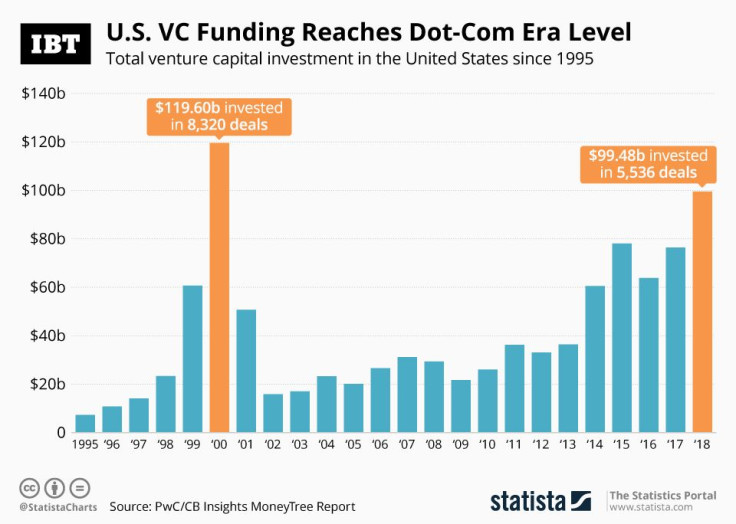

Infographic: US Venture Capital Funding Jumps To Highest Level Since The Dot-Com Era

Venture capital activity in the United States reached its highest level since the turn of the millennium in 2018. According to PwC and CB Insights’ quarterly MoneyTree Report, U.S. venture capital funding jumped to $99.5 billion last year, the second highest recorded total since the peak of the dot-com boom in 2000. Meanwhile, the number of completed deals dropped to the lowest level since 2013, a trend that was offset by an increase in $100+ million mega-rounds, of which a record number of 184 was completed in 2018.

Despite the fact that venture capital funding is edging towards levels previously seen shortly before the internet bubble burst, another crash doesn’t seem imminent. As opposed to the dot-com era, the current surge in investment volume is mainly driven by large deals involving later-stage companies with proven track records.

Internet companies profited most from the surge in VC funding, drawing a total of $36.7 billion in 2018. Healthcare and Mobile & Telecommunications were the other main beneficiaries, receiving $20.3 and $14.8 billion in venture capital, respectively. "2018 was a phenomenal year for US venture capital”, Tom Ciccolella, PwC’s US Venture Capital Leader concludes, adding that a “healthy availability of funds and appetite for investment” contributed to the birth of a record-breaking 55 unicorns.