It's Official: Credit Scores Can Predict Relationship Success

This could give a whole new meaning to the phrase, “She’s checking you out”: Credit scores accurately predict whether a relationship will last, according to researchers.

Although prospective paramours have long used credit scores as a matchmaking proxy -- and creditscoredating.com has existed since 2006 -- a study released this week provided the first rigorous findings linking credit quality and romantic potential.

The evidence comes from a no less august source than the U.S. Federal Reserve, which examined millions of credit records to conclude that healthy credit scores imply healthy couplings.

However, the researchers took their results one step further to suggest that it’s not just domestic nickel-and-dime concerns that explain the findings (it’s no secret bankruptcies bode poorly for relationships). Rather, the researchers posited that “credit scores reveal general trustworthiness” of relationship partners, a finding that could have widespread ramifications for American social life. Credit scores “reveal information about an important relationship skill,” the study’s authors wrote.

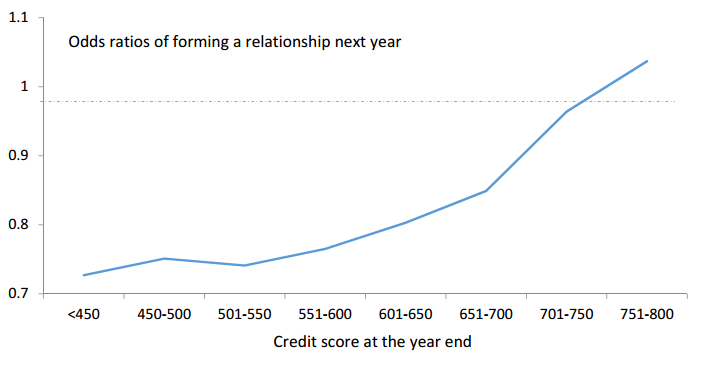

At the most basic level, the authors found that people with quality credit have more luck with Cupid than their low-scoring peers. For every 109-point rise in credit score, a single has a 14 percent greater chance of finding a partner in the coming year, the researchers said, a finding that held true even when adjusting for income and other demographic factors.

Moreover, people tend to match up with those who have similar credit scores. Two strangers bumping into each other in the street have on average a 150-point difference between their respective credit scores. Among couples, that spread narrows to 69, the study found.

The researchers had no way of knowing whether this similarity arose from potential matches inquiring after their dates’ credit scores, or whether they perceived some other quality, like trust, that might correlate with credit quality.

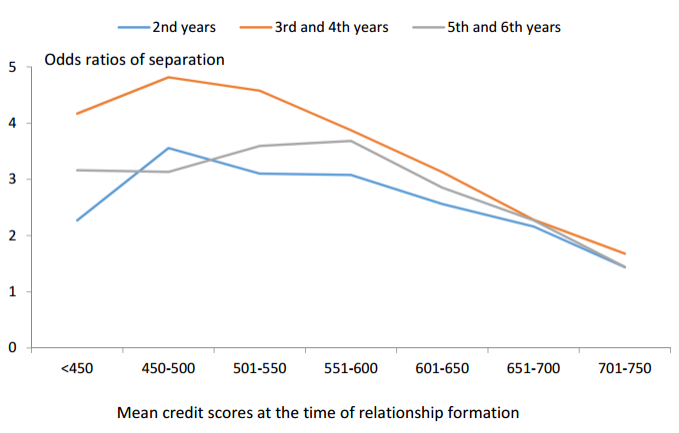

Either way, the study found the better a couple’s initial credit scores, the higher the likelihood they’ll stick together. For every 93-point increase in a couple’s initial average credit score, the chance of them making it through year two of the relationship increases 30 percent.

So what it is ultimate meaning of the Fed’s argument that there exists a “quantitatively large and significant role for credit scores in the formation and dissolution of committed relationships”? And how much does it have to do with trustworthiness?

The proprietors of dating sites may take notice -- as might users of those sites. Those with subpar credit scores could someday find themselves getting less attention on Tinder.

But at present, the Tinders and OKCupids of the world eschew credit scores. And the assumption that credit scores “reveal information about an important relationship skill,” as Fed researchers had it, could be unwelcome news for people whose credit scores have been damaged by forces outside their control.

Some have criticized the use of credit scores in other, nonlending fields, namely in screening job seekers, a practice used by as many as 60 percent of employers. For example, African-American and Latino job applicants tend to have lower credit scores than their white counterparts. According to the American Psychological Association, lending discrimination plays a part.

“African-Americans are more likely to be denied loans,” the APA wrote in a 2012 brief, which raised concerns around the use of credit checks in employment. “When they are approved for loans, they are more likely to receive loans with worse terms than Caucasians.”

It remains to be seen how or whether these findings will work their way into a dating scene increasingly mediated by algorithms. Just don’t be surprised when more economists start listing their credit scores on Tinder.

© Copyright IBTimes 2025. All rights reserved.