Price Manipulation Talks Around $XRP Mount As Token Challenges $3

KEY POINTS

- Vincent Van Code said short timeframe charts unravel the "real" manipulation in crypto prices

- He used a one-second $XRP/$USDT chart to highlight how steep spikes and sharp dumps take place

XRP has one of the cryptocurrency space's most active communities, which is also why the top altcoin is closely watched by crypto users and observers. Recently, it has also drawn increased attention amid widespread discussions of potential price manipulation.

The XRP Ledger's native crypto token isn't the only digital asset that has been at the center of manipulation discussions, as Bitcoin and several other altcoins have also been questioned in the past.

What makes XRP stand out is its apparent popularity despite the coin's price largely staying the same, even though BTC and other tokens were pumped to new highs in recent months.

$XRP price alleged manipulation: Is Binance involved?

In a post on X on Tuesday, Vincent Van Code, a well-followed figure in the crypto space, said there was "real" market manipulation going on in the industry and crypto exchange giant Binance allegedly "enables" it.

Code, who has a decent following on the social media platform, said Binance was allowing "VIP APIs" to "fleece retail," making the crypto titan a key player in the plight of retail crypto holders who have to deal with an asset's volatility.

Code posted an XRP/USDT one-second chart that he said should prove there was manipulation going on, given the sudden price spikes then "sharp dumps" within very short timeframes.

Market manipulation is REAL. and the MFs Binance enables with the VIP APIs let's them fleece retail, yes FK over their OWN retail customers, hard working "you and me" ripping us sideways.

— Vincent Van Code (@vincent_vancode) May 13, 2025

Here is some MORE PROOF using XRP/USDT chart.

Asking ChatGPT why price dumps each time… pic.twitter.com/3eq3Qr3TBt

Are $XRP whales betraying retailers?

According to Code, whale activity was one of the reasons for the dumping of XRP prices. He noted how large traders or trading bots run by large financial institutions can have a significant impact on prices due to their massive orders.

"They spike the price to trigger stop-losses or bait retail traders into chasing the move. Then they sell heavily into the momentum (known as a 'liquidity grab'), crashing the price," the software engineer wrote.

There are also some traders who place "fake orders," he said, wherein manipulators place fake orders to create a false impression of demand for a token. A price spike then takes place, triggering real buyers to come around.

When real buyers are in, "spoof orders are removed and the manipulator sells into the fake rally."

The XRP team has yet to respond to concerns around price manipulation, but some crypto holders agree that many are "in denial" of how there is allegedly manipulation in the price of XRP and other crypto assets.

Exactly

— MAXIMUS (@J_MAXIMUS) May 13, 2025

HOLD…

It’s pure manipulation…

There are also some who are now calling out Binance for its supposed involvement in the manipulation.

@binance @cz_binance ARE SCAM ENABLERS, OR MAYBE EVEN PART OF THE SCAM...

— XRPayments.X (@XRPaymentsX) May 13, 2025

AND IF YOU ARE NOT PART OF THE SCAM THEN DO SOMETHING AND STOP THE DAMN MANIPULATORS!

SCREW BINANCE THEY ARE A BUNCH CLOWNS!!!!!!!!

They’re robbing us in broad daylight.

— XRPAdict (@XrpAdict) May 13, 2025

💰 Binance VIP bots pump XRP, bait retail, then dump hard. We get wrecked — every. single. time.

1-second charts don’t lie. This is engineered.

Stop playing their rigged game.

Buy. Hold. Opt out.#XRP #XRPArmy #XRPHolders #XRPCommunity

$XRP begins uptrend

Concerns around manipulation in the XRP token come as one of the world's most prominent cryptocurrencies begins the road to $3.

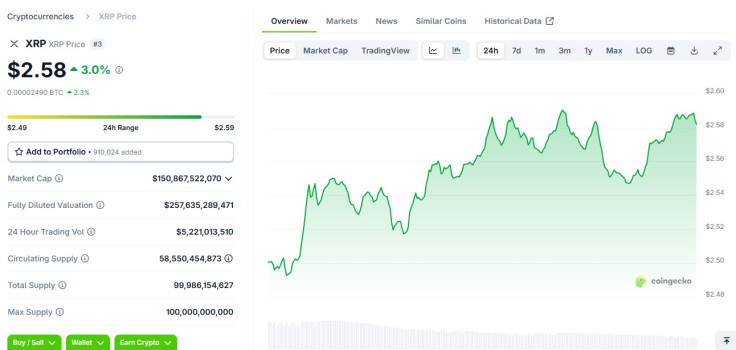

The digital coin is currently trading at around $2.58 after a low of $2.49 in the last 24 hours. The asset remains volatile but is up 3% in the day and has been on a 20% spike in the past week.

Following weeks of trading in the $2 lows, it has once again flipped Tether to become the world's third-largest crypto token.

© Copyright IBTimes 2025. All rights reserved.