GE May Fund Its Biggest Acquisition Ever With Overseas Profits Never Taxed In The US

General Electric Co. (NYSE:GE) is poised to make its biggest-ever acquisition, but the proposed deal is just as likely to draw brickbats from critics of American corporate tax policy as it is kudos from investors.

The U.S. conglomerate could announce a deal to buy French industrial company Alstom SA (EPA:ALO) for $13 billion in coming weeks, Bloomberg News reported Thursday. That could spark a public relations headache for the Fairfield, Conn., company, as it is likely to fund the deal from an estimated $57 billion cash hoard kept overseas to avoid U.S. taxes. The Alstom deal could also see regulatory scrutiny from the French government.

GE has long been criticized for its light tax burden. Between 2002 and 2011, it paid an estimated average tax rate of just 1.8. GE’s strategy of keeping cash offshore mirrors moves by other U.S. companies such as Apple Inc. (NASDAQ:AAPL) and Pfizer Inc. (NYSE:PFE).

“This [overseas] money is available to fund the operations of our non-U.S. subsidiaries,” GE spokesman, Seth Martin, told International Business Times, in an email.

The company’s 2013 annual report notes that if overseas cash were repatriated, GE would face more in U.S. income taxes and foreign withholding taxes.

“GE’s effective tax rate is reduced because active business income earned and indefinitely reinvested outside the United States is taxed at less than the U.S. rate,” the annual report said.

In the U.S., corporate tax rates can reach up to 35 percent, but General Electric paid just 4.2 percent in taxes on its operating earnings last year, down from 28.5 percent in 2011, partly thanks to “global funding structures.”

Last year, GE made more than $1 billion in revenue from each of at least 24 countries, though nearly half of its revenue usually comes from the U.S.

The Alstom deal comes as a surprise given GE CEO Jeff Immelt’s promise earlier this year to favor acquisitions of under $4 billion. The deal isn’t yet official, but an announcement could come as early as next week, sources cited by Bloomberg said.

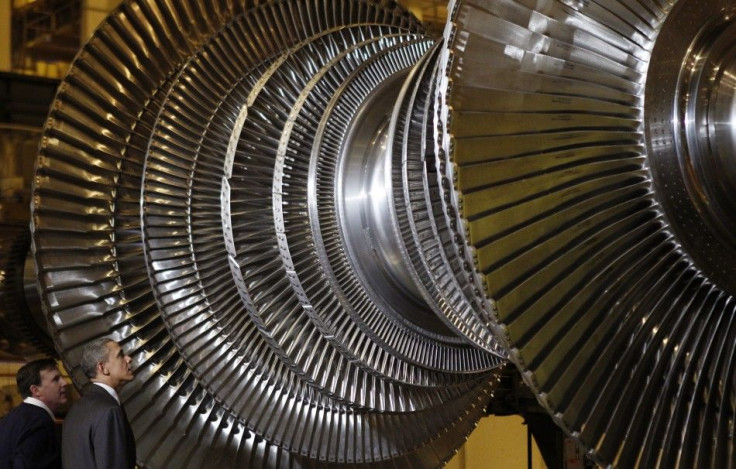

GE has worked to wind down its nonindustrial operations, especially its financial arm, GE Capital. The company has also sought to boost its industrial businesses, which sell energy, mining and locomotive equipment to businesses and governments. The proposed acquisition echoes that theme and comes amid GE's planned spinoff of its consumer finance arm, expected later this year.

For the first nine months of 2013, Alstom, a top maker of energy and rail equipment, generated 14.5 billion ($20.1 billion) euros in sales, though its shares have performed poorly in the past few years. About two-thirds of Alstom's revenue comes from power-related sales, with transportation and grid equipment ranking second and third in importance, respectively.

Sanford C. Bernstein analyst Steven Winoker lauded the deal in an interview with Bloomberg, calling it, “among the best fits we have seen with the GE portfolio for some time.”

At this point, it remains unclear just how much the two companies could save by merging operations. Both have significant overlaps in the industrial equipment segment, though GE’s train business has focused on commercial freight, while Alstom sells passenger rail cars.

In a statement Thursay, Alstom said that it wasn’t aware of any potential public bids. The French company said that its plans to report its annual results on May 7 and will give shareholders an update on its actitivites at that time. GE declined to comment. Since Immelt succeeded Jack Welch as GE's chairman and chief executive in 2001, the company has done more than 200 takeovers, according to data compiled by Bloomberg.

© Copyright IBTimes 2025. All rights reserved.