Pope Francis Visit To US: Pope's Call To Climate Action Inspires Activism Among Catholic Investors

Pope Francis won't visit New York until Thursday, but his presence already looms large on Wall Street. The pontiff's call to action on climate change is inspiring Roman Catholic investors to fuel a new era of financial activism. Religious orders and institutions in the U.S. are dumping investments in coal, oil and gas, and pushing companies in other sectors to reveal more details about their environmental impact.

The latest wave builds on decades of work by Catholics to align investment decisions with core religious values. In his 184-page encyclical released in June, Francis said the world's 1.2 billion Catholics -- and everyone else -- have a moral obligation to phase out fossil fuels and drastically reduce greenhouse gas emissions. The pontiff is expected to renew that call during his tour of the U.S. this week.

The most recent response to Francis' message comes from the University of Notre Dame. Rev. John Jenkins, the president, said Monday the Catholic research university will stop burning coal-fired electricity within five years, invest $113 million into renewable energy projects and slash the school's carbon footprint by more than half in 15 years. He cited the pope's encyclical, called "Laudato Si," and his upcoming visits to Washington, Philadelphia and New York City in the announcement.

"Notre Dame is recommitting to make the world a greener place, beginning in our own backyard," Rev. Jenkins said in a statement.

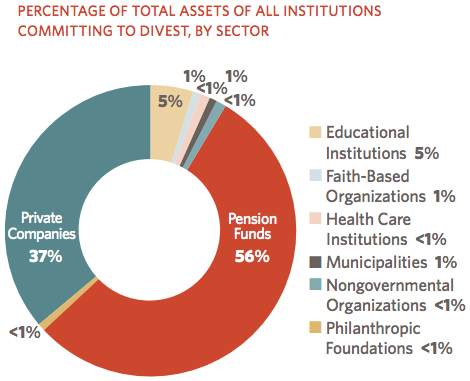

The pope's influence on religious investors is also helping drive a wave of fossil fuel divestment, climate activists said this week. To date, 430 institutions and more than 2,000 people representing $2.6 trillion in assets have committed to dump their holdings in firms exposed to fossil fuels, Arabella Advisors, which advises philanthropies, reported Tuesday. The organization's previous count in September 2014, revealed about 180 institutions and 650 people representing over $50 billion in assets committed to divest.

"There's no question that the pope gets an assist," said Fletcher Harper, executive director of GreenFaith, an interfaith environmental organization in New Jersey. "What people hear from him is this very genuine and real care for people. And a very real recognition of the ways in which climate change hurts people. It’s not an ideological fight."

So far, around 130 faith-based organizations with a collective $24 billion in assets have committed to pulling their shares in fossil fuel firms, according to the Arabella Advisors report. U.S. Catholics in total control around $150 billion in assets, the Christian Brothers Investment Services, a Chicago investment management firm, has estimated.

Pope Francis is scheduled to arrive in Washington Tuesday afternoon and will appear at an official ceremony Wednesday with President Barack Obama. On Friday, the pontiff will address the United Nations General Assembly, which is celebrating its 70th anniversary.

The pope's U.N. speech will cover "poverty, social justice, climate change, and what we call peaceful institutions and societies," Archbishop Bernardito Auza, the Vatican's permanent observer to the U.N., told reporters. "These are also the priorities of the Catholic Church."

Francis is also expected to urge the U.N. negotiators to forge a climate change pact at a December conference in Paris. Nearly 200 nations, including the U.S., have agreed to sign an international accord to reduce greenhouse gas emissions and help communities adapt to the effects of climate change, including rising seas, vanishing rainfall and deadly heat waves.

Shedding fossil fuel stocks isn't the only way Catholic investors are exerting influence. Religious orders and individuals are also using their roles as shareholders to pressure energy firms and large corporations on environmental issues.

Julie Tanner, assistant director of Catholic Responsible Investing at Christian Brothers Investment Services (CBIS), said she's noticed an uptick in shareholder activism since the pope began urging climate action last year. "I do think it has really grown [by] leaps and bounds," she said.

In the latest proxy season, faith-based investors filed more than 250 shareholder proposals at nearly 190 companies as of May 18, 2015, according to the Interfaith Center on Corporate Sustainability. That's up from 193 proposals filed in 2014. Environment and climate issues account for a large chunk of those filings, although many proposals confront companies on human rights and labor issues, corporate governance, political contributions and financial risk.

Last week, the Congregation of Benedictine Sisters in Boerne, Texas, filed a shareholder proposal to McDonald's asking the fast-food giant to ban all of its meat suppliers from using antibiotics on animals. The nuns cited growing concern from public health experts that the overuse of such drugs is causing humans to grow resistant to life-saving antibiotic treatments.

Tanner and CBIS took part in recent successful shareholder proposals aimed at Royal Dutch Shell PLC and BP PLC, two of the world's largest oil and gas companies. The measures required the energy giants to disclose the risks the companies could face if countries reduce their fossil fuel use and drastically curb greenhouse gas emissions. The boards of Shell and BP supported the resolutions, both of which passed this spring.

The companies have committed to publishing more information on a variety of climate issues, including whether the value of their oil and gas reserves will be harmed by limits on carbon emissions; the scale of emissions from its operations; lobbying on climate change; and investments in low-carbon alternative technologies.

"I expect these [shareholder] efforts are only going to grow," Tanner said.

Still, the broader financial activism movement has yet to spark significant policy shifts at U.S. companies or result in meaningful reductions in fossil fuel use. And many Catholic investors, including U.S. bishops, are still not responding to Pope Francis' climate push.

"The idea of bringing our values to bear in a public way and in engaging ways with companies using our investments is not something that’s on the front burner of the bishops," said Father Michael Crosby, whose religious community in Milwaukee holds about $2,000 in Exxon Mobil Corp. shares.

Top Catholic leadership in the U.S. in general has been reluctant to embrace the pope's climate campaign, the Guardian recently reported. Archbishop Joseph Kurtz, who heads the U.S. Conference of Catholic Bishops, has not echoed Francis' call for an urgent phasing out of fossil fuels or joined the pope in linking climate change to human activities. In a recent welcome address to the pope, Kurtz did not mention climate change at all, according to the Guardian.

Crosby, who has filed shareholder resolutions with companies for nearly two decades, said he is now working to push Catholic leadership to join the cause. On Sunday, he signed a letter inviting bishops in Minnesota, Illinois, Iowa, Wisconsin and North and South Dakota to consider Francis' encyclical and "take a more active role with their investments," Crosby said.

The pope's climate push "is a good sprinkling of holy water on what we're already trying to do," he said.

© Copyright IBTimes 2025. All rights reserved.