Talk of Greece voluntarily leaving -- or being kicked out of -- the eurozone was once verboten. Now bank economists, investors, and even central bankers are talking about it as though it's a done deal. The divide between rhetoric is also growing. Those predicting the future Greek exit are calling it "manageable," while those saying it won't happen are labeling the possibility "catastrophic."

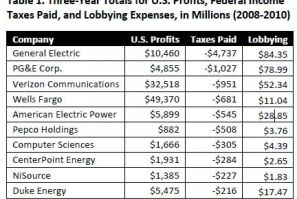

The SEC on Thursday charged Wachovia Bank N.A. -- now Wells Fargo Bank following a merger in March 2010 -- with fraudulently engaging in secret arrangements with bidding agents to improperly win business from municipalities and guarantee itself profits in the reinvestment of municipal bond proceeds.

Pacific Sunwear of California Inc said it received a $60 million loan from private equity firm Golden Gate Capital in return for two board seats and the right to buy a 20 percent stake in the teen retailer.

It turns out that credit unions did not benefit so much from fed-up customers of big banks. The Credit Union National Association said in early November that their survey showed an estimated 650,000 Americans have opened new accounts at credit unions since Sept. 29, the day Bank of America (BAC) announced the $5 debit card fee that it later cancelled due to mounting pressure. However, a newly released regular monthly report shows quite a difference scenario.

U.S. equities rallied in the last hour of trading Wednesday, before retreating in the last few minutes, as rumors that a $600 billion International Monetary Fund Bailout of the European sovereigns was about to be announced swirled the market, only to be dispelled just before trading closed for the day.

Wells Fargo & Co. (WFC) announced that all deposit-taking ATMs in its network of more than 12,000 machines in the U.S. are now entirely envelope-free. Citibank (C) stated in its recent edition of client manual for consumer accounts that the bank will be installing new envelope-free ATMs at Citibank branches and other Citi locations "throughout 2011."

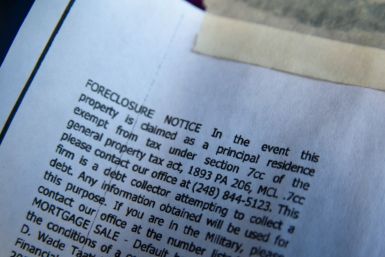

Anti-Wall Street protesters, seeking a new focus as cities across the country shut down two-month old Occupy encampments, launched a new wave of activism on Tuesday by rallying around homeowners as they try to resist evictions from foreclosed homes.

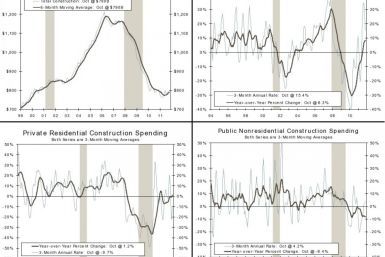

Total construction spending has contributed to real Gross Domestic Product (GDP) over the past two quarters and is expected to add to economic growth through 2013.

A strange and winding day for the shares of major U.S. financial companies ended as oddly as it began, as shares of major U.S. banks seemed to brush off bad news on sovereign debt ratings that rattled the wider market and shares of five of the biggest financial institutions traded on the New York Stock Exchange ended the session on a sell imbalance.

In a research note, banking industry analyst Matthew Burnell reduced fourth-quarter earnings estimates for JPMorgan Chase (NYSE:JPM), Citigroup (NYSE:C), Goldman Sachs (NYSE:GS) and Morgan Stanley (NYSE:MS). Burnell reduced the earning estimates for JPMorgan and Citi by about 4 percent, but sounded a much more pessimistic note on Goldman and Morgan Stanley.

In the wake of a lawsuit filed by the Massachusetts attorney general, GMAC Mortgage, a subsidiary of Ally Financial, said on Friday that it would stop buying mortgage loans in the state after Dec. 5.

The U.S Department of Commerce released the construction spending index for the month of October. Total construction spending rose 0.8 percent in October, the third consecutive monthly increase.

Massachusetts Attorney General Martha Coakley hit five banks with a lawsuit over foreclosure practices in the midst of multistate settlement negotiations.

From the time when a statement by Massachusetts' attorney-general announcing a lawsuit against five major banks began appearing on the newswires, shares of the financial institutions being sued actually went up slightly.

Wells Fargo & Co. (WFC) announced Thursday the reduction of fixed interest rates for many of its private student loans, as the company tries to coincide with peak season and appeal to graduates interested in consolidating their student loan debt, as well as those who are in the midst of obtaining financing for second semester coursework.

Suit targets nation's largest lenders

Wells Fargo Securities said California's wholesale trade, transport and export industries have been big beneficiaries of the growing wealth of Asia and growing demand from other countries, such as Canada and Mexico.

Wells Fargo Securities said California's labor market has shown some encouraging signs of improvement over the past three months, though jobs creation for much of the year has been a hit-or-miss venture.

A gradual broadening and strengthening of U.S. growth should cushion the American economy against severe damage from the storms in Europe, unless a financial meltdown causes global havoc.

Wells Fargo Securities said there are still many signs that California's labor market remains deeply ill, despite the better job creation performance this year.

Wells Fargo Securities said the California housing market continues to struggle and is not yet ready to bolster California's economic rebound.

While big U.S. banks assured investors they were financially healthy during the financial crisis, they also quietly approached the Federal Reserve for more bailout money. As of March 2009, the Fed committed $7.77 trillion to rescue the financial system, which is more than half the value of everything produced in the U.S. that year. The amount dwarfed the Treasury Department's better-known $700 billion Troubled Asset Relief Program, or TARP.