President Barack Obama called on Wednesday for an expanded homeowner refinance program that would lift restrictions for more borrowers, representing another government effort to aid the ailing housing market.

On Monday, NPR and ProPublica published a report revealing that Freddie Mac, the government-owned mortgage giant, had purchased $3.4 billion in mortgage securities that became more profitable if homeowners were unable to refinance at lower rates.for homeowners to pay off their mortgages. It's the latest public blow to a firm that has been blamed for its role in the housing crisis, even as it continues to deal with the fallout of the toxic mortgages that it continues to hold

Top Republican lawmakers on Sunday said they expect to forge a deal with Democrats to extend the payroll tax cut before it expires at the end of February but offered no specifics on how they would pay for it.

The U.S. administration on Friday expanded its main foreclosure-prevention program and pushed to open it to those with loans backed by mortgage giants Fannie Mae and Freddie Mac, a move that could meet resistance from their regulator, the Federal Housing Finance Agency.

The Justice Department issued civil subpoenas to 11 financial institutions as part of a new effort to investigate misconduct in the packaging and sale of home loans to investors, Attorney General Eric Holder said on Friday.

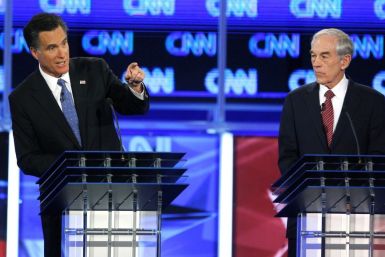

Mitt Romney, Ron Paul, Newt Gingrich and Rick Santorum tackled a broad range of foreign, domestic and social issues during last night's debate, from immigration law and foreign policy to Romney's link to Obamacare and whose wife would make the best first lady. Relive the highlights of the CNN Florida Republican debate, and get a rundown of the top quotes and biggest arguments of the night.

Mitt Romney, Newt Gingrich, Ron Paul and Rick Santorum faced off last night in the final GOP debate in Florida before the Jan. 31 primary. Here, find out what statements from the primary debate were true and which got the facts wrong, from Santorum on Latin America to Mitt Romney's involvement in Freddie Mac.

President Barack Obama's proposal to allow millions of homeowners to reduce mortgage payments is the latest in a series of federal efforts to aid the housing market, but it faces a number of obstacles.

Are Newt Gingrich and Mitt Romney the same? Vice President Joe Biden thinks so, and a side-by-side comparison of their positions shows more similarities than differences.

In an attempt to deflect attention over his involvement with Freddie Mac, Republican presidential candidate Newt Gingrich's former consulting firm on Monday released a contract he had with the troubled mortgage firm.

The regulator for Fannie Mae and Freddie Mac told lawmakers that forcing the two mortgage firms to write down loan principal would require more than $100 billion in fresh taxpayer funds.

The five-year slide in U.S. home prices will stop this year, followed by the start of a weak recovery next year, according to a Reuters poll that also showed economists split on whether the government would make new efforts to support the market.

Michael Williams, CEO of mortgage giant Fannie Mae, is resigning, the company announced on Tuesday.

Here is an overview of Jon Huntsman's economic plan, as the former Utah governor scrambles to finish in one of the top spots in New Hampshire.

The federal government will soon begin selling government-owned foreclosed properties in bulk to investors as rentals, in a new effort to dispose of its growing portfolio of distressed properties.

Three top Federal Reserve officials aggressively pushed on Friday for more stimulus for the U.S. housing market, saying the government should be looking at ways to help the sector for the purpose of speeding the country's economic recovery.

Two top Federal Reserve officials on Friday pushed the case for more stimulus from the U.S. central bank to help the economic recovery, each zeroing in on the country's weak housing market.

The Federal Reserve released a report on Wednesday that called for changes to foreclosure processing and an expanded role for Fannie Mae and Freddie Mac to bolster the still-struggling U.S. housing market.

Richard Cordray's short time as Ohio's attorney general earned him national recognition as a Wall Street watchdog.

U.S. mortgage applications fell 3.7 percent in the week ending Dec. 30, compared to the week ending Dec. 16, according to the Mortgage Bankers Association (MBA).

A series of groundbreaking (and head-scratching) bills in states from Florida and Tennessee are set to become law on New Year's Day 2012. Here's everything you need to know, from aids for illegal immigrants and abortion restrictions to Utah's ban on Happy Hour and California's move for LGBT rights, and why you should care.

As the end of 2011 approaches, the housing market is another year removed from the subprime mortgage meltdown. But the legacy of the crash remains, as homeowners, lenders, regulators and brokers alike continue to deal with falling home prices, a glut of unprocessed foreclosures and an uncertain economy.