Infographic: Tech Heavyweights Lose $141 Billion In Market Cap

After a brief respite on Monday that saw share prices climb in hope of a truce in the ongoing trade war between China and the United States, things turned sour again on Tuesday, erasing all of Monday’s gains and then some. The widely watched FAANG group of tech companies (Facebook, Apple, Amazon, Netflix and Google/Alphabet) saw their share prices drop by 4.5 percent on average, collectively erasing $141 billion in market capitalization.

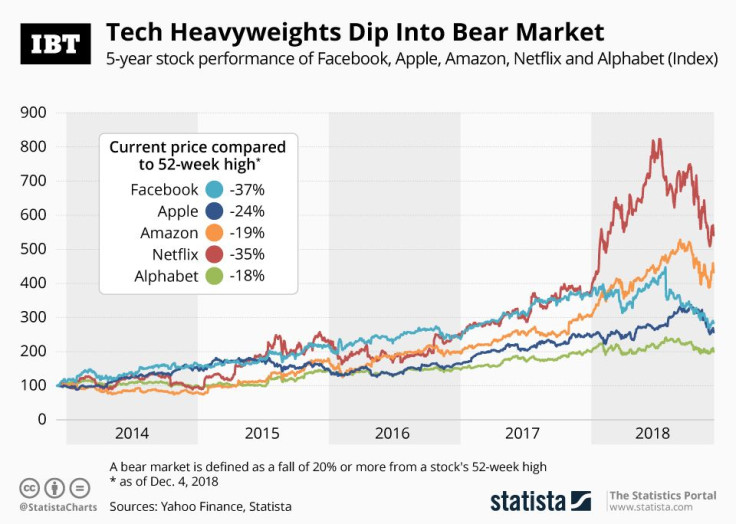

Tuesday’s sell-off added another chapter to a fall that couldn’t have gone much worse for some of the world’s most famous technology companies. Fears of new tariffs, slowing growth and stricter regulation have changed the market environment for the worse over the past few months, pushing all the FAANG stocks into or to the edge of bear market territory. Facebook is currently down 37 percent from its 52-week high, Netflix is down 35 percent and Apple is also firmly in bear territory at minus 24 percent.

As the following chart shows, the current downswing doesn’t change the fact that tech stocks have been doing great in recent years. Looking at their 5-year performance shows that each of them is still up by at least 100 percent since December 2013.