How The Stock Market Plunge Affects Silicon Valley's Startup Market

Investors are still swooning as a panicked wave of selling leaves major financial markets the world over deeply in the red. Most publicly traded companies are bruised from the plunge, which saw the Dow Jones Industrial Average sink more than 500 points Friday for the first time in four years. But it's privately held companies that could feel the squeeze next.

Pre-IPO tech firms have amassed hundreds of billions of dollars in speculative venture capital investments, which in turn have driven up their overall value. Car-hailing app Uber leads the pack with a valuation of $51 billion. Other household names, from Airbnb to Snapchat to Dropbox, have also secured 11-digit valuations.

But after the stock-market slide last week, some are wondering what lies ahead for these start-ups, many of which have exhibited exponential growth but inconsistent profits.

Venture capital heavyweight Bill Gurley, who sits on the boards of at least a dozen Silicon Valley startups, worries the correction could be an “inflection point” for hot young tech companies.

“We may be nearing the end of a cycle where growth is valued more than profitability,” Gurley tweeted Friday. “Investors are likely to refocus on business model viability and path to profitability. This will seem like an abrupt sea-change to many.”

2/ The China stocks are also under pressure. The BATs (Baidu, Alibaba, Tencent) are down on average 34% off their highs.

— Bill Gurley (@bgurley) August 21, 20154/ One might reasonably assume that this would have an adverse impact on late stage private market liquidity and valuation. I certainly do.

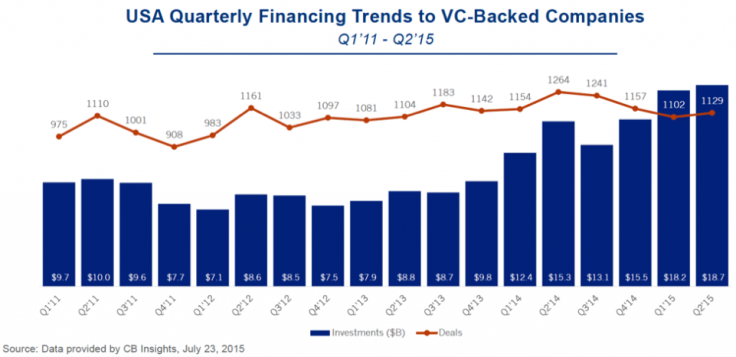

— Bill Gurley (@bgurley) August 21, 2015So far, 2015 has been a bonanza for startups. The first half of the year saw 107 venture-capital deals bring in at least $100 million. The most recent count of unicorns -- private companies valued at more than $1 billion -- stands at 123, with a combined market share of $469 billion.

But that exuberance, Gurley has argued, has been tied more to growth than concrete revenue expectations.

“Which Unicorn entrepreneurs/CEOs are prepared for such a shift? Who can adjust quickly?” Gurley tweeted. “Can you get to profitability on your last round? Have you even considered such a reality?”

Those questions are sure to swirl around even the most prominent unicorns. The seemingly inexorable growth of Uber, for instance, has reportedly been borne on the back of operating losses totaling $470 million. Leaked documents have shown Snapchat, too, hemorrhaging investors’ cash.

And the recent performance of Silicon Valley darlings that have gone public in recent years hasn’t inspired confidence in investors hoping to cash out on startup IPOs. Cloud storage company Box is down nearly 40 percent from its initial public offering in January. And late last week Twitter dropped below its 2013 IPO price for the first time.

For investors who raise their eyebrows at startups' stratospheric valuation multiples -- the ratio of a firm’s total value to its revenue or earnings -- things ahead look rough for Silicon Valley.

“The bottom line,” Gurley tweeted, “is that global tech valuation multiples are compressing...Quickly.”

6/ Investors are likely to refocus on business model viability and path to profitability. This will seem like an abrupt sea-change to many.

— Bill Gurley (@bgurley) August 21, 20158/ Can you get to profitability on your last round? Have you even considered such a reality?

— Bill Gurley (@bgurley) August 21, 2015© Copyright IBTimes 2025. All rights reserved.