Oil Price Slump: Energy Sector Bracing For A Rough First-Quarter Earnings Season As Producers Are Hammered

U.S. energy companies are facing a brutal earnings season this spring as low oil and natural gas prices continue to hack away at revenue and hamper spending.

Earnings growth for the sector could fall by about 100 percent in the first quarter from the same period last year, S&P Global Market Intelligence said this week in a survey of energy firms listed on the Standard & Poor’s 500 index. Total earnings growth for the S&P 500 is expected to drop only about 7.5 percent for the quarter.

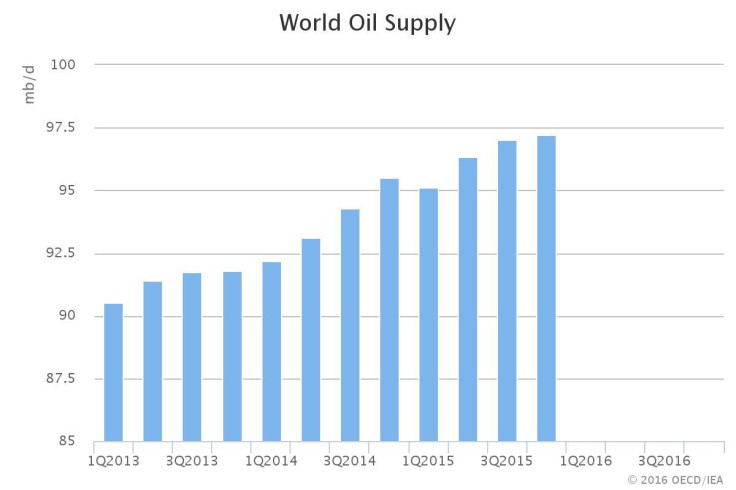

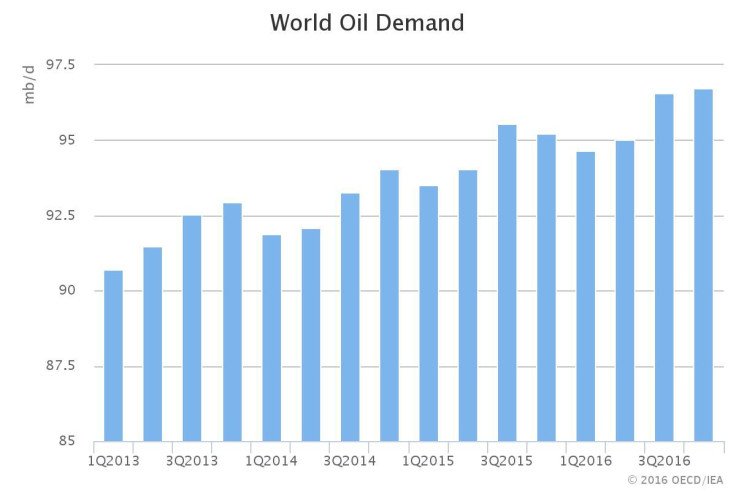

The plunge in energy sector earnings might sound dramatic, but analysts said the numbers aren’t exactly surprising, given that many U.S. oil and gas producers are no longer profitable. Crude prices have tumbled precipitously over the last 20 months on fears that global oil supplies are surging ahead of worldwide demand. The price collapse has erased billions of dollars in revenue and forced companies to cancel projects, gut their workforces and delay investments in new wells.

The second quarter, which starts Friday, could be even darker for companies struggling to pay down sky-high debt. Many U.S. and European banks, concerned about their exposure to the energy industry, are starting to review their loans to producers. If banks decide a company has borrowed more than it can afford, the reviews could trigger a repayment, spark asset sales to raise cash, or drive more firms into bankruptcy.

“What we continue to see in the energy sector are big headwinds to profitability driven by lower energy prices and high production costs,” said Jeff Reeves, executive editor of InvestorPlace.com in Maryland. “Some people are surprised that this dynamic has persisted as long as it has, and doesn’t seem to be abating at all.”

Global oil and gas giants, from Exxon Mobil Corp. and ConocoPhillips to BP Plc and Royal Dutch Shell Plc, will start reporting first-quarter earnings in late April.

The companies endured substantial losses in 2015, with British behemoth BP reporting a $5.2 billion loss — its biggest annual loss to date — and ConocoPhillips in Houston seeing a net loss of $4.4 billion. Exxon fared better than its rivals, although its full-year profits still plunged by about half to $16.2 billion for the year.

The losses arrived as U.S. oil prices tumbled from a peak of $105 a barrel in June 2014 to below $27 a barrel this January. West Texas Intermediate, the U.S. benchmark, has recently recovered some of that lost ground and is trading around $40. It's expected to hover in the $30-$40 range in the coming months due to continued growth in world crude supplies. Even as low oil prices hammer energy producers, the industry is still boosting production.

In the U.S., crude output has stayed above 9 million barrels a day through the downturn, according to federal energy estimates. A surge in offshore production in the Gulf of Mexico has helped offset the recent declines in shale oil production from Texas, North Dakota, Oklahoma and other energy-rich states. Onshore, some producers are forced to keep drilling to manage their ballooning debt obligations or keep their land leases, while other companies are improving their balance sheets through aggressive cost-cutting and more efficient technologies.

On top of that, some 4,200 drilled — but uncompleted — wells are sprawled across the U.S. Companies initially held back from finishing those wells, hoping to turn them on at a higher price. But with oil prices expected to stay low for longer, many of the wells are expected to come online this year as producers seek to raise cash, bringing even more crude into the U.S. mix.

“The economic reason for waiting has gone away over the last year,” said Sarp Ozkan, a senior energy market analyst at Ponderosa Energy in Denver. “Even with an expected fall in earnings and huge [capital expenditure] cuts this round, we expect that production will still be pretty resilient in the United States.”

That’s despite the fact that more than 50 oil and gas companies have filed for bankruptcy protection since the start of 2015, including nine this year, Haynes and Boone, a corporate law firm, found in its latest oil patch bankruptcy report. The bankruptcies involve more than $17 billion in cumulative secured and unsecured debt.

“All indications suggest many more producer bankruptcy filings will occur during 2016,” Haynes and Boone said in the March 7 report.

Other top oil-producing nations are similarly expected to keep supplies high. Saudi Arabia, Russia and others are floating a proposal to freeze production to January levels, and OPEC and non-OPEC members are expected to meet in Doha, Qatar, on April 17 to discuss the idea.

But several major producers, including Iran and Iraq, have rejected the freeze proposal, and many analysts say it wouldn’t do much to balance global markets, since producers wouldn’t actually reduce their output. Saudi Arabia itself apparently isn’t slowing down. The kingdom and neighboring Kuwait are expected to resume oil production soon at a joint offshore field, the state-run Kuwait News Agency reported Tuesday.

The persistent supply arrives as demand for oil is slowing in China, Brazil and other emerging markets where producers had hoped to sell large volumes of crude, the International Energy Agency reported earlier this month. Demand in the U.S. and European economies over the long term is expected to slowly slide as automakers design more fuel-efficient cars and regulators restrict greenhouse gas emissions.

Continued low oil prices this year will make it harder for many producers to meet their debt obligations, which have soared to unprecedented levels in recent years as energy companies borrowed heavily when oil prices were higher. Globally, the net debt of publicly listed oil and gas companies has nearly tripled over the last decade to $549 billion in 2015, excluding state-owned oil companies, the energy consultancy Wood Mackenzie estimated.

Still, Ozkan said the oil market could eventually rebalance this year as production slides in countries more vulnerable to lower crude prices, including Nigeria, Angola, Algeria and Colombia. By the end of the year, those declines could total roughly 1.5 million barrels a day, enough to nearly bridge the gap between world oil supplies and demand, he said. Production in the U.S. is also expected to steadily decline throughout the year, further chipping away at the global supply glut.

“That doesn’t mean prices will rise at that particular moment,” Ozkan cautioned. “The second factor is we now have to work off the additional storage inventories, which [are] now very high.”

Reeves of InvestorPlace.com said the key for investors in energy players is to find the companies that are best positioned to weather the rocky market — not just in 2016, but for years to come.

“This is what happens when you go from an industry with a big tailwind of high prices and decent margins, to now, not so much,” he said. “You need to make sure your investments in this space aren’t expecting conditions to change.”

© Copyright IBTimes 2024. All rights reserved.