Understand Iraq’s Impact On Global Oil In Four Easy Charts

In less than a week, an al Qaeda splinter group called the Islamic State of Iraq and Syria has seized several key cities in the north and center of Iraq, the world’s seventh-largest oil-producing country, causing its largest oil refinery to shut down Tuesday and bumping up international oil prices as traders fear the escalating violence could inhibit production.

Energy industry watchdogs had expected Iraq to expand its oil production considerably in the next decade, which would help keep global oil prices stable and meet rising demand, particularly in China. Brent crude prices, the international benchmark, were at $113 per barrel on Tuesday, a little above the $110-per-barrel price that erupted after the wave of revolutionary protests and civil wars known as the Arab Spring swept across North Africa and the Middle East.

According to Capital Economics on Tuesday, global growth has been "slugglish" ever since Brent crude prices rose above $100 per barrel, and economic activity tends to slow sharply when they cross $120.

"We suggest that, as a rule of thumb, the net impact of a $10 rise in oil prices is to cut global growth by around 0.2-0.3 percentage points," Julian Jessop, chief global economist of Capital Economics, said Tuesday in a note.

To show the impact that Iraqi oil production has in the global market, here are four charts from the International Energy Agency and the Center on Global Energy Policy at Columbia University, based on data from the U.S. Energy Information Administration. Since IEA’s forecasts were made before ISIS claimed control in the north, they are likely to be revised downward if ISIS is not contained soon.

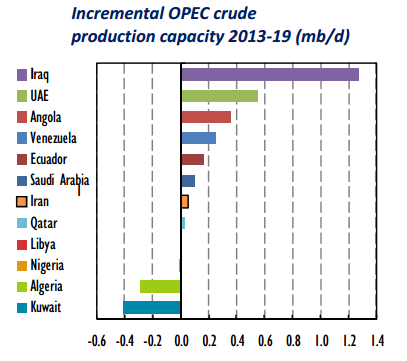

IEA has said that North America’s rising oil production may not be enough to meet global demand in the long term, and that growth in production of crude oil and natural gas will be needed from the Organization for the Petroleum Exporting Countries. On Tuesday, IEA’s report forecast that 60 percent of expected growth in OPEC's crude production capacity in 2019 would come from Iraq.

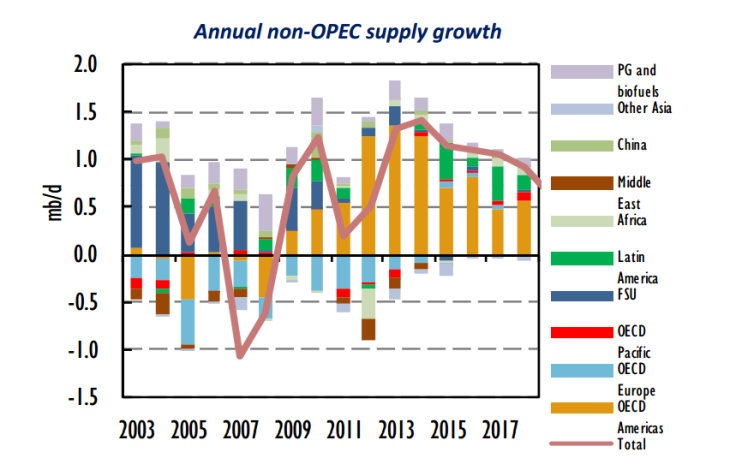

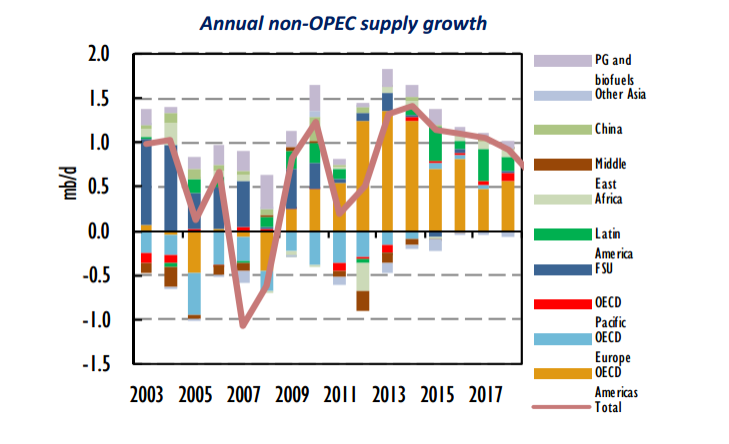

IEA forecast last week that global oil demand will rise this year by 1.3 million barrels a day to 92.8 million barrels a day, compared to last year. Global oil supplies rose in May to 92.6 million barrels a day, mostly on a 440,000-barrels-a-day increase in non-OPEC production. Here’s a look at IEA’s prediction that the growth of North American oil production will soon taper off.

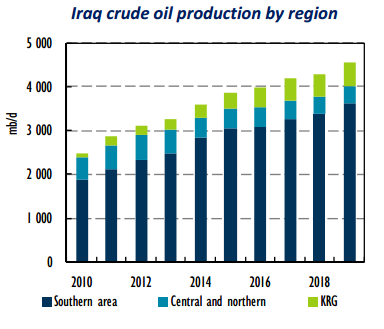

Iraq produces about 3.3 million barrels of oil a day, about 4 percent of the world’s total supply, and its crude production capacity growth was expected to rise by 40 percent, by 1.3 million barrels a day to 4.6 million, by 2019, according to IEA.

“Worsening political stability and security issues add major downside risk in Iraq, Libya” and others, IEA said. That’s led to delays in contract awards and infrastructure plans that would secure oil projects.

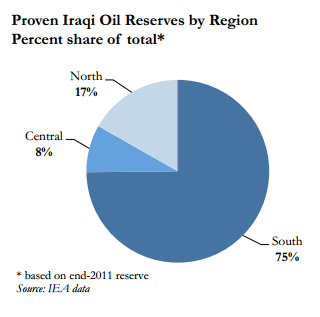

A quarter of Iraqi oil reserves are in the north and center of the country, closest to ISIS territory. The other three-fourths of the oil fields are in the south.

When asked Tuesday if the IEA would update its forecasts regarding Iraq to reflect recent events, an IEA spokesman said the next update on Iraq, if needed, would not be published until IEA's monthly oil market report. The June report will be released in mid-July.

© Copyright IBTimes 2025. All rights reserved.