SolarCity Corp (SCTY) Earnings Preview Q4 2015: Utility Pushback And Strategy Shift Fuel Uncertainties

SolarCity Corp. will report earnings this week on the heels of two critical victories for the U.S. solar sector: the extension of a key federal tax credit and a favorable ruling for California’s rooftop solar owners.

But the outlook isn’t entirely bright for the San Mateo, California, company. The industry is facing growing pushback from traditional power companies in Nevada and other key growth markets for solar energy projects. SolarCity, whose chairman is tech billionaire Elon Musk, is also bleeding cash after years of aggressive investment and expansion around the country.

The nation’s largest rooftop solar installer is slated to report fourth-quarter and full-year earnings Tuesday after the markets close in New York. For the fourth quarter, SolarCity’s fully reported losses are expected to widen to $120.3 million, or $1.60 per share, from $3.56 million, or 4 cents per share, in the year-earlier quarter, analysts polled by Thomson Reuters estimated. Revenue is expected to grow to $105.6 million from $71.8 million in the fourth quarter of 2014. The company has been profitable in only two of the 13 quarters since its initial public offering.

For all of 2015, the company is expected to report a loss of $243.81 million, or $3 per share, on revenue of $389.68 million compared to a loss of $56.03 million, or 60 cents per share, on revenue of $255.03 million, according to Thomson Reuters.

SolarCity's (NASDAQ:SCTY) share price has plunged 30 percent since the residential solar panel installer last reported quarterly earnings in late October. Shares were down over 10 percent to $26.58 on Monday at 1:47 p.m. EST.

Shares of SolarCity's competitors also fell over the same period amid fears of growing utility opposition and the staggering collapse in oil prices, which makes petroleum alternatives to solar power financially attractive. While solar companies don’t compete directly with oil, the 70-percent plunge in crude prices since mid-2014 has weighed on energy stocks overall. Sunrun Inc. (NASDAQ:RUN) has fallen nearly 14 percent since Oct. 30, while VivintSolar Inc. (NYSE:VSLR) dropped 35 percent. Vivint’s acquirer SunEdison Inc. (NYSE:SUNE) was down more than 65 percent over the same period.

SolarCity surprised investors last fall by announcing a strategic shift in its growth strategy. CEO Lyndon Rive said the company would slow installation growth as it seeks to reduce costs and become cash-flow positive. SolarCity has installed more than 1,000 megawatts of solar panels since its 2006 launch, but the costs of finding and securing new customers have soared, Rive said.

SolarCity expected to have installed as much as 898 megawatts in new projects in 2015, a 79 percent jump above 2014’s installations of 502 megawatts, the chief executive said. In 2016, that growth could plunge to about 40 percent as the company focuses on its more profitable installations.

As SolarCity trims its growth this year, some of its biggest cuts will come from Nevada.

The state Public Utilities Commission in December approved a plan that raises fees and reduces “net metering” incentives for the owners of rooftop solar systems. With net metering, solar users sell their excess electricity to the utility for a set price, which allows customers to dramatically reduce their utility bills.

SolarCity and other solar installers argued Nevada’s new rates make solar too expensive for residential customers and eliminate the economic attraction of going solar. On Dec. 23, Solar City said it would immediately cease solar sales and installations in Nevada. A month later, the company eliminated more than 550 jobs in the state and closed an employee training center plus three warehouses in Henderson, North Las Vegas and Reno.

NV Energy, the state’s main utility, said the policy change was a matter of fairness. Solar panel owners still depend on the grid to light their homes when the sun isn’t shining, but they don’t necessarily pay for that access. The utility argued its other ratepayers were forced to cover those costs. The new rates, it said, shifted the burden back to solar owners.

But the solar industry avoided an even bigger setback in the Golden State. The California Public Utilities Commission narrowly approved a proposal that continues the state’s net metering policy, with a few changes.

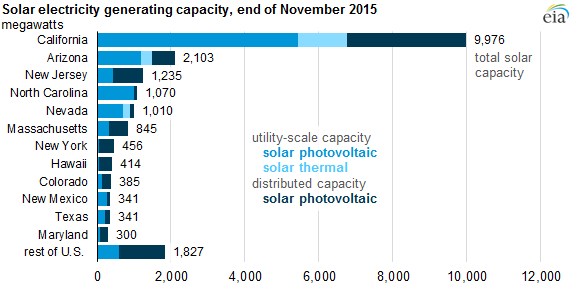

California accounts for nearly half the nation’s solar energy capacity. The state had about 9,979 megawatts in solar projects through November 2015, compared to slightly over 20,000 megawatts nationwide, the U.S. Energy Information Administration reported.

New U.S. solar installations could total 25,000 megawatts over the next five years thanks to the extension of the Investment Tax Credit, analysts at GTM Research in Boston projected.

Congress approved the five-year extension in December as part of a $1.15 trillion federal spending bill. The subsidy, which applies to household rooftop systems as well as utility-scale installations, allows solar power companies to claim tax credits at 30 percent of the price of a solar array. The credits were previously scheduled to fall to 10 percent in 2017, a cliff that propelled developers to install record amounts of solar power in 2015. Now, the credits will remain at 30 percent through 2019 before steadily dropping to 10 percent in 2022, where it will remain.

GTM analysts said U.S. residential installations could grow by an estimated 2,928 megawatts this year, a 38 percent jump over 2015 installations of 2,119 megawatts.

The tax credit extension and pro-solar decision in California will ensure steady demand for solar in the next few years. Yet questions still loom over whether rooftop solar installers like SolarCity will successfully profit from the U.S. clean energy push.

“SolarCity's stock, which once seemed invincible, has shown that it has flaws that investors need to consider,” Travis Hoium, a solar expert a Motley Fool, a stock market research site, wrote in a Feb. 7 post. “Fourth-quarter earnings and guidance for 2016 could give investors a better view of the company's future.”

SolarCity announced last week it is preparing to securitize a portfolio of more than 5,600 U.S. residential rooftop systems. About 83 percent of the portfolio’s projects are in just three states: Arizona, California and Colorado, the company said in a Feb. 5 filing cited by Bloomberg. Rooftops in Hawaii, New Jersey and New York each represent at least 1 percent.

SolarCity’s sixth securitization will include long-term leases and power-purchase agreements. The company completed its fifth securitization in January. The private placement of $185 million included, for the first time, U.S. solar loans.

© Copyright IBTimes 2025. All rights reserved.