumann, the ousted CEO of WeWor, who already has received a $1.6 billion exit package, could earn hundreds of millions of dollars more if the office space provider goes public.

The Financial Times reported shortly after Neumann left WeWork in September, he entered into another deal with the company’s top stockholder, SoftBank of Japan, which revised the terms of a share class he still held – called “profits interests,” which were created in connection with a complex restructuring earlier this year. While these shares held no value in the wake of a failed initial public offering in the summer, a future flotation of shares could eventually generate hundreds of millions of dollars for Neumann should he cash in his stake.

This became possible because in October, Softbank persuaded Neumann to give up some of this profits interests while improving the terms of his remaining holdings. Reportedly, these profits interests will convert into stock at a value that will be equal to the price of the public shares minus a “catch-up price,” thus rendering them similar to share options.

The Financial Times noted Neumann’s “catch-up price” was cut from $38.36 a share to either $19.19 or $21.05 a share. SoftBank valued the company at $19.19 a share in its rescue bailout.

The final value of these shares would depend on how much interest a public offering generates, if any.

If a future IPO led to WeWork shares trading at $25 – thereby granting the company a value of $10 billion -- Neumann’s profits interests would convert into shares valued at $111 million. At $35 per share, they could be worth about $352 million, and at $45 per share, they could be worth about $593 million.

In addition, Neumann also owns tens of millions of shares in a holding company that was created in the summer restructuring. He holds the right to sell up to $970 million of these shares to SoftBank in the next few months. That $970 million was part of his $1.6 billion severance package.

Softbank bailed out WeWork to the tune of $9.5 billion after its IPO collapsed.

However, a future IPO for WeWork is not a given – investors worry that the company has yet to generate a profit and takes costly long-term leases on buildings,

The company has lost more than $5 billion since 2016, and was on the books for $49.9 billion of lease commitments to landlords at the end of September.

Moreover, SoftBank's huge bailout of WeWork may be in some trouble. SoftBank planned to partially finance the rescue agreement by borrowing $3 billion from Japan's three biggest banks -- Mizuho Financial Group , Mitsubishi UFJ Financial Group and Sumitomo Mitsui Financial Group -- but banks have already reached their internal lending limits to SoftBank.

As an alternative, the three banks are mulling how they might make the loans while reducing their exposure – including using SoftBank's 26% stake in Chinese internet giant Alibaba (BABA) as collateral.

"SoftBank is an important client so we want to do everything we can to help, but we have to consider our credit risk," a senior bank executive told Reuters.

The Japan Times reported that if the three banks are able to lend the $3 billion to SoftBank, their aggregate loans would exceed $15 billion.

Lenders in Japan reportedly want to see an effective restructuring plan at WeWork before agreeing to provide more cash to SoftBank.

To make matters worse, SoftBank's posted $6.4 billion net loss in the quarter ended in September, largely due to the write-down of the value of its investments in WeWork and Uber. It was SoftBank’s first quarterly loss in 14 years.

“Banks cannot loosen their credit criteria only for SoftBank,” said S&P Global Ratings senior director Ryoji Yoshizawa.

© Copyright IBTimes 2025. All rights reserved.