Reading The Market Tea-leaves For Global Recession Risks

The fastest rate-hiking cycle in decades and inflation nearing double-digits has got investors scouring market moves and data to gauge whether the world economy is headed for recession.

Business activity is slowing, many stock indexes are in "bear" territory, while higher borrowing costs are squeezing corporate and consumer spending.

The U.S. Federal Reserve last week upped interest rates by 75 basis points, its biggest single rate hike since 1994, and has signalled its commitment to containing price pressures even if it brings about a growth downturn.

"Inflation is still rising and that means the Fed will hike more and move more rapidly, which will put downward pressure on the economy, so that's adding to recession fears," said Seema Shah, chief strategist at Principle Global Investors.

"There are also growing signs of economic weakness coming earlier than expected."

The World Bank currently expects 2022 global growth at 2.9%.

Here is what some closely-watched indicators are saying about recession risks.

1/ OLD FAVOURITE

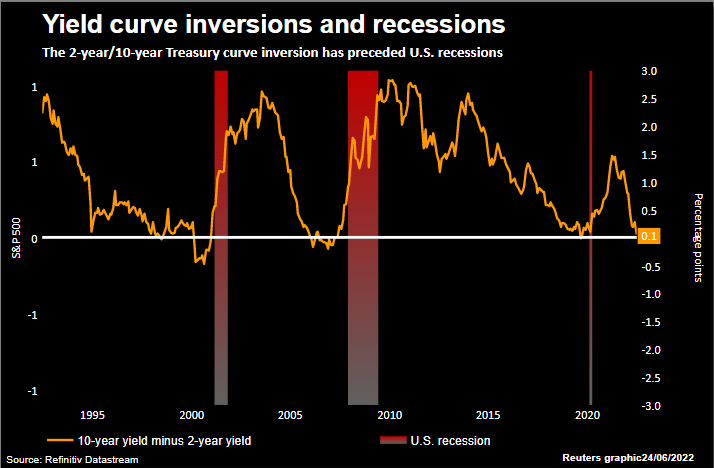

The U.S. Treasury yield curve has a track record of predicting recessions, especially when two-year yields rise above 10-year maturities.

At around 5 basis points (bps), the spread between the two segments has flitted in and out of negative territory recently, so recession watchers are paying attention.

The U.S. bond yield curve

The concern is that the Fed, facing 8%-plus inflation, will take monetary policy into what economists call restrictive territory, slowing economic activity.

"Chances the Fed can land on that narrow strip of safe ground are very remote," Mizuho senior economist Colin Asher said.

Money markets, having slashed bets on how high the Fed will take interest rates, now expect rates to fall about 20 bps between April and July 2023.

2/ PMI PROBLEMS

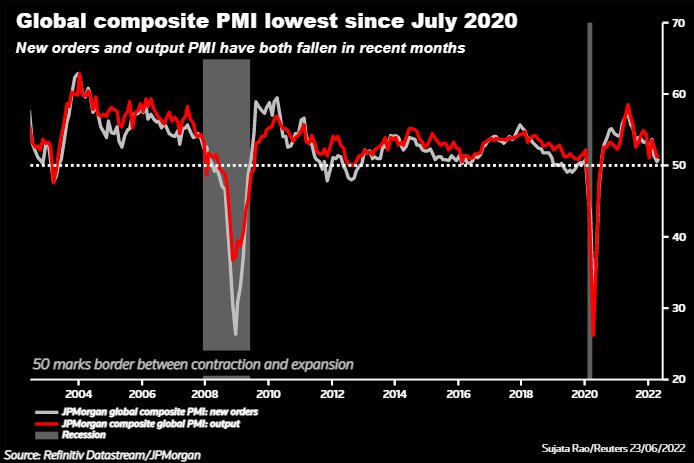

Purchasing Managers' Indexes (PMI) are reliable predictors of manufacturing, services, goods inventories, new orders, and therefore future growth.

A global composite PMI index from JPMorgan was the weakest since July 2020 in May, with the new orders component only just above the 50 level dividing activity expansion from contraction.

PMI

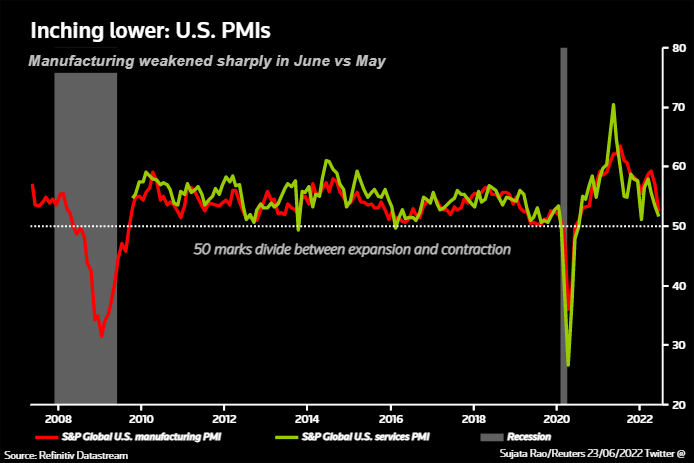

U.S. PMIs too have fallen, with manufacturing decelerating sharply in June. Sub-50 readings coincided with recessions in 2008 and 2020.

"Global PMIs sliding towards 50 is another sign that the post-COVID boom is behind us," Mizuho's Asher said.

US PMI

3/ COUNTING COMMODITIES

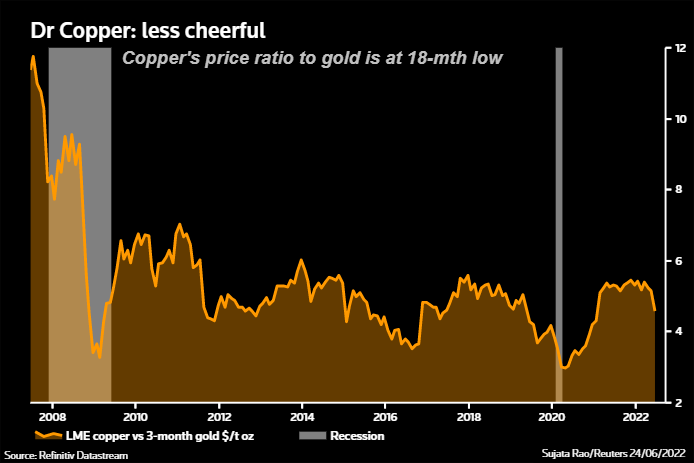

Copper, a well-known growth bellwether, has slid 7% this week - its sharpest weekly drop since the March 2020 meltdown.

Dubbed "Dr Copper" because of its record as a boom-bust indicator, the metal has also seen its price ratio to gold hit an 18-month low. In short, if you think the economy's tanking, dump copper and buy gold.

Brent crude has also slid 10% in June and is set for its biggest monthly fall since November.

copper-gold

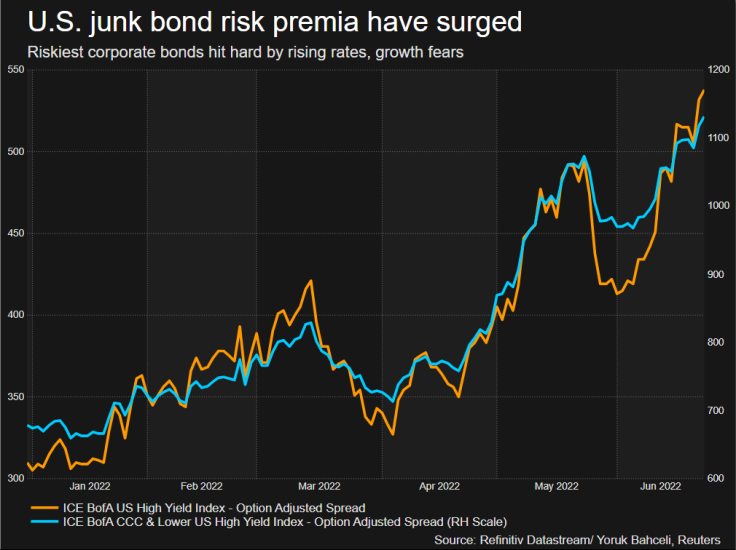

4/CARING ABOUT JUNK

Corporate sector stress, especially at the lower end of the credit spectrum, is another warning signal.

Financing costs for sub-investment grade, or "junk" U.S. companies have almost doubled this year to 8.51%. In euro markets, yields have soared to 6.8% from 2.8%.

According to BofA, if recession becomes a consensus view, U.S. junk bonds' risk premia would average 600-650 bps, and peak above 700 bps.

At current spreads around 500 bps, the index "is about 70% on our way to pricing in a certainty of a recessionary outcome", BofA analysts wrote.

Spreads on bonds rated triple-C and lower - facing the highest default risk - have risen above 1,000 bps, a significant sign of stress.

U.S. junk bond spreads

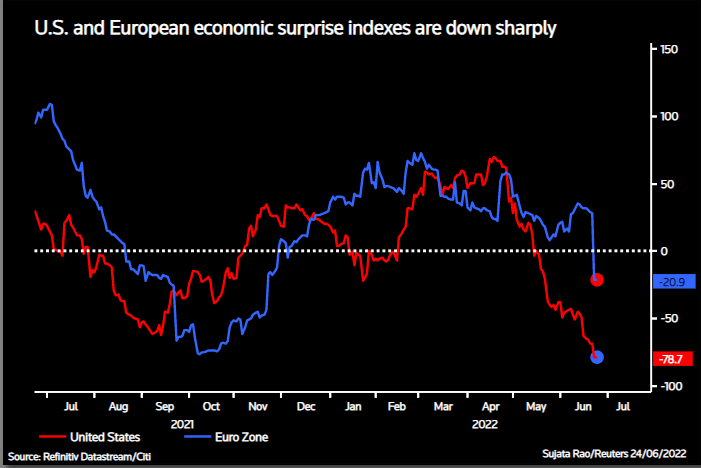

5/ SHIFTING CONSENSUS

Several big banks are flagging increased likelihood of recession.

Goldman Sachs forecasts a 30% chance of the U.S. economy tipping into recession over the next year - versus 15% earlier - while Morgan Stanley places U.S. recession odds for the next 12 months at around 35%.

Citi forecasts a near-50% probability of global recession.

Citi's Economic Surprise Index, measuring the degree to which the data is beating or missing forecasts, has fallen sharply for both Europe and the United States.

US, euro area surprise index is pointing sharply lower

© Copyright Thomson Reuters {{Year}}. All rights reserved.