Japanese Monetary Policy Might Be Irking US Automakers, But American Consumers Are Seeing Lower Auto Parts Prices

While the Detroit 3 automakers continue to beat their drums over Japan’s version of quantitative easing, which has been driving down the value of the yen to promote exports to the U.S., American consumers are benefiting from so-called Abenomics because the cost of Japanese car components is also falling.

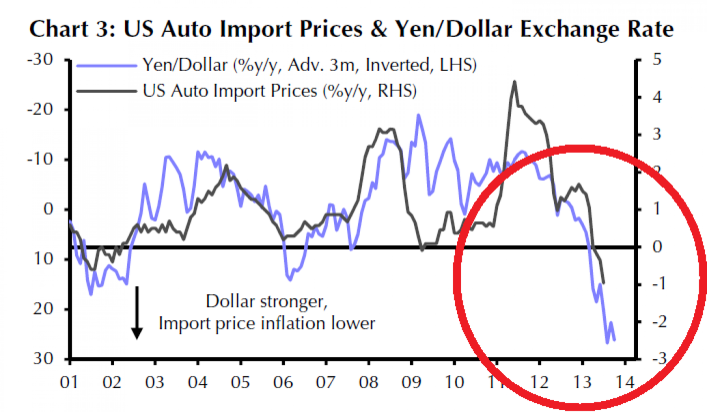

"The recent strengthening in the dollar against the Japanese yen suggests it will soon cost [automakers] even less to import components from Japan,” said Capital Economics senior analyst Paul Dales in a research note on Tuesday. “Lower retail prices may be enough to lure some households back into the showrooms.”

Japan’s share of the U.S. auto-parts market stood at 13.7 percent last year, or about $17 billion, second only to Mexico’s 31.3 percent, according to the U.S. Department of Commerce.

Consumer price inflation for new vehicles – the rate of price increase over time – slowed to 1.2 percent in July compared to 4 percent in July 2011. Over the past 12 months, U.S. automakers have dropped their selling prices by 2 percent, according to Dales’ research.

This trend is likely to continue through next year as the dollar continues to strengthen against the yen.

U.S. automakers might be livid over Japan’s monetary policy, as well as its highly protected domestic market that stymies vehicle imports, but many American consumers are benefiting from Japan’s central bank maneuvers.

© Copyright IBTimes 2024. All rights reserved.