Samsung Cuts Q4 Profit Forecast, Announces Share Buyback

Tech behemoth Samsung Electronics Co. Ltd. lowered its fourth-quarter earnings forecast but announced an 11.3 trillion won ($9.9 billion) share buyback, its largest to date, Thursday. The move had investors roaring with approval, sending the company’s shares as high as 2.3 percent, its highest in about five months.

The Seoul-based company said it would phase the buyback over a year, adding that the company also plans to increase dividends -- a welcome news for shareholders who had been clamoring for higher payouts.

"Samsung's decision to buy back and cancel its own shares was exactly what the market was hoping for," HDC Asset Management Fund Manager Park Jung-hoon told Reuters.

The company, however, lowered its fourth-quarter earnings target as it does not expect exchange rate conditions to be in its favor this quarter.

Foreign exchange rate conditions such as the won's weakness against the dollar boosted Samsung's profits by 800 billion won ($770.4 million) during the July-September period, according to reports. The company posted a quarterly profit of 7.4 trillion won ($6.48 billion), up 82 percent from last year.

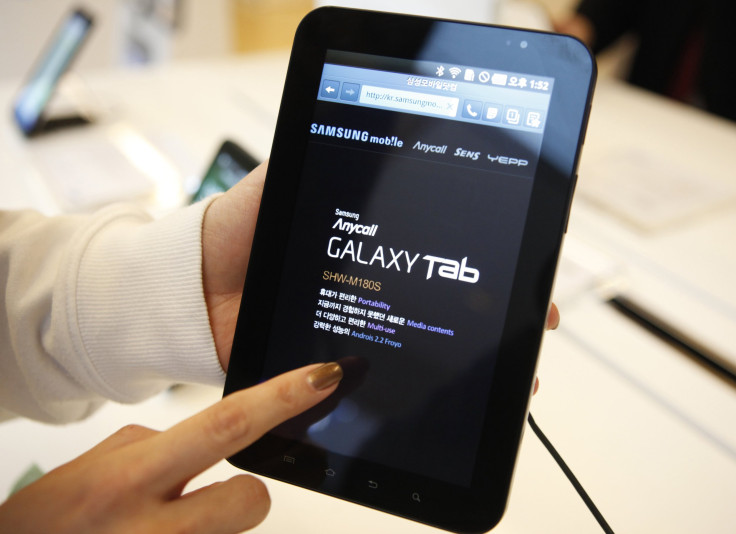

The smartphone maker, which lost ground to Apple Inc. and Huawei Technologies Co. Ltd. in recent times, posted a modest uptick of 9 percent in third-quarter revenue buoyed by strong demand for Galaxy Note 5 tablets and healthy chip sales.

The company's shares were up 1.53 percent during midday trading on the Korea Exchange.

© Copyright IBTimes 2025. All rights reserved.