New York Woman Charged With Laundering Bitcoin For ISIS

A 27-year-old New Yorker named Zoobia Shahnaz was accused of bank fraud and laundering bitcoin to support the Islamic State, according to federal prosecutors. In March, the Pakistani-born immigrant started using new credit cards and a bank loan to buy cryptocurrency and send funds to the terrorist group.

“The defendant defrauded numerous financial institutions and obtained over $85,000 in illicit proceeds, which she converted to Bitcoin and other cryptocurrencies,” the U.S. Department of Justice said in a statement. “She then laundered and transferred the funds out of the country to support the Islamic State of Iraq and al-Sham (“ISIS”).” Time reported her lawyer, Steve Zissou, claimed the funds were charitable donations meant to help Syrian refugees.

Law enforcement officers questioned Shahnaz at John F. Kennedy International Airport when she tried to board a flight with a multi-day layover in Istanbul, Turkey, one of the most popular points of entry for Westerners looking to sneak into Syria.

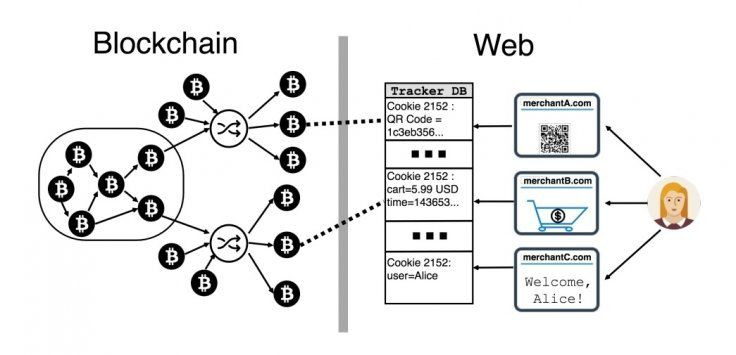

This highlights one of the most widely cited concerns about cryptocurrency, that it can be used for money laundering and financing terrorism. Congress drafted a bill over the summer to address this risk; it’s called the “Combating Money Laundering, Terrorist Financing, and Counterfeiting Act of 2017.” However, the Washington D.C. think tank Coin Center immediately published a statement arguing this case proves “law enforcement has the tools necessary to deal with this sort of money laundering even when it involves cryptocurrency.” Coin Center’s statement also pointed out the prosecutor’s statements suggest Shahnaz had to use an old school wire transfer, not a bitcoin transaction, to get ISIS the funds.

Daniel Wager, vice president of global financial crime compliance at LexisNexis Risk Solutions, agreed there are still many unanswered about this case. “It’s that information that is critical to understanding if there is a vulnerability at play here that needs to be closed,” Wager told IBT. “The question is whether bitcoin was utilized because it is seen by terrorist organizations as a way to create additional layers of anonymity in the movement of funds.”

Chief scientist at the cybersecurity blockchain startup QUED-it Aviv Zohar, who is also a cryptocurrency researcher at the Hebrew University in Jerusalem, told IBT these types of crimes are still rare. “There is relatively little money laundering being done today through bitcoin,” Zohar said. “I myself traced a lot of ransomware [bitcoin transactions]...the money laundering was actually being done with physical currency.” Most cryptocurrency exchanges in North America use “know your customer” requirements to identify the real people cashing out their cryptocurrency. These days, most people eventually turn their bitcoin into fiat currency if they want to make a purchase. “You know where the bitcoin is going, but we don’t know where the cash goes,” Zohar said.

He warned that someday, if cryptocurrency reaches mass adoption for daily usage, it could become harder to track criminal activities involving cryptocurrency. Yet that doesn’t concern Zohar too much because for most of history, when money was paper and coins, law enforcement didn’t track financial transactions with the minute detail electronic bank records provide today. For the moment, Wager agrees with Zohar that the exchange KYC process has improved security in the cryptocurrency market.

Wager added that different concerns may arise when more people start buying cryptocurrency directly with credit cards. Thousands of people are already using cryptocurrency to buy tokens through initial coin offerings. The latter is tricky to monitor because it doesn't always involve an exchange. “[ICOs are] an area that is minimally regulated, both from a security standpoint and the anti-money laundering/Bank Secrecy Act standpoint,” he said. “The question here is whether bitcoin provides any unique capability to obfuscate the beneficiary of the illicit funds.”

© Copyright IBTimes 2025. All rights reserved.