Snapdeal CEO Talks Online Retail In India, After eBay Funding Round (Q&A)

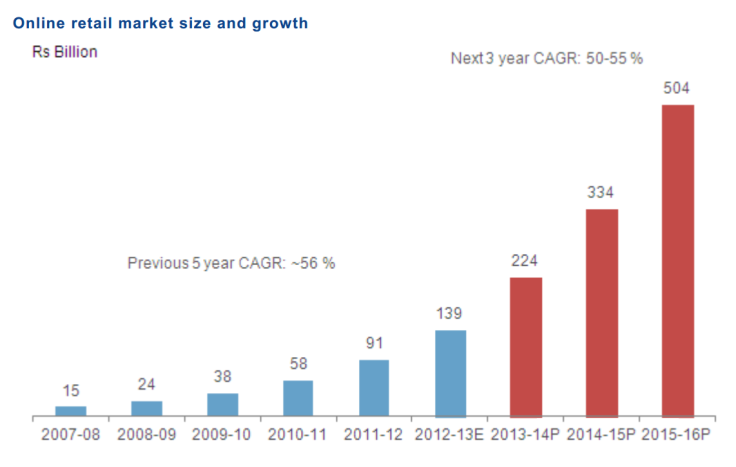

India’s online retail market will expand by more than 50 percent annually for the next three years, tripling to 500 billion Indian rupees ($8 billion) by 2016, according to leading Indian research firm CRISIL.

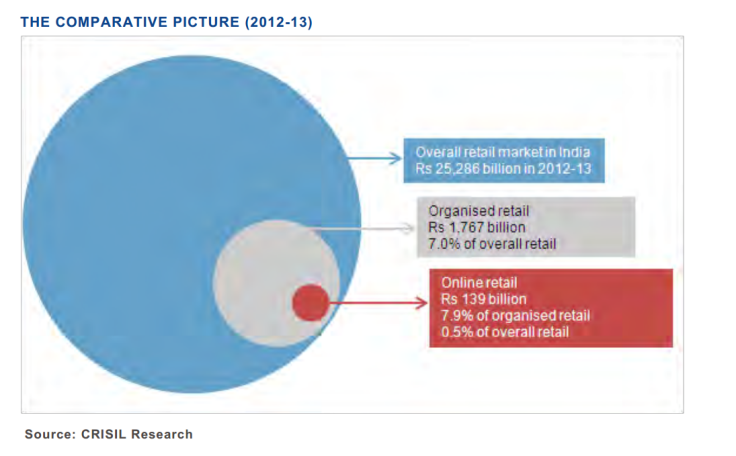

That represents a thirty-fold expansion from the end of fiscal 2008. Still, Indian e-retail represents a tiny slice of India’s total retail market, which includes a vast informal retail sector, characterized by small and disorganized individual sellers rather than companies.

Two players dominate online marketplaces in India: Flipkart and rival Snapdeal. The latter brands itself as the biggest online marketplace in India and allows more than 20,000 businesses to sell on its platform, though Flipkart reportedly earns more in revenue.

The Snapdeal platform, launched in 2010, represented more than $500 million in annual sales in its most recent year, and it aims to hit $1 billion this year. Snapdeal makes its cut in revenues, over $100 million or so, through transaction fees of 5 percent to 30 percent.

For context, Amazon.com made $61 billion in global revenue in 2012 via direct and third-party sales, though Amazon.com, Inc. (NASDAQ:AMZN) and eBay Inc’s (NASDAQ:EBAY) India subsidiaries are less developed.

We spoke to Snapdeal CEO Kunal Bahl, discussing e-commerce in India and the company’s ambitions.

Q: eBay recently led a $134 million fundraise for Snapdeal, becoming your largest investor and sparking talk of a potential buyout down the line. What do you say to that?

A: eBay and I have had a discussion, trying to avoid the speculation and rumors. Both them and us will stay non-committal to any discussions around the financing.

But given the size of the opportunity in the Indian e-commerce market, it’s not unlikely that we’ll eventually go public on an international stock exchange. It’s too early for us to eliminate any options.

Earlier in November, new Indian government regulations allowed unlisted Indian companies to list abroad on any foreign exchange, without having to list in India first. It’s very clear that the appreciation for our growth trajectory, and the value of our kind of business, is more appreciated in the financial markets of the U.S.

So there’s a substantial likelihood that’s the direction we’ll probably head within the next couple of years. Traditionally, if you were an Indian company you could not list abroad until you had listed in India first.

Q: What is the Indian e-commerce landscape like?

A: The opportunity in Indian e-commerce is huge. Only 0.25 percent of India’s retail is e-commerce, versus 4 percent in Latin America, 6 percent in China, 9 percent in the U.S. and 13 percent in South Korea. The market here could grow to $1 trillion over the next ten years, if e-commerce exists to the same level as in other emerging markets, of around 4 to 5 percent of retail.

Whereas brands account for a large chunk of consumer buying elsewhere, like in the U.S., in India they only account for 5 percent of overall sales. The rest of the market is long-tail manufacturers and distributors, selling great products at great prices, but not necessarily with a national footprint. Consumers in India are very value conscious. No single fashion or lifestyle brands commands more than $200 million in sales, so that means there's huge framentation on the supply side.

Our focus has really been on middle-class India. Middle India has started shopping for some core products online. In many areas, you can’t buy a refrigerator or TV where you live. We want to bridge that gap. We cover over 90 percent of urban India, or over 4000 towns and cities.

For the longest time, no one took India’s Internet industry seriously. That’s changed in the last twelve months, thanks to high quality companies and good management teams backed by blue-chip global investors. We were invited to the Goldman Sachs Private Internet Company Conference in November 2013, the only Indian company there.

Q: What did you take away from that Goldman Sachs conference?

A: Before, everyone knew that social networks were going to move to mobile. Now everyone believes that e-commerce will also be won or lost over mobile, especially in emerging markets. In emerging markets, eventually mobile could see 10 times the users from normal PC Internet.

For us, a year ago we saw 5 percent of our orders from mobile. Now it’s about 30 percent, excluding tablets. We expect that three years out 80 percent of our orders will come over mobile, making us the largest mobile commerce site in India.

Another theme was advertising and monetization. There’s potential for millions of dollars a year in ad money. There’s clearly a great opportunity for us to monetize, since we’re a top 15 traffic site in India, but we don’t necessarily intend to open it up for third parties.

We’d like to provide advertising more for our sellers, so they can earn visibility and drive traction. It’s like advertising inside a mall. That’s how we think of it.

Q: What are challenges to Indian e-commerce?

A: Cash payment on delivery is a feature here. But I think it has helped to increase the size of the market quite significantly. A lot of people don’t have credit cards or don’t want to use them.

For us, cash on delivery is about 60 percent of payments right now. It used to be about 70 percent. Over time it will probably keep coming down, but I don’t think cash on delivery will become zero percent of payments, ever. About 85 percent of offline transactions are done in cash in India.

The typical problem for cash on delivery are refusals. People order the product and then say I don’t want it anymore. That’s a single digit number for us, because we’ve used analytics to figure out repeat offenders. With buyers who keep rejecting products, we don’t give them the option of cash on delivery, though we still allow them to buy.

Q: What about e-commerce competition in India? Do you consider Amazon a rival or a potential partner?

A: I do not think an inventory-led e-commerce business can succeed in India. Specific to Amazon, I’m not sure I can comment. But, specific to us, we’ve already built significant scale in a very short period of time. We have millions of products, thousands of sellers and millions of buyers, with 20 million registered users.

We’ve already built tremendous scale, with 80 percent of all buying traffic coming to us through organic channels. Over 50 percent of people just type snapdeal.com and come directly to the site. We’ve created tremendous top-of-mind recall both for buyers and sellers on Snapdeal.

Building that rhythm is non-trivial. It’s not really only a function of spending a bunch of money. We’ve adapted for the Indian market, for instance with our logistics platform. Multinational companies sometimes have a tough time in emerging markets, because they don’t always build tools or infrastructure for their sellers.

Amazon has a tiny market share in China after being there for years. For context, Alibaba’s sales this year are going to be larger than all North American e-commerce sales put together, including eBay and Amazon.

In India, if you have an opportunity within ten years to be a significant market player in such a large and exciting opportunity, there’s no motivation to do anything but win that market. From an entrepreneurs’ perspective, this will happen only once in a hundred years in India – this is a once in a generation opportunity.

If we have the opportunity to build that kind of business in scale, similar to Alibaba but in India, then you can imagine there’ll always be a lot of interest in financing the business.

Q: You’ve made some acquisitions in recent years. What’s the theme there and what can we expect for acquisitions in coming years?

The theme of acquisitions so far has been fourfold. The company has had demand, supply, technology, or team aspects that we liked. Now that we have traction, where we are really one of the largest marketplaces, expanding demand through acquisitions is not that interesting anymore.

Supply was interesting at a certain point in time, but now that we have 4 million products, and are adding a product every twenty seconds, that part has also become less interesting.

Teams and technology will continue to be a focus area, where we are out on the watch. We watch for technology that can either aid the buyer’s experience in terms of personalization or recommendations, or the seller’s experience servicing orders.

We do foresee such opportunities for acquisitions going into the future.

© Copyright IBTimes 2025. All rights reserved.