Paycheck Calculator: How Will The Presidential Candidates Change Your Tax Bill?

Voting is free, but the aftermath isn't. Whether you feel the Bern, or want to make America great again, the next president’s tax policies will directly affect your take-home pay. Every election year, presidential hopefuls paint idealistic portraits of how they’ll reshape America. But with 76 percent of Americans living paycheck to paycheck, according to a survey from Bankrate, a few hundred dollars here or there can really make a difference.

International Business Times built this paycheck calculator (below) with data from the Washington D.C.-based Tax Policy Center, to show how your take-home pay might change under the next President of the United States. Of course, all results are approximate and represent potential changes to your federal tax bill only. State and local taxes are not included.

This season’s tax debate is largely unchanged from presidential campaigns of the recent past. Republican candidates generally say they want to make government smaller and more efficient so you can keep more of your tax money and spend it as you see fit. The Democrats’ message, on the other hand, is that everyone should pay their fair share so the federal system has enough money to fund programs that serve the greater good.

These days, the political tug-of-war between tax cuts and tax increases tends to focus on the wealthy. But all taxpayers, not just the 1 percent, have skin in the game. To estimate how much you’ll pay for each candidate’s vision for the future, the best place to look is their proposed tax plans. Ideals often fade after election day, as the reality of working with Congress to enact policy changes sets in. Still, choosing a candidate means striking the right balance between your values and your livelihood. There are no right answers, only informed decisions.

Behind The Numbers

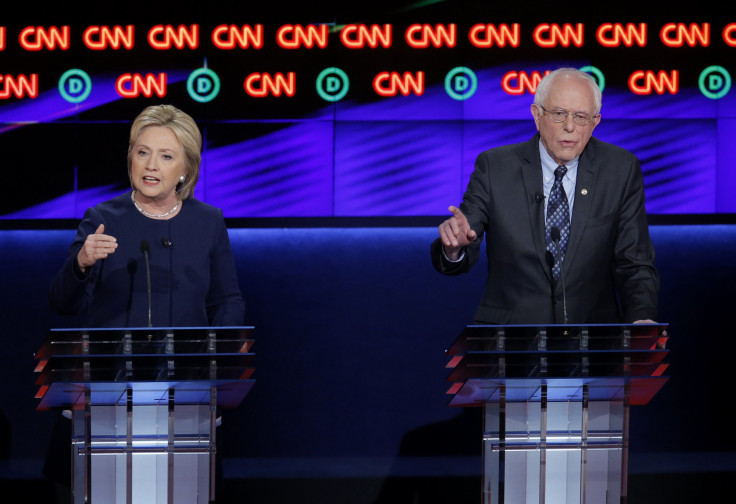

Clinton — You won’t see much of a change to your take-home pay unless you earn more than $1 million each year. Her plan maintains the status quo for the majority of Americans, but high earners could see a significant increase to their annual tax bill. Clinton proposes a minimum tax of 30 percent for those earning seven figures, as well as an additional 4 percent surtax for taxpayers with an annual income over $5 million.

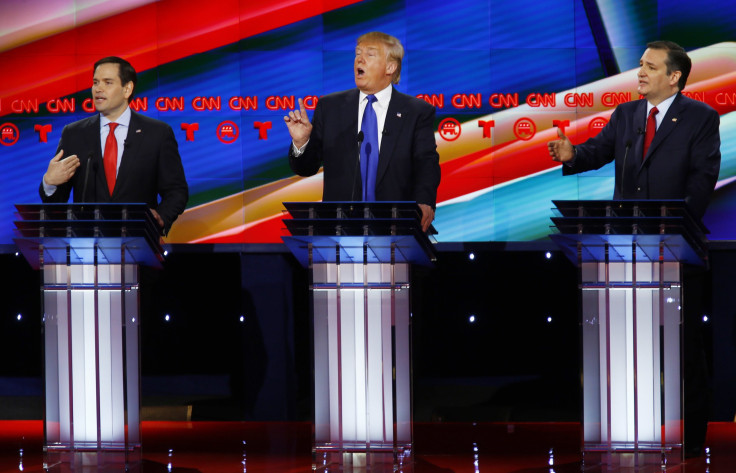

Cruz — It’s arguably the most creative of the bunch. Cruz proposes simplifying the tax code to a flat 10 percent rate across all income groups, as well as eliminating Social Security and Medicare taxes. He would add in a corporate flat tax of 16 percent, that would essentially replace the amount previously paid in payroll taxes. His tax cuts heavily favor the wealthiest Americans, even more so than the other Republican candidates. Such sweeping change isn’t likely to make it far in Congress, but if Cruz’s plan were to be implemented, it would result in a federal deficit of $8.6 trillion over the next decade.

Rubio — Families are likely to take to this tax plan, with Rubio's proposed $2,500 tax credit per child available to households earning up to $300,000 per year. That’s a big jump over the current $1,000 child tax credit available to families who earn up to $110,000. His plan also eliminates taxes on investment income and inheritances, a tax cut that is likely to appeal most to a small number of wealthy Americans. Despite a potential federal deficit of $6.8 trillion over the next decade, Rubio’s plan actually offers the smallest tax cut of all the Republican candidates.

Sanders — The Vermonter's plan would generate the most tax revenue for the federal government, bringing in an extra $15 trillion in taxes over the next decade. His tax increases are income-agnostic, impacting earners across all income groups. The highest earners would owe more than 40 percent of their take-home pay in additional taxes. By requiring all taxpayers to siphon off greater amounts of their paycheck to the IRS, Sanders plans to fund government programs like free college and government-sponsored healthcare.

Trump — More than any other Republican candidate, Trump will move a huge amount of money from the government’s budget to Americans’ pockets. If his plan were approved as is, it would add up to $1 trillion in tax savings for workers each year. For a family earning $75,000, their share would be nearly $3,000, or over $100 per paycheck. Of course, those tax savings would come at a cost. Estimates vary, but Trump’s tax plan would add about $9.5 trillion to the federal budget deficit over the next decade. Even drastic cuts to government programs would not be enough to offset the increased deficit.

© Copyright IBTimes 2024. All rights reserved.