Gold and silver prices rose Wednesday, but a falling stock market pulled down shares of silver mining companies and left gold mining company stocks mixed in midday trading.

To say it's been an unsettling time for U.S. stock investors would be an understatement. The Dow has been on a wild ride, with plunges followed by sudden reversals. Look for market choppiness to continue until investors determine whether the Fed's latest monetary policy decision -- low interest rates for two years -- will be enough to rev-up U.S. GDP growth.

U.S. stocks clawed back most of Monday's losses as a U.S. Federal Reserve promise of at least two more years of near-zero interest rates overshadowed its warning about slowing economic growth. The Fed's statement gave markets a glimmer of hope, with stocks' gains accelerating into Tuesday's close.

Stocks rallied on Tuesday in a volatile session as investors struggled to decipher the Fed's signals on the economy after a dizzying two-week slide.

U.S. stocks rebounded sharply on Tuesday after a major sell-off, but markets remained vulnerable to selling if the Federal Reserve fails to ease fears of a double-dip recession.

U.S. stocks soared in turbulent trading Tuesday, coming off the worst three day selloff since the financial crisis, as investors took in stride the Federal Reserve's pledge to keep interest rates near zero at least through mid-2013.

The Dow Jones Industrial Average and Bank of America both bounced back from disastrous Mondays to steady gains during Tuesday trading.

Gold rose Tuesday to another record high as U.S. stocks fluctuated in a narrow range and crude oil fell below $80 a barrel.

In response to a slowing economy, the U.S. Federal Reserve, despite some internal dissent, announced Tuesday that it plans to keep monetary policy stimulus in place, noting that it will keep short-term interests rates exceptionally low through at least mid-2013. The Fed will also continue to reinvest bond proceeds maturing in its portfolio.

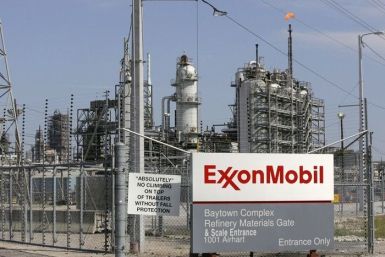

Oil and natural gas companies, whether integrated or independent, whether upstream or downstream, posted gains as investors picked up heavily discounted stocks.

Gold continues its climb to new heights even as U.S. stocks stage a rebound.

Stock index futures rose on Tuesday, indicating a partial rebound from the previous session's nosedive, as investors looked to a Federal Reserve statement for clues on how it may combat the growing perception the nation was headed for recession.

McDonald's Corp reported a better-than-expected 5.1 percent rise in global July sales at established restaurants on Monday, as it takes share from rivals with low-priced food and new drinks.

The Dow Jones Industrial average closed the day on Monday at 634.76 points. The drop is the sixth worst point decline for the Dow in the last 112 years and the worst since December 2008. Additionally, every stock in the Standard and Poor's 500 index dropped on Monday.

The Dow Jones Industrial Average was rocked by investor fear on Monday, dropping 634 points during trading.

Investors fled stocks on Monday in the first session since Standard & Poor's cut the AAA credit rating of the United States, adding to worry about the economic outlook and Washington's ability to meet the challenges.

Gold notched a new high on Monday as investors ran to the precious metal for safety amid collapsing stock markets.

The Dow Jones industrial average plummeted more than 600 points midday Monday, as the disarray continues following Standard & Poor's downgrading of the United States' credit rating on Friday. The Dow traded down 536.18 points, or 4.7 percent, at 10908.43. It is fast on track to having its worst day since December 2008. Additionally, the Standard & Poor's 500 index sharply went down 68.49 points, or 5.7 percent, to 1130.89.

Amidst the slaughter in equities, Treasuries rallied and gold soared to a new all-time high.

The Dow Jones suffered its sixth-worse loss ever on Monday, dropping 634 points in the first trading day after S&P's downgrade of the United States.

U.S. stocks plummeted for the second straight session, driving the S&P 500 and the Nasdaq down 6 percent on Monday in the first session since Standard & Poor's cut the nation's perfect AAA credit rating.

Next week, Perry is scheduled to visit South Carolina, which just happens to be an important primary state and Haley?s home.