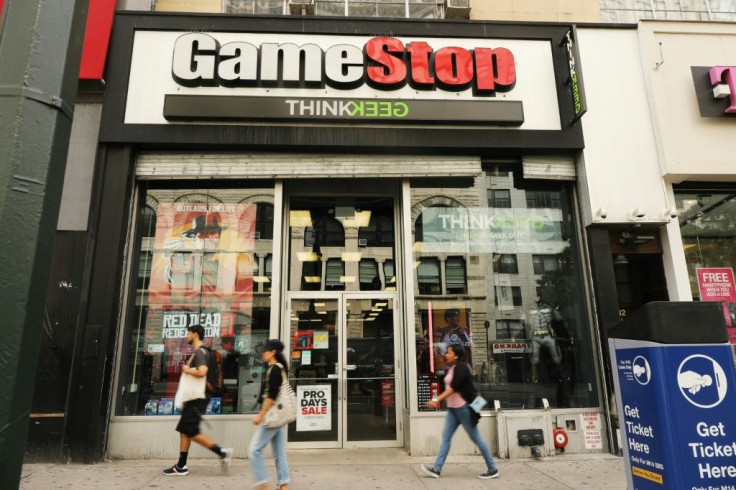

GameStop Shares Rocket As Frustrated Short Seller Walks Away

Shares in GameStop rocketed on Friday as an activist short-seller said he was walking away from the stock in the retailer due to what he called an "angry mob" that has terrorized him and his family.

Andrew Left of Citron Research put out word of the decision on Twitter a day after he posted a video at YouTube detailing reasons he was certain the retailer was overpriced in the market.

GameStop shares ended the formal trading day up 51 percent, having more than tripled since the year began mere weeks ago.

Short-sellers borrow shares they think are priced unreasonably high, then sell them in the hope of buying them back cheaper a bit later and pocketing the difference. They lose money if they bet wrong.

Left said in a letter shared on Twitter he still believes GameStop share price is due to collapse, but will no longer comment on the company because Citron has become a target of "an angry mob who owns this stock."

"This is not just name calling and hacking, it includes serious crimes such as harassment of minor children," Left said in the letter.

"We are investors who put safety and family first and when we believe this has been compromised, it is our duty to walk away from a stock."

A video in which Left makes a case for GameStop shares being overpriced remained available at YouTube on Friday, where it had logged more that 89,000 views.

A livestream of the presentation on Twitter was delayed a day this week due to hacker attacks on the Citron account, according to the company.

In his talk, Left pointed out that despite record video game hardware sales in the US in December of last year, GameStop saw decline at its physical locations.

GameStop's model of customers trading in old game discs for new or other used titles has become "antiquated" and is out of synch with trends of downloading game software online or playing games hosted in the internet cloud, Left reasoned.

Like other traditional retailers, GameStop is under tremendous pressure to adapt to online shopping trends where it faces rivals such as Amazon, Best Buy, Target, and Walmart, the short-seller noted.

He said that he is pressured by GameStop supporters "who are ordering pizzas to my house or signing me up for Tinder" to harass him.

"If you want to save the company, take your energy, go out there and actually buy something from GameStop, because that is the only thing that saves this," he wrote.

Fear of missing out on the rise of GameStop shares along with day trading for quick profits could be ramping up demand for the stock and, as a result, pushing up the price.

"We are looking at a trading phenomenon," Left said in the video.

"People just keeping it up by a lot of call volume."

Citron critics were quick to point out that it was wrong years back when it took a short-seller position regarding electric car star Tesla, which has been a winner for long-term investors.

Citron Research did a complete U-turn in 2018, advising buying and holding Tesla shares.

© Copyright AFP {{Year}}. All rights reserved.