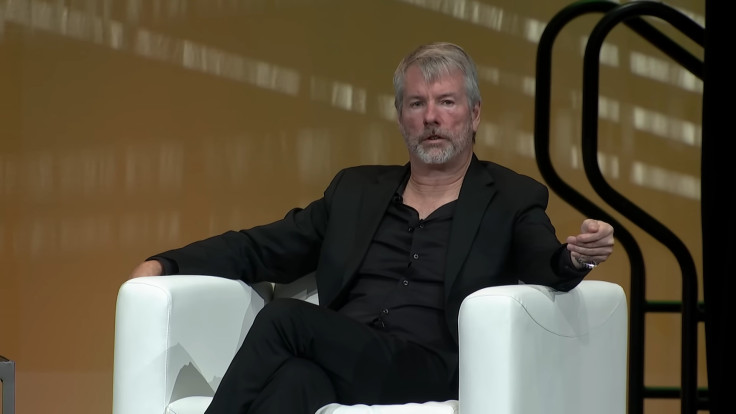

Michael Saylor's Strategy Inc. Ups Its Bitcoin War Chest to $2 Billion

Michael Saylor isn't letting up on his Bitcoin thesis and this week, he proved it again. His firm, Strategy Inc. (formerly known as MicroStrategy), has expanded its latest preferred equity raise from $500 million to a staggering $2 billion, doubling down on its long-standing mission: accumulate as much Bitcoin as possible, and never sell.

These Series A Perpetual Stretch Preferred Shares offer a 9% dividend and will be priced below face value, making them appealing to yield-hungry investors who want Bitcoin exposure without touching BTC directly.

The raise is being underwritten by Morgan Stanley, Barclays, Moelis & Co., and TD Securities, with 5 million preferred shares on offer. These shares rank senior to Strategy's common stock and some preferreds, but remain junior to existing convertible debt.

Michael Saylor: Why This Move Matters for Bitcoin and Institutional Adoption

As of now, Strategy Inc. holds 607,770 BTC, worth around $72.4 billion—that's over 3% of Bitcoin's circulating supply. If this $2 billion raise goes toward more purchases, Saylor's company will deepen its already aggressive position.

This strategy isn't random. Saylor has called it a "quadratically reflexive, engineered instrument," meaning Strategy raises capital during favorable market conditions, then uses that capital to buy Bitcoin—boosting both its holdings and, theoretically, its stock price. It's a flywheel model:

- Raise capital while MSTR trades high.

- Buy more BTC.

- Watch BTC (and MSTR) rise.

- Repeat.

- It's bold. It's controversial. But so far, it's worked.

Saylor's Playbook: Be the Bitcoin ETF Before Bitcoin ETFs Exist

At the time of writing, Bitcoin is hovering around $115,300, down slightly on the day. Strategy shares closed Thursday at $412.31 and dipped 0.44% in after-hours trading.

Despite the mild pullback, broader sentiment remains positive. The move signals growing institutional confidence in Bitcoin, especially as macro investors eye crypto hedges against monetary debasement and inflationary pressure.

While spot BTC ETFs have become a hot topic in 2025, Strategy has long served as a de facto Bitcoin ETF for institutions, especially those unable or unwilling to custody Bitcoin themselves. The preferred equity route now provides another mechanism for exposure—this time, with guaranteed yield.

Saylor's bet is that Bitcoin will become the backbone of corporate treasury reserves, and his company is the test case. Whether it pays off in the long run depends on the market's continued appetite for BTC—and whether competitors emerge with similar hybrid investment models.

Final Take: The Mad Genius of a Bitcoin Maximalist

With each passing raise, Michael Saylor moves deeper into uncharted territory. Strategy's balance sheet is now functionally tied to Bitcoin's performance. If BTC booms, shareholders win. If not, the risk is outsized.

But that's the thing about Saylor—he's not hedging. He's all in.

In the eyes of crypto believers, that makes him a visionary. In the eyes of skeptics, a gambler. Either way, Wall Street just handed him another $2 billion to keep playing.

© Copyright IBTimes 2025. All rights reserved.