Gold prices dropped sharply in holiday-thinned trade on Monday, falling as much as 2.7 percent after Wall Street stocks opened higher, deflecting interest from the safe-haven metal.

In the aftermath of Hurricane Irene, Chase bank has found a heart for potential suffering customers in New York, New Jersey and Connecticut: Staff will be increased, banking hours will be extended, and that banking overdraft fees and credit card late fees will be waived.

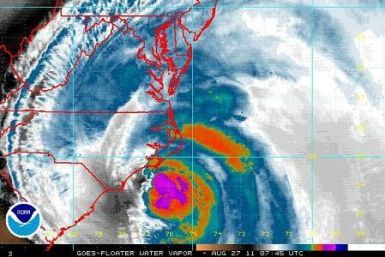

Hurricane Irene's rampage through 10 states caused an estimated $7 billion to $13 billion in damage from violent winds and flooding, and left almost 6 million homes and businesses without power.

The top pre-market NASDAQ Stock Market gainers are: Partner Communications, Micron Technology, Lululemon Athletica, Clearwire, Universal Display, Green Mountain Coffee Roasters, OmniVision Technologies, and Aruba Networks. The top pre-market NASDAQ Stock Market losers are: IncrediMail, and Logitech International.

Record gold prices, rather than denting China's enthusiasm for bullion, have emboldened investors to plough more money into gold bars and riskier bullion-based derivatives.

Gold prices eased a touch in holiday-thinned trade on Monday as investors took bets on higher prices off the table, disappointed by a lack of clear guidance from the Federal Reserve on Friday on the options for U.S. economic stimulus.

Record gold prices, rather than denting China's enthusiasm for bullion, have emboldened investors to plough more money into gold bars and riskier bullion-based derivatives.

Stock index futures pointed to a higher open on Wall Street on Monday, with futures for the S&P 500 up 1 percent, Dow Jones futures up 0.8 percent and Nasdaq 100 futures up 1 percent at 0930 GMT (5:30 a.m. ET).

Record gold prices, rather than denting China's enthusiasm for bullion, have emboldened investors to plough more money into gold bars and riskier bullion-based derivatives.

European shares gained in early trading Monday morning, tracking a late rally in Wall Street Friday, after Federal Reserve Chairman Ben Bernanke raised hopes for more economic stimulus.

Flat-screen maker LG Display will slash next year's capital spending by a quarter as booming sales of mobile devices from iPads to Android smartphones saps demand for TV panels, its main source of earnings.

Switzerland's banking industry may have to slash 10,000 jobs by the end of next year, particularly at Swiss subsidiaries of big foreign banks, Swiss newspaper SonntagsZeitung reported.

Sipping coconut water and honey, Anna Hazare ended a hunger strike on its 13th day on Sunday, a protest that had sparked huge rallies across the country, exposed a weak government and ushered in a new middle-class political force.

The Bank of America (BAC.N) is completing plans to sell over half of its shares in the China Construction Bank (0939.HK), with a group of Asian and Middle Eastern sovereign wealth funds negotiating to buy, the New York Times reported on Saturday.

Emerging economies should find other ways to buffer themselves from global crises than stockpiling U.S. government debt, a prominent economist argued on Saturday.

The storm comes just a week after an unprecedented magnitude-5.8 earthquake struck central Virginia.

Tanzanian authorities have seized as many as 1,041 elephant tusks on the island of Zanzibar, in the largest ivory haul in a year, reports say.

Scenes from before the storm strikes

Toronto's main stock market cut early losses in volatile trade on Friday morning as investors deemed an earlier sharp selloff overdone as they digested remarks by the Federal Reserve chairman.

Bank of America could strike a deal as early as Monday to sell about half of its 10 percent stake in China Construction Bank, CNBC reported Friday, citing an anonymous source.

Guinea is in advanced talks with state-owned China Power Investment to develop a bauxite mine and build an alumina refinery, deep water port and a power plant in the West African state, Guinean government sources said.

Shaanxi Coal Industry plans an initial public offering in Shanghai to raise as much as 17.3 billion yuan ($2.7 billion) in what could be mainland China's biggest IPO this year.