Israeli Institutional Investors Dive Into US Real Estate, Especially In New York City

Israeli institutional investors like insurance giants and pension funds are pouring money into U.S. real estate, as they diversify from Israeli assets and equities.

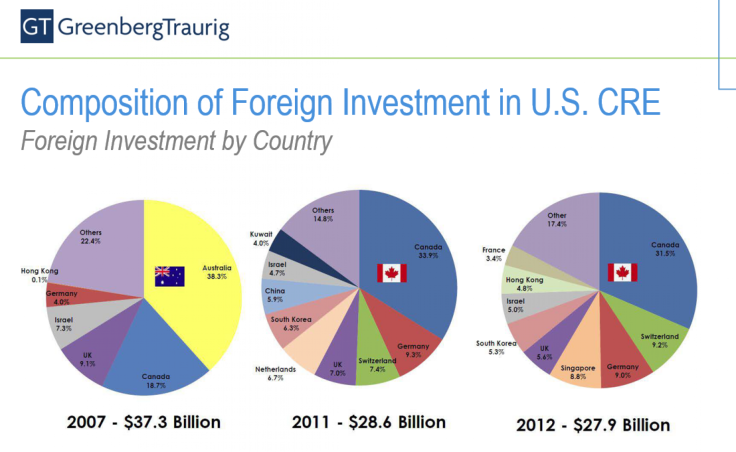

Israel accounted for 5 percent of all foreign investment in U.S. commercial real estate in 2012, according to a June 2013 presentation by Greenberg Traurig lawyers, part of one of the biggest real estate law practices in the U.S.

That’s lower than heavyweights like Canada, which accounted for a third of the $27.9 billion in investment in 2012, and Germany and Switzerland, both at about 9 percent each, respectively.

But Israeli interest is significant, given the size of the country and the way it funnels foreign cash into New York City, specifically.

In late November, Rob Ivanhoe, chair of Greenberg Traurig’s U.S. real estate practice, returned from a trip to Tel Aviv, where he met with nearly a dozen institutional investors who were interested in U.S. real estate.

“Whatever their pension plan or insurance company allocations toward real estate have been, they’ve increased substantially in the last couple of years,” Ivanhoe told IBTimes. “The appetite is way up.”

As capital held by Israeli pension funds ballooned, thanks to a high contribution pension system, pension funds diversified away from Israeli securities and towards alternative investments starting about 2010, according to Ivanhoe.

“Real estate allocations have gone up significantly, and a much greater percentage of their GDP goes into these pension plans than in almost all other countries,” said Ivanhoe.

“Now many of their pension plans are looking to focus at least half their investments outside of Israel, and the most popular destination is probably the U.S.”

The trend is not entirely new and shows signs of fluctuating. A 2011 survey by an Israeli real estate firm found that Israelis were the second largest foreign buyers of US income-making real estate from July 2010 to June 2011, accounting for a tenth of foreign real estate investment.

But Israeli investment has fallen from 7.3 percent of the total foreign inflows into real estate in 2007, to 5 percent in 2012, according to the Greenberg presentation. That was likely impacted by the financial crisis.

Israeli insurance heavyweight Harel Insurance Inv. & Fin. Services Ltd (TLV:HARL) has been one key player in this scene. Harel chief investment officer Amir Hessel told IBTimes that the company has six U.S. investment partners in the U.S. real estate market, with plans to secure more local partners.

About 5 percent of Harel’s $29 billion in managed assets is allocated to real estate, and that will also increase, Hessel said. Harel has cut several deals in New York in the past few years, building student dormitories for Pace University and selling a retail co-op on Madison Avenue for a tidy profit.

“Given the amount of real estate in Israel, it’s not enough for portfolios of our size,” said Hessel. “In the current interest rate environment, U.S. real estate is even more attractive to us.”

Harel has chiefly invested in New York, but has also left its footprint in Houston, Minneapolis and a broad multi-family homes portfolio spread across the East Coast.

“It’s an interesting market, and we’re still trying to develop it,” said Hessel.

One of Harel’s New York partners, SL Green Realty Corp (NYSE:SLG), reportedly made about $90 million in a year in the Madison deal, according to the New York Post.

SL Green’s Brett Herschenfeld estimates that SL Green has done seven deals with Harel, who it also partners with on loan, debt and preferred equity real estate financing.

Israeli interest in U.S. real estate is high, he said, though he added that they haven’t done as many deals as investors from China or Germany.

“Certainly, we’ve seen a lot more interest from Israel capital in the past couple of years,” he told IBTimes. “We think it’s only going to grow. You’ll see more institutional capital chase Manhattan real estate deals.”

Herschenfeld is a senior vice president and Harel’s contact at SL Green, which is one of New York's largest office landlords, with interests in 85 Manhattan properties.

But investing in New York real estate is often tough. Companies must move very quickly, even as they scrutinize deals from abroad, and foreign real estate investors are penalized with heavy taxes, according to Hessel.

“Since we entered New York in 2010, prices jumped up, and the market is now much more competitive,” Hessel said. “New York is not as attractive as it used to be.”

Hessel is unsure, too, whether the U.S. broadly is the most attractive market for Harel, especially compared to Germany or the U.K. There are lower investment returns in capitalization (‘cap’) rates in New York than Germany or the U.K., he said.

“I must say that our last deals were in Germany and the U.K., the last two or three deals,” said Hessel. “But we are still looking, and we will keep investing in the U.S. We don’t stop. We keep working.”

Other Israeli players in New York include the Elad Group, Izaki Group Investments and the Naftali Group, according to the Real Deal.

U.S. and global commercial real estate suffered badly from the financial crisis, as credit markets tightened and companies shied away from new leases. New commercial development may only rebound in the U.S. in 2014, despite initial expectations, Citigroup Inc. (NYSE:C) found in August. According to Deloitte LLP, the global commercial real estate market saw about $470 billion in deals in the first half of 2013.

© Copyright IBTimes 2025. All rights reserved.