Machine Building: Driver Of Global Industry

Machine building steadily lost ground in 2019 and 2020. At first, this was a result of the global semiconductor shortage, which made a basic component for most machines and electronic devices frustratingly scarce. As 2020 wore on, pandemic-related restrictions shut down factories and snarled the supply chain, further hobbling the machine-building industry.

Things started to turn around in 2021, with economic recovery fueling a dramatic increase in demand for industrial products of all kinds. The machine-building industry responded by ramping up production, and Euromonitor predicts that machine output will post a record growth of 12.8% by year-end.

China is currently the largest manufacturer of machinery, accounting for 40% of global output. Other top exporters include the United States, Germany, Japan, and South Korea. Russia was the twelfth largest machinery manufacturer in the world in 2020, with an output worth USD 40.27 billion. Over a quarter of that total (28.6%, worth USD 8.45 billion) was manufactured in Moscow. These results declined slightly from the previous year as the Russian market was affected by the same supply chain issues, falling demand, and factory shutdowns that plagued global markets.

Exports from Moscow

After over a year of export troubles, 2021 saw a turnaround: in the first six months alone local manufacturers exported machinery worth USD 4.59 billion, up 46.7% year-on-year and up 15% from the same period of 2019. This recovery was driven by demand for machinery in foreign markets and the need for equipment and parts to relaunch global production. Local exporters saw some categories, like medical devices, vehicles, and lighting equipment, grow faster than others.

“The city government provides support for local exporters through a range of programs,” explains Alexander Prokhorov, head of Moscow’s department for investment and industrial policy. “In 2019, our department opened the Mosprom Center to assist local exporters with industry analysis, custom reports, and educational events. The Center also helps companies find partners in foreign markets and set up talks with them.”

In 2021, Mosprom held 12 business missions, both in-person and online, for 81 export-oriented companies based in Moscow and helped 29 exporters attend seven international trade shows. The Center’s global reach encompasses several continents and focuses on regions like Latin America, the Middle East, Africa, and the CIS, as well as Germany and Bulgaria.

Export Patterns and Outlook

Demand for Moscow-built machinery is centered in Southeast and South Asia, the CIS, Europe, and North Africa, with top importers in China, Hong Kong, Kazakhstan, Belarus, Azerbaijan, Germany, the Czech Republic, Serbia, and Algeria. The most popular categories are mechanical equipment, telecommunications equipment, measuring devices, and lighting technology, all of which showed gains in 2021.

Case in point, local companies exported 67.4% more lighting technology year-on-year in the first half of 2021. In addition to the active, existing markets in the CIS and Eastern Europe, this increase included countries like Morocco, Jordan, and Uganda, where Moscow-based importers had little or no presence prior to 2020.

Incotex is a local supplier of smart lighting systems whose catalog includes LED solutions and power supply units for lights and other devices. The company sells its wares in 30 countries, from Argentina to Germany. Incotex has provided lighting for a NATO facility in Greece, railroads in Kazakhstan, an airport in Frankfurt, a medical center in Munich, and the National Bank of Belarus.

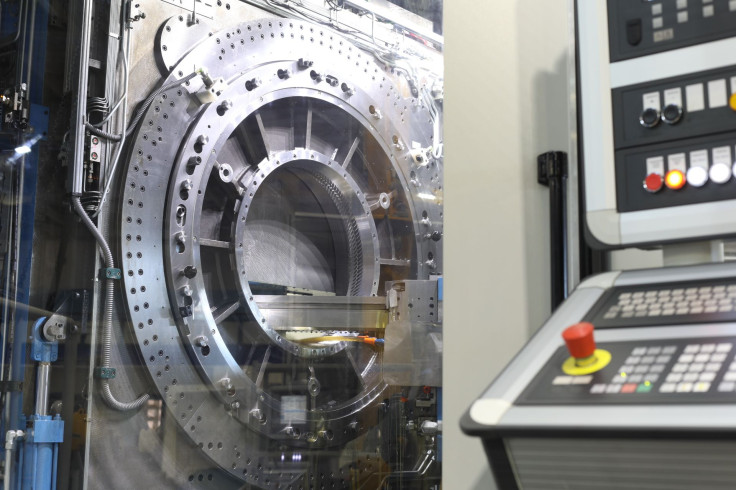

The Mosprom Center’s experts see mechanical equipment as another promising category for local exporters. This group includes everything from gas turbines and fluid pumps to filtering equipment, centrifuges, and transmissions, as well as optics (control devices, lab equipment for physical and chemical testing) and medical devices (dental drills, ultrasound equipment, catheters, and the like).

Mosprom experts believe that local exporters of machinery and equipment would do well to focus on the CIS (Belarus, Kazakhstan, Uzbekistan, Azerbaijan), Eastern Europe (Moldova, Poland, Serbia), and select countries farther abroad (Yemen, Saudi Arabia, the Philippines, and Myanmar).

Problems and Solutions

Despite the vigorous global demand for industrial products, exporters face barriers to launching in new markets that include stringent certification requirements for imports. When Fingo, a manufacturer of industrial gas cleaning equipment, was ready to sell to the European Union, it had to overhaul its technology and business processes, purchase European equipment, and hire new specialists. With these steps in place, the company was able to obtain certification showing that its metal products and welding processes meet EU standards.

Organizational and legal issues aside, exporters often choose the wrong market and end up pitted against weak demand or stiff competition from foreign manufacturers.

Mosprom Center experts like to remind exporters that demand can look very different across countries in a single region. Products that spark interest in one country may be ignored in a neighboring country. Before launching an export program, companies need to get as much detailed information as possible about their target markets: conditions in the industry, its dependence on exports and imports, the competitive field, the need for partners, and the level of infrastructure.

Mosprom Center offers local companies the level of detail in the reports its specialists develop for target markets, including risk profiles, barriers to entry, industry conditions, and a SWOT analysis of the consumer market. The Center also performs custom analyses to help companies choose the most effective export strategy, and it works with companies to adapt their marketing materials and prepare a pre-sales strategy that highlights their products’ competitive advantages before they ever meet with potential partners and customers. In addition, the Center offers export-focused education on topics like logistics, certification, and legal questions, as well as webinars on exporting to specific regions.