Minimum Wage For Tipped Workers: New Report Suggests Customer Subsidies To Business Payrolls Should End

The last year in which the U.S. federal government raised the minimum wage for employees who depend on customer gratuities, Poland got its first democratically elected president, the Dow Jones Industrial Average barely topped 3,000 and only a million computers were hooked up to something called the Internet.

The minimum wage for workers who earn more than $30 per month in customer tips went up by four cents in 1991, to $2.13 per hour. Five years later, in order to push through an increase to the federal hourly minimum wage that covers most hourly workers, the tipped wage was frozen under legislation proposed by Republicans and signed into law by then-President Bill Clinton, a Democrat.

Now, a new study by Sylvia Allegretto and David Cooper of the left-leaning nonprofit Economic Policy Institute in Washington, D.C., is aimed at debunking the common justification for the American practice of raising consumer costs by encouraging tips to subsidize business payrolls. By adding a 15-percent (or in big cities, 20-percent) gratuity on top of a bar tab or restaurant bill, customers are chipping-in to lower business payroll expenses, something defenders of the policy say helps small businesses and creates jobs.

Here’s what the report says:

The creation of the tip credit—the difference, paid for by customers’ tips, between the regular minimum wage and the sub-wage for tipped workers—fundamentally changed the practice of tipping. Whereas tips had once been simply a token of gratitude from the served to the server, they became, at least in part, a subsidy from consumers to the employers of tipped workers. In other words, part of the employer wage bill is now paid by customers via their tips.

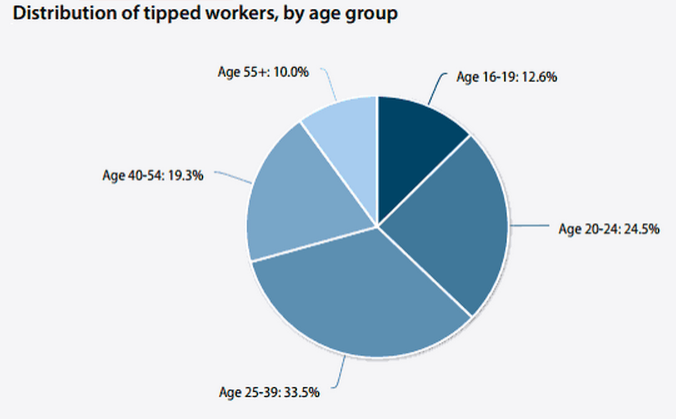

The study concludes the two-tier wage system is more likely to keep most tipped workers at the federal minimum wage of $7.25 an hour because their incomes are dependent on the ebb and flow (and generosity) of customers. If tips don't add up to at least $5.12 an hour, the employer pays the difference to conform with the federal minimum wage. For tipped workers outside of big cities and tourist towns, earning $5.12 per hour in gratuities can be difficult.

Opponents of minimum wage increases say raising payroll costs leads to job losses. Researchers William Even of Miami University and David Macpherson of Trinity University, in San Antonio, Texas, say their research shows eliminating the customer subsidy to employer payrolls would cost nearly 300,000 jobs because tipped workers typically work for small businesses, like family-owned restaurants, who couldn’t afford the added expense without curbing staff.

In response to congressional inaction on the federal minimum wage, many states and some cities in recent years have increased their hourly wages, but 21 states still adhere to the $2.13-per-hour rule while only seven states, including Washington and Minnesota, have banned the two-tier system by requiring employers to pay the same minimum rate extended to all workers.

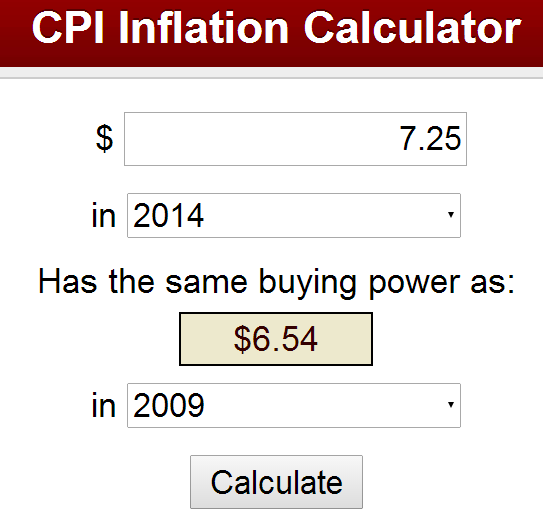

The current federal minimum wage went up from $6.55 per hour to $7.25 per hour in 2009, but five years of inflationary growth has wiped out that wage increase:

© Copyright IBTimes 2024. All rights reserved.