Let The American Entrepreneur Save The US Economy

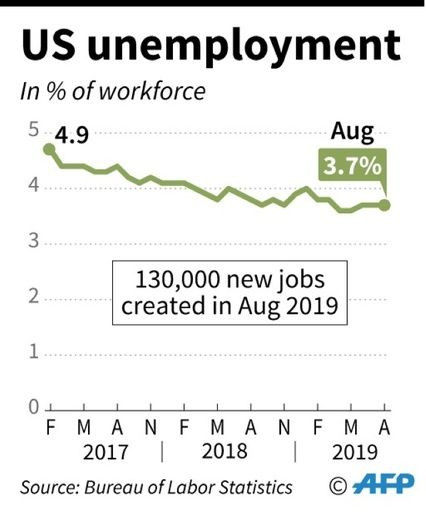

While the unemployment rate remains at an incredible 3.6 percent, the declining trend in job growth should start the alarm; both parties should focus on net new business creation as the 2020 election heats up.

A reminder that current economic policy did not build the world’s greatest Gross Domestic Product (GDP) or the world’s largest private employers. Quantitative easing did not develop ride-sharing and tax cuts did not invent the iPhone.The American entrepreneur did.

It is easy to view GDP and unemployment statistics through the eyes of rose-colored government glasses; it is depicted as such through President Donald Trump all the time. However, instead of his constant celebration of past accomplishments and legacy industries, both parties should focus on innovative ways to create and sustain start-up and young businesses that bring new ideas and technologies past their infancy stage, creating our large employers of the future.

New ideas create jobs

The United States has long been a leading innovator of new technology and ideas. It is certainly a major contributor to our position on the world stage. Sadly, we risk losing that status as other countries foster the entrepreneur and advance around us.

According to the Congressional Research Service, since 2011, small establishments have created 2/3rdof net employment gains in the U.S. economy. With that, those surviving more than five years created the largest numbers. If stronger labor market participation and sustained job growth are the end goals, it is essential to help these businesses compete with their larger counterparts and survive with their expanding ideas and emerging economies. We need to help those looking to create.

For starters, clarity in trade, reduction in small employer healthcare pricing and a sensible cost of higher education could help with new business formation and their prospect of longer-term success.

According to the U.S. Small Business Administration, small business exporters decreased from 2018 to 2019 while net numbers of new businesses grew. Clarity in trade could help reverse this trend, giving confidence for our entrepreneurs involved in manufacturing to expand their customer base and new ideas to markets outside the United States.

As important, it opens the window to new investment from private capital, as the geopolitical risks of their investment decrease. The looming uncertainty and volatile environment in global trade make this corner of innovation less attractive to start and do business.

Increasing healthcare cost for small employers continues to put them at a disadvantage in comparison to their larger peers. Annual premiums rose five percent over the prior year and The Wall Street Journal recently reported that an employer-provided family plan cost an average of $20,576 annually; with the employer bearing 71 percent of that cost. This has caused many small firms to cease offering plans, taking talent from the startup and making the alternative of working for a large business more attractive.

With student loan debt hitting a staggering $1.6 trillion in 2019 and an average of $29,200 per student, we have made it increasingly hard for aspiring entrepreneurs to escape their debt-load and take risk outside of large companies. This only perpetuates the strong hold that large organizations have on top talent, monopolizing new technology and ideas, and reducing competition.

Competition breeds the need for innovation

According to the Fraser Institute's Jason Clemens and Steven Globermanit, the ideal age for those adventuring into new business is 25 to 49. This group’s experience with the dot com bust and the great recession has forced them to innovate and has groomed a new generation of entrepreneurial minds, similar to how the Great Depression did. As we have recovered from the great recession, this generation had to educate, take risk and build a future for themselves; away from the comfort of pensions, unions and a lifetime at the same company.

Sadly, as economic conditions improve, so does the ability for large businesses to employ more top talent with rising wages and attractive benefits. This has historically reduced small business competition as well as the number of individuals willing to take on the risk of exploring their own ideas; as the safe alternative of working for a big business can be attractive, even while complacent.

Take note of this, as I believe this “comfort” has the unfortunate phenomenon of slowing productivity growth and innovation. As President Obama mentioned in the Economist before leaving office, his administration had not figured out a way to substantially boost productivity growth and this growth was the key to wage gains that people want.

As productivity growth slows, we risk driving future years of complacency and stagnated growth. I believe pursuing innovation is inherent to the American Dream and to the American success story. We are inadvertently encouraging the opposite.

New ideas create jobs. New jobs in innovative areas increase productivity, and increased productivity accelerates our GDP. If Americans foster the environment for this, the country’s entrepreneurs will continue to lead us as the world’s premier economic power. Entrepreneurs push progress forward, in spite of current politics.

(Steve Frazier is the President of financial services firm Frazier Investment Management. He advises entrepreneurs, businesses and families throughout the United States.)

The opinions voiced in this material are for general information only and economic forecasts set forth in this material may not develop as predicted.

© Copyright IBTimes 2025. All rights reserved.