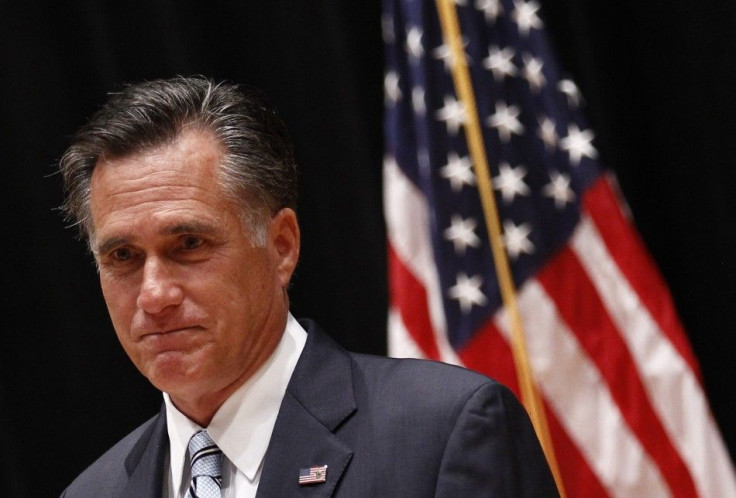

Mitt Romney Releases 2011 Tax Returns And 20-Year Tax Rates Overview

Mitt Romney released his 2011 tax returns around 3 p.m. Friday, with details of his tax rate over a 20-year period.

Romney's campaign revealed in a blog post on Friday that the GOP presidential nominee made almost $13.7 million last year and paid close to $2 million in taxes. That's about 14 percent. Romney has said never paid less than 13 percent in taxes in the last decade.

He paid approximately $3 million, or 13.9 percent, in 2010.

"[Romney's] 2011 tax return will appear as four separate documents,” Brad Malt, a Romney trustee, wrote in the blog post. “It includes Governor and Mrs. Romney’s Form 1040, as well as three underlying Massachusetts trusts detailing the sources of their income. Those are the W. Mitt Romney Blind Trust, the Ann D. Romney Blind Trust and the Romney Family Trust.”

Democrats have long been pushing Romney to release more than two years of tax returns. However, the nominee and his wife, Ann, have said they will only release returns for the last two years.

That move by Romney is not in keeping with the precedent set by his father, George Romney, who released a whopping 12 years of returns when he was running for president. It has also led to allegeations that Romney didn't pay taxes for 10 years.

However, Malt's blog post also stated that Romney's 2011 tax returns will be accompanied by a letter from Romney’s tax preparer, Pricewaterhouse Coopers LLP, giving a summary of the tax rates from the Romneys' returns for a 20-year period dating from 1990 to 2009.

Here’s what the campaign said you should expect to see in Romney’s 2011 tax returns:

- The Romneys paid $1,935,708 in taxes on $13,696,951 in mostly investment income.

- They paid a tax rate that year of 14.1 percent.

- They donated $4,020,772 to charity.

- The Romneys claimed a deduction for $2.25 million of those charitable contributions.

As for the letter showing details of taxes paid between 1990 and 2009, you can expect to read:

- Each year during that time, the Romneys owed both state and federal income taxes.

- Over that 20-year period, the average annual effective federal tax rate was a little over 20 percent.

- The lowest annual federal personal tax rate was 13.6 percent.

You can read about Romney's 2011 returns online.

© Copyright IBTimes 2024. All rights reserved.