Tesla Is The Most Dangerous Stock And It's 'Getting Ready To Fold,' Analyst Warns

KEY POINTS

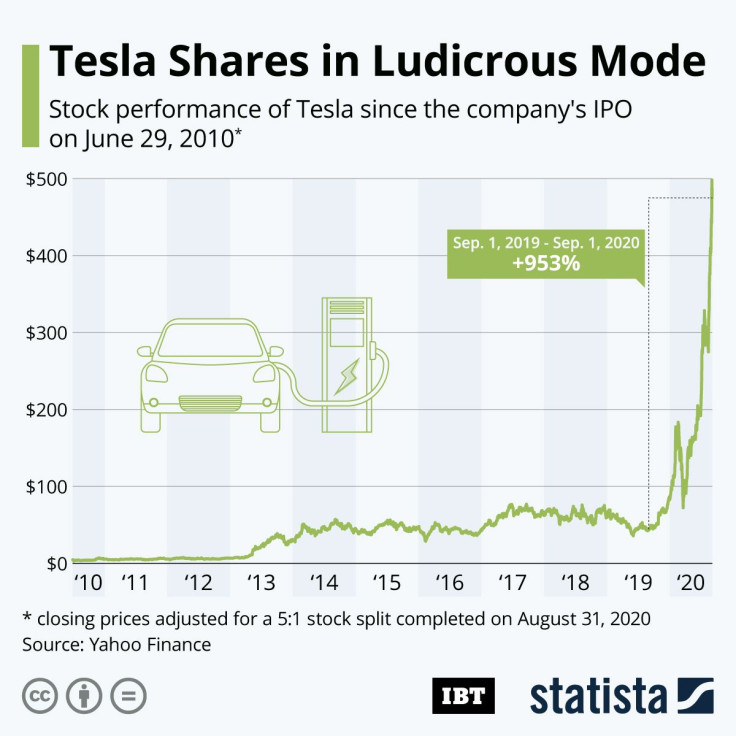

- Tesla's almost 400% surge in value since the start of the year is both welcome and unnerving for investors

- A correction is widely expected since analysts say Tesla's fundamentals can't support its current lofty valuation

- One analyst predicts an incredible drop in price of 90%

Tesla's soaring stock price remains dangerously overvalued, analysts say, with more who track the stock now warning of a painful reckoning not that far into the future.

The stock's meteoric rise continues to defy its fundamentals. It's also leding to more warnings of a massive correction, perhaps by as much as 90%. The stock stood at $418.32 last Friday on the NASDAQ, its highest level yet, and up 386% over its closing price on Jan. 2 of only $86.05.

This unbridled ascent makes Tesla the most dangerous stock on Wall Street, contends David Trainer, CEO of investment analysis firm New Constructs LLC. Trainer asserts the stock's fundamentals don't support its far too lofty price and valuation.

“We think this is a big, big -- one of the biggest of all time -- house of cards that’s getting ready to fold,” Trainer told CNBC's "Trading Nation."

He said a more realistic valuation would be far lower than current levels.

“I think around a 10th of what it is is probably appropriate if you look at, you know, kind of a reasonable level of profits,” he said.

“Tesla doesn’t rank in the top 10 in market share or car sales in Europe for EVs and that’s because the laws changed in Europe that have strongly incentivized the incumbent manufacturers to crank up hybrids and electric vehicles. The same is coming in the United States. I think realistically we’re talking about something closer to $50, not $500, as a real value.”

His assessment echoes that of research boutique firm GLJ Research, which sees a steep plunge to the bottom for Tesla over the next 12 months.

Analyst Gordon Johnson expects Tesla shares to plummet to what seems like an impossibly low $19 a year from now, implying an unprecedented plunge of 96%. As might be expected, Johnson’s rating for Tesla is a Sell.

To justify his claim for this incredible rout, Johnson told Tip Ranks he still has many issues with Tesla. He argues that without Tesla's “FSD (full self-driving) and credit sales in 2020,” Tesla will lose about $200 million “in both 3Q20 and 4Q20." Johnson believes “the core business is still a perpetual loss maker.” He derided FSD as "vaporware."

He also predicts a sales plunge in the U.S., Canada and Europe while data points to “disappointing” sales in China. Johnson also takes issue with Tesla's tendency “to shift numbers around as it sees fit (as it did in 1H20 where credit sales jumped to $782mn vs. $267mn in 2H19) -- making modeling the company's earnings more an ‘art’ than science.”

He said the impossible rise in Tesla shares is “a valuation approaching that of more than the entire global auto industry.” He asserts this jump has nothing to do with fundamentals or with U.S. boosted by Fed money. Johnson contends markets are "structurally broken" and that a bubble is building in markets not properly functioning.

© Copyright IBTimes 2025. All rights reserved.