Bank of America Corp. (NYSE:BAC), the troubled financial behemoth that teetered just above the abyss during the last few weeks of 2011 and has since made somewhat of a recovery, is expected to swing to profit when it reports quarterly financial results Wednesday morning.

Taking inspiration from global regulatory investigations into the interest rate manipulation, the U.S. is now building strong evidence of criminal wrongdoings against big banks and individuals ensnared in the heart of the scam.

The chief executive of New York-based Citigroup Inc. (NYSE:C) had a surprisingly confident outlook for his bank's future business prospects during a conference call with analysts Monday.

The Consumer Financial Protection Bureau's complain database has been live for six weeks, Here's who ranks best and worst among the big credit card issuers.

When San Franciso-based Wells Fargo & Company (NYSE:WFC), releases quarterly results Friday morning, analysts will be examining the corporate filing for hints as to the state of the U.S. housing market.

When New York-based banking behemoth JPMorgan Chase and Co. (NYSE:JPM) reports its financial results for the latest quarter on Friday morning, the market's collective attention will be focused on just one figure: the one finally detailing how much JPMorgan lost as a result of its ill-advised strategy of putting huge hedge bets on the CDS derivatives market.

The late King Hussein of Jordan titled his autobiography ?Uneasy Lies the Head.? That could be the title Thorsten Heins, CEO of Research in Motion (Nasdaq: RIMM), the ailing BlackBerry developer, could use for his book, too.

LinkedIn (NYSE: LNKD), the leading professional social networking site, lost as much as 6 percent of its value Monday on a report that Facebook (Nasdaq: FB), the No. 1 social networking site will start direct competition.

BlackBerry developer Research in Motion (Nasdaq: RIMM) values its intellectual property at $3.37 billion, or nearly 85 percent of the value of the entire company.

Consider BlackBerry developer Research in Motion (Nasdaq: RIMM): is it in a ?death spiral? or a tarnished diamond that with better management can be revived for a bright future?

Three of the world's biggest financial institutions in the U.S. are closing their European money market funds to new investments after the European Central Bank (ECB) reduced its benchmark rate to a record low of 0.75 percent and slashed deposit rates to zero on Thursday, undermining global investor confidence.

Despite no announcements ahead of its Tuesday annual meeting, BlackBerry developer Research in Motion (Nasdaq: RIMM) is worth another $130 million by midday Friday.

Earnings season for the second quarter is almost here, with America's biggest aluminum producer, Alcoa Inc., announcing its results on Monday and JPMorgan Chase & Co. disclosing a portion of its total derivatives-trading losses on Friday the 13th.

Elan Corp, SXC Health Solutions, Micron Technology, Thompson Creek Metals, Alcoa, Veolia Environnement and Nokia and Logitech International are among the companies whose shares are moving in pre-market trading Thursday.

Former Barclays boss Bob Diamond testified Wednesday before the British Parliament's Treasury Select Committee denying that anyone in the British government instructed the bank to manipulate the rate that determines the cost of trillions of dollars worth of loans and derivatives traded worldwide every day.

Following the revelation last week that British banking giant Barclays was engaging in massive fraud meant to distort the Libor, the interest rate underpinning hundreds of trillions of dollars in credit transactions, politicians and regulators the world over are taking a sober look at the system. What they find may prove to be shocking.

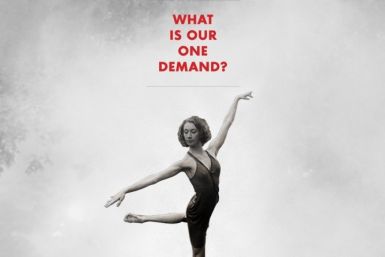

Manhattan community leaders began pressing Sunday for the cage around the iconic Charging Bull statue in the middle of New York's financial district to be removed.

Shares of BlackBerry developer Research in Motion (Nasdaq: RIMM) fell nearly 20 percent after announcing a first-quarter loss of $518 million and a further delay in shipping the next-generation BlackBerry 10.

Investors in Barclays PLC (NYSE: BCS) (London: BARC) lost over £4 billion Thursday as the British bank lost one-sixth of its market capitalization a day after international regulators announced the bank would have to pay hundreds of millions as a fine for an audacious price-fixing fraud some of its traders were found to have engaged in.

LiveDeal, Orexigen Therapeutics, Lincare Holdings, Synta Pharmaceuticals, Barclays, JPMorgan Chase and Deutsche Bank are among the companies whose shares are moving in pre-market trading Thursday.

Several underwriters that shared $176 million in fees from the $16 billion initial public offering of Facebook (Nasdaq: FB), the No. 1 social networking site, told investors to buy the share Wednesday.

It's not turning out to be a good week for Morgan Stanley (NYSE: MS). Over the past few days, the bank has been embroiled in two international scandals and cut by analysts at Goldman Sachs. That follows a month that saw a major credit downgrade, participation in the fumbled IPO of Facebook Inc. and behind-the-scenes grumbling by the FDIC. The bank has lost more than one-third of its market capitalization since late March.