What Really Happened To FTX?

Within a week, Sam Bankman-Fried's FTX exchange had gone from establishment's crypto star to a villainous failure. In the aftermath, dozens of companies are at risk of bankruptcy or have already declared one. What happened?

By the end of this article, you will be equipped to answer every question related to Sam Bankman-Fried defrauding millions of people through his operations.

It All Begins With Alameda Research

Together with Tara Mac Aulay, Sam Bankman-Fried (SBF) founded Alameda Research in 2017 in Berkley, California. While Tara has a background in healthcare consulting, Sam grew up in an academic environment, having graduated in Physics at MIT.

Quick facts: I started Alameda Research with Sam in 2017. In April 2018, I and a group of others all quit, in part due to concerns over risk management and business ethics.

— Tara Mac Aulay (@Tara_MacAulay) November 16, 2022

At this early stage, the company operated as an arbitrage trading firm, headquartered in Hong Kong. But what exactly made it successful? Alameda took advantage of different crypto prices in different regions.

Specifically, the quantum trading firm bought Bitcoins at a discount in the West, only to simultaneously sell them at a higher price in Japan and South Korea. This arbitrage opportunity, often called the kimchi premium, exists because of many bureaucratic hurdles present in the Asian markets.

"Many found a way to do it for small size. Very, very hard to do it for big size, even though there are billions of dollars a day volume trading in it because you couldn't offload the Korean won easily for non-crypto."

SBF

To upscale arbitrage trading, Alameda had to find a platform to buy Bitcoin in large amounts and get approval from Japanese/Korean exchanges. This was all topped off by moving large sums of money out of Japan to the U.S. on a daily basis.

For a year, the business was booming, until other competitors started doing the same. In April 2018, Tara Mac Auley quit the company "due to concerns over risk management and business ethics."

Tara now sees Sam's actions as "a perversion of everything crypto stands for".

From its inception to its bankruptcy filing, Alameda had made 180 investments in the crypto space, out of which 30 were lead investments, according to Crunchbase. To get to that endpoint, we must understand how SBF made FTX as a modular extension of Alameda.

FTX Attaches to Alameda Research

Once it became clear that arbitrage trading had become too competitive to be profitable, SBF wanted to upgrade Alameda Research into a market maker. Market makers are key cogs of any market because they grease it up with liquidity.

Specifically, market makers cover the ask/bid spreads of any trade, while getting a small cut in return. For instance, Citadel Security is one of the key players in the stock market and allegedly had a controversial role in the GameStop/AMC short squeeze saga.

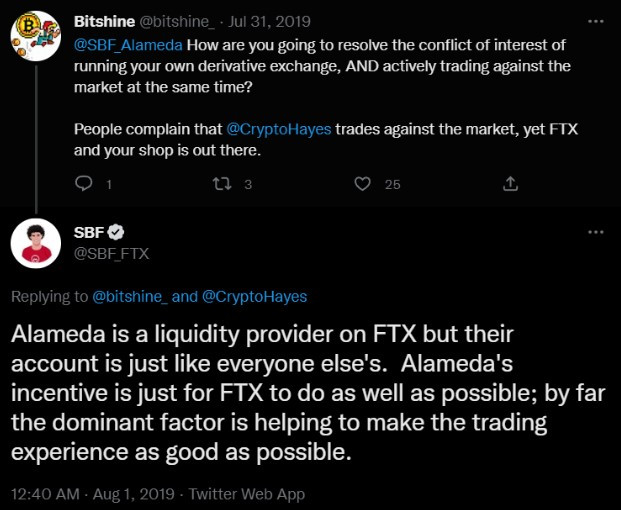

Together with Gary Wang, SBF founded the FTX cryptocurrency exchange in May 2019 in a bid to gather the necessary enormous capital any market maker needs. With careful marketing that aligns with the establishment, combined with Tara's Effective Altruism, SBF became a legacy media darling, which attracted over a million users to FTX.

Boosted by lucrative fees from trading and derivatives, FTX was in a position to boost Alameda's market-making activities.

How Did FTX and Alameda Work To Subvert the Market?

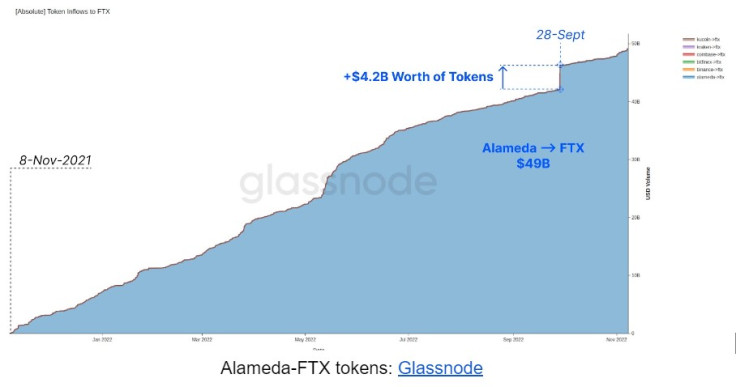

Although officially separate entities, these companies worked in tandem for all intents and purposes. For instance, glassnode research revealed that Alameda Research had deposited $49 billion worth of tokens to FTX since November 2021.

Alameda-FTX tokens: Glassnode

The relationship between Alameda and FTX manifested in many ways, most of which are highly irregular or illegal. Case in point, crypto compliance firm Argus revealed that between January 2021 and March 2022, Alameda had accumulated 18 tokens in its portfolio, worth about $60 million, all of which would then be listed on FTX.

This is called frontrunning. When tokens are then listed, they receive a huge price bump, only to be dumped shortly after the listing. Of course, as FTX's market maker, Alameda was in a position to see all the buy and sell orders, which is a forbidden practice in traditional stock markets.

Illusory Altcoin Value: FTX Shitcoins

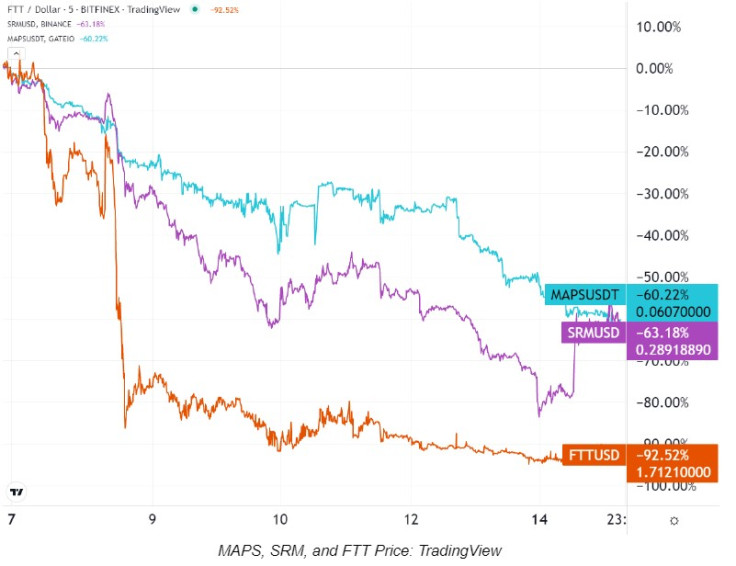

SBF also engaged in creating own tokens for the purpose of wash trading. These include MAPS, FTT, and SRM. Wash trading of these tokens would then create an illusion of market activity, further ballooning FTX valuation through them to its top — $32 billion.

Based on this valuation, SBF then leveraged that nebulous altcoin value to receive massive loans for further acquisitions. One of the most notable was Voyager Digital crypto broker in a $1.4 billion bid. It is likely that SBF bought the company to forestall its bubble implosion.

To explain, when creditors receive equity, they typically liquidate it to return investments. In this case, creditors would've liquidated Voyager Digital's crypto assets. But, if that had happened, they would drop in price, lowering the value of the collateral SBF was using to prop up his fragile empire.

In the end, this was all in vain after CoinDesk privately reviewed Alameda's balance sheet.

CoinDesk Leak and CZ Response

On November 2, CoinDesk reporter Ian Allison published Alameda's balance sheet. It showed what many had suspected. Out of $14.6 billion worth of Alameda assets, about $5.8 billion were tied to FTX's native exchange token — FTT.

As with other exchange tokens, traders can use them to get a discount when paying fees. However, it showcased that the bulk of Alameda's market-making wealth rests on the back of a token made up by FTX.

"It's fascinating to see that the majority of the net equity in the Alameda business is actually FTX's own centrally controlled and printed-out-of-thin-air token,"

Cory Klippsten, CEO of investment platform Swan Bitcoin

Spotting the weakness, the head of the world's largest exchange Binance, Changpeng Zhao, announced the liquidation of FTT tokens.

Liquidating our FTT is just post-exit risk management, learning from LUNA. We gave support before, but we won't pretend to make love after divorce. We are not against anyone. But we won't support people who lobby against other industry players behind their backs. Onwards.

— CZ 🔶 Binance (@cz_binance) November 6, 2022

Binance had a large number of FTT tokens because CZ invested in FTX, in December 2019. As a part of the strategic partnership, Binance received FTT tokens.

"Binance has also taken a long-term position in the FTX Token (FTT) to help enable the sustainable growth of the FTX ecosystem, aligning with the broader scope of the partnership."

Following this tweet exchange, the FTT bank run ensued, losing -92% of value since November 7. Likewise, the exchange suffered a $6 billion withdrawal wave in 72 hours after that. But, the final collapse happened once SBF released FTX's balance sheet to attract investors and boost its liquidity.

FTX Balance Sheet As the Final Collapse Vector

Sam Bankman-Fried even approached CZ of Binance directly to buy FTX and prevent total collapse. Yet, once CZ saw the state of the exchange, he walked out, stating the following:

"In the beginning, our hope was to be able to support FTX's customers to provide liquidity, but the issues are beyond our control or ability to help."

This begs the question, what was in the FTX balance sheet that spooked CZ?

If you want to see it as a visualized poster, take a look at it here. In short, FTX had nearly $9 billion in liabilities, merely $900 million in liquid assets, $3.2 billion in illiquid assets, and $5.5 billion in semi-liquid assets, largely in made-up coins like FTT, SRM, and MAPS.

All of these tokens have collapsed in value since.

MAPS, SRM, and FTT Price: TradingView

This accelerated the FTX exodus, leading SBF to file for bankruptcy on November 10 (the press release came a day later), a couple of days after the exchange suspended withdrawals on November 8. Interestingly, SBF publicly lied when he said on the same day, November 10, that FTX.US is 100% liquid and operates separately.

The bankruptcy filing included all 134 corporate entities, from Alameda to FTX.US and FTX International, marking the end of SBF's crypto empire. A day later, he stepped down from the FTX CEO position.

The moment users weren't able to withdraw their funds; it became apparent that SBF fibbed the public when he said that user funds are not used as a collateral for loans. After all, FTX would have to violate its own terms of service in order to endanger the withdrawal of user funds:

"None of the Digital Assets in your Account are the property of, or shall or may be loaned to, FTX Trading; FTX Trading does not represent or treat Digital Assets in User's Accounts as belonging to FTX Trading."

The only way that could've happened is if FTX funneled them to Alameda for its hedge fund trading schemes. To make matters worse, SBF appears to have built an FTX backdoor. Out of $10 billion sent to Alameda, at least $1 billion remains unaccounted for, as reported by Reuters.

Moreover, on November 12, a "hacker" stole $477 million worth of cryptocurrencies from various FTX wallets. As the cherry on top, Sam Bankman-Fried described word-for-word what he was doing when he was retelling the vulnerabilities of the traditional financial system that led to the Great Recession of 2008.

HOLY SHIT

— MrChief (@HaloCrypto) November 9, 2022

In front of a room of lawmakers… pic.twitter.com/7aGWdJ0l9W

TLDR Recap of Bankman's Schemes

As you can see, there is a lot more to this scandal than it meets the eye. We didn't even touch on the heavy political involvement of SBF's parents. For example, his mother, Barbara Fried, is one of the co-founders of Mind the Gap, which Vox described as a "secretive Silicon Valley group" that funnels money to Democrats.

Indeed, Open Secrets reveals that SBF contributed 92% to Democrats, giving them nearly $40 million dollars worth of donations. This makes SBF second to the top Democrat donor, George Soros.

Ken Griffin (Citadel Securities) on FTX, TRUMP LOSE and Democratic Party donations. pic.twitter.com/dSbZLjXrXm

— Holland Cedar Capital Management (@hollandcedarcap) November 15, 2022

Furthermore, SBF's father, Joseph Bankman, is heavily involved with politics as a tax expert and drafting legislation for anti-crypto Senator Elizabeth Warren. The most interesting connection of all is SBF's purported former girlfriend, Caroline Ellison.

Not only was she the head of Alameda Research, but she is the daughter of Glenn Ellison, who is the former MIT boss of Gary Gensler, the current Chairman of the Securities and Exchange Commission (SEC), appointed by Democrats and a former Goldman Sachs banker.

May I introduce the mastermind behind Alameda Research - CEO Caroline Ellison #ftx #ftt #cryptocrash pic.twitter.com/f8Vrn5Oyz4

— marc friedrich (@marcfriedrich7) November 11, 2022

Or

https://twitter.com/marcfriedrich7/status/1591350131945013248

Lastly, let's recap the summary of the underlying problems that led to the FTX fiasco in the least number of words possible:

- Alameda is both a hedge fund and a market maker, unseemly linked to FTX.

- When Alameda invests in a project, that project typically invests in FTX.

- FTX sends the project's capital back to Alameda.

- Alameda continues the investment cycle of dubious shitcoins.

- FTX leverages users' funds to keep the cycle going, gobbling up smaller companies based on leveraged debt.

- When the house of shitcoin cards is exposed, it crumples, along with the shitcoins and all the acquired/exposed companies.

In the end, Sam Bankman-Fried is a warning. Corruption blooms when there is no code to bind it. Specifically, a smart contract code on DeFi platforms. Even J.P. Morgan had to admitas much:

While the news of the collapse of FTX is empowering crypto skeptics, we would point out that all of the recent collapses in the crypto system have been from centralized players and not from decentralized protocols.

© Copyright IBTimes 2025. All rights reserved.